Btw, I buy VWRL in CHF

I see many people have already voted. Now I would like to hear your opinion:

- if you invest in US: are you not afraid that you might become potentially liable in the future? (perhaps even retroactively)

- if you invest in IE: are you not missing these 0.2% annually, due to cumulation of various costs?

Retroactive liability I consider as very unlikely. And there are already active liabilities under the tax treaties (iirc everything beyond 5M USD in assets in US is taxed under US law, no?)

I generally will start bothering if I’m reaching those territories or if Biden lowers the amounts.

All I care about are costs and returns. I don’t have any issue with IBKR or US in general and the tax treaties exist (up to 11M).

But I’ll probably transfer chunks of my ETFs from IBKR to a Swiss broker once I reached a certain amount (200k+). So I’ll probably keep ~200k in assets in IBKR and the rest in Switzerland in the future.

Estate tax exemption has been raised to around $11 million during Trump reign. But it’s a good point. Biden could lower or abolish this exemption. I added it to the list of IE pros.

It’s important to distinguish the domicile of your assets (the ISO code at the beginning of the ISIN) from the location of the custodian. This thread is about the former. It’s possible to hold VT via Swissquote, as it is to hold VWRL via IB. Broker risk is a good point, but I guess it’s best to be discussed separately.

Do you have a bulletproof calculation with data from a reliable source to back up that claim? You know…

![]() in the quoted post you provided has some numbers, but how should I know if it’s correct? Does the US-return include reclaimed withholding tax? If it would be the case, that the performance difference between US and IE is not a given, that would strongly speak in favor of IE, and 75% of forum members would be making a mistake.

in the quoted post you provided has some numbers, but how should I know if it’s correct? Does the US-return include reclaimed withholding tax? If it would be the case, that the performance difference between US and IE is not a given, that would strongly speak in favor of IE, and 75% of forum members would be making a mistake.

I’d like to invest 100% in VT, save for fun bets on BTC & TSLA. And I think it’s best to keep allocation to a separate thread. I’d only like to tackle to IE vs US battle here. ![]()

That thing about California seems from another world. Sources? The Onion? I won’t probably spend 60days in California anyway… but who knows.

Yeah it’s a WSJ opinion anyway, it’s not even a currently proposed bill: https://www.natlawreview.com/article/why-wsj-attacking-dead-bill

and I assume if the US is like most countries, many of the proposed bills are like posturing to get media attention, not a thing that has a chance of passing (but it did succeed on the former!)

There will always be some small differences between two funds that do not track the same index. If one did better in the past few years, then it doesn’t follow that it will happen in the next few years.

Also your data might be wrong, are you sure that you used gross income and not the net income?

VT is up 80.38% in the last 5 years while VWRL is up 77.62%(Total return data from vanguard). The difference is 35 basis points per year or quite close to the ~30 basis points difference in cost + tax that you would expect.

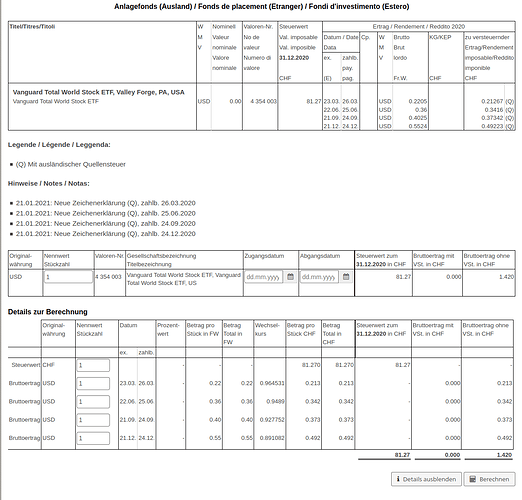

They list the net income under gross income of the fund.

Will you buy the same ETF as now on IBKR?

You can’t publish it because… it has data in it? So you tell me that I have to manually search for each year here, because you just don’t want to share?

Anyway, ICTax gives you dividends and the EOY closing price, but the closing price is not comparable between VT & VWRL or between VOO & VUSA. It’s because the two markets close at different times. In a few hour, the price can change by a few percent, heavily skewing the return. How did you tackle this problem?

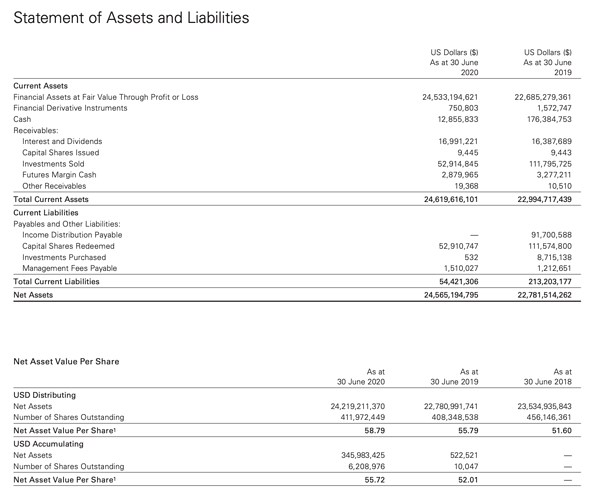

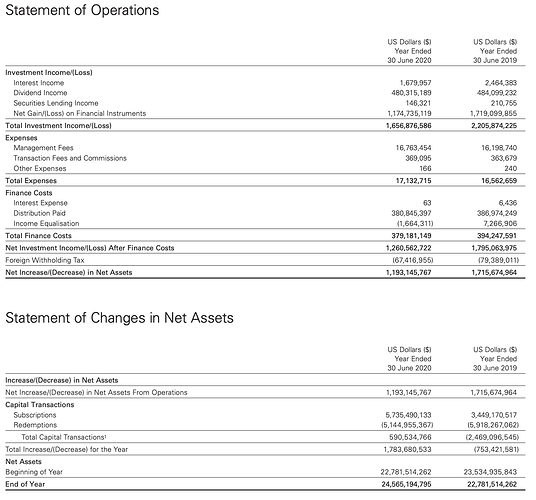

FYI another way is to look at the annual report they list the amount lost to tax.

Usually they don’t (change by multiple per cent within hours). And you can sample a few days to compare.

You mean this?

I think I once tried to do it, but US & Europe have different reporting periods.

Here’s what I found for Vanguard S&P 500 (VUSA):

Dividend income: $480 million

Distribution paid: $381 million

Foreign Withholding Tax: $67.4 million

What would you like to calculate here? I don’t even understand why is there a difference between dividend income and paid distribution. Does the tax come on top or is it included? How to compare this to the US? It all seems a bit shaky…

BTW, VT and VWRL doesn’t track the same index… VT includes small caps

My take is a similar one: I intend to diversify my risk among brokers and/or jurisdictions, not wanting to keep everything at IBKR/in the US.

I am already holding the biggest part of my current liquid assets at IBKR (to benefit from fee waivers).

It’s mainly a portfolio of single stocks though, and a few funds I can’t get elsewhere, not index funds.

The biggest part of my monthly savings, on the other hand, are invested into index funds.

Since I want to avoid increasing my exposure to IBKR, I do so through European (E.U.) brokers…

…who wouldn’t let me purchase U.S. ETFs anyway.

Side note: As I stated above, about half a year ago, I’ve settled investing half my savings on Quality ETFs, not VT or VWRL. I’m not sure if there’s an MSCI Quality ETF domiciled in the U.S.

At most. Tendentially less. I’m not losing any sleep about that.

Distribution yield isn’t that much different to make up a 0.35 basis point difference. The difference in yield would need to be around 1.2% for a marginal tax rate of 30%. However looking at the data from vanguard, the difference in yield is around 0.32%. Another data point that points toward that ~30 basis point difference in return between the two funds.

I also don’t see why VWRL covers small cap better than VT, this doesn’t seem true.

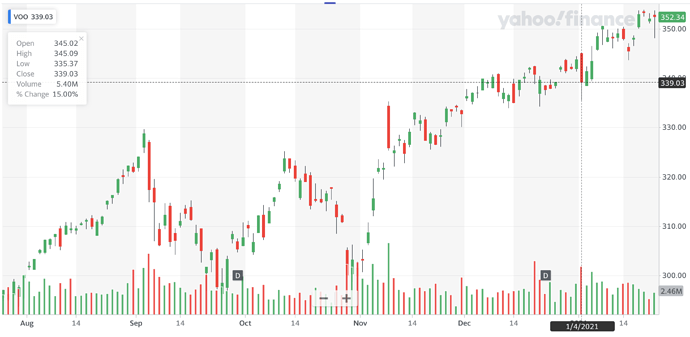

Good point, it adds up to the confusion I guess the easiest thing to compare would be VOO vs VUSA, they track exactly the same index.

@TeaCup you still didn’t answer my question: how do you make a reasonable comparison if you don’t have reliable start/end points?

That was the intention I had when opening this thread. I would like to stop funnelling money to IBKR and maybe open up a brokerage account at PostFinance and continue buying VWRL there. Just want to make sure if I’m not sacrificing too much profit by doing so…

Here the difference between high and low was 3%. There are more days like this. And the difference between Europe closing and US closing is 6 hours, enough to make a big gap.

VT has more than twice as much holdings as VWRL.

A factor regression against international markets(no EM) shows a higher negative SMB loading for VWRL than for VT. Although I’m not sure how valid a regression of a all world fund against the international market is.

So VT is probably the one that covers small caps better

Wrong.

VT = FTSE Global All Cap Index

https://research.ftserussell.com/Analytics/Factsheets/Home/DownloadSingleIssue?issueName=GEISLMS&IsManual=false

VVWRL = FTSE All World Index https://research.ftserussell.com/Analytics/Factsheets/Home/DownloadSingleIssue?issueName=AWORLDS&IsManual=false