Bought CHF 100k of vt. It costed less than chf 10 with tiered.

that is a bit hurting right now, I guess

Why? He still has many shares of VT, a solid ETF

Sure, just thinking about 15% loss of 100k purchased when it was almost ath

Yes and no. It was a transfer from VWRL to VT.

And my investment time horizon is more than 20y… I don’t care about few months, even 2-3 years.

It makes sense.

I’m just trying to figure out a way to deal with these ‘temporary’ losses and a possible 10y recession (not being 30 years old anymore)

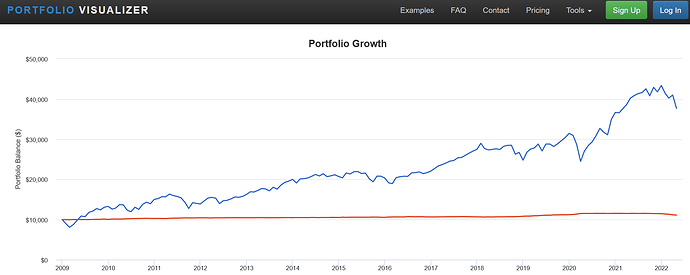

If you’ve been invested for some time, perspective may help. VT vs a short term treasuries fund (“cashlike” investment) total returns in USD from 2009 (VT’s inception) to now:

Backtest Portfolio link

Inflation adjusted CAGR of 7.85% (in USD, still, ain’t got CHF data unfortunately). It can give up some more gains and still have been a good investment.

These are not the worst 10 years in the history of the stock market and it was just after a big dump, but ok

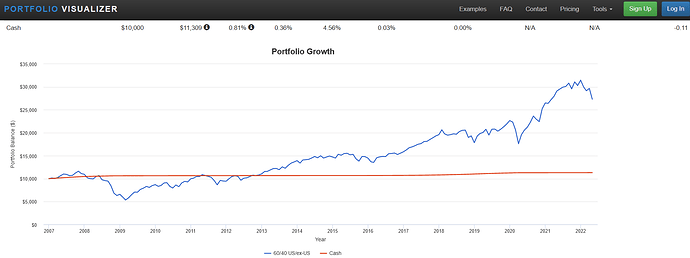

Fair enough, here’s a 60/40 US/Ex-US stock portfolio vs Cash, starting in 2007:

Backtest Portfolio link

4.3% inflation adjusted CAGR, without additional contributions and that’s right before the Great Recession.

Sure, those were good years, but they’re the years right before what we are living now. If you were invested during those, you’ve reaped the benefits before suffering the consequences of today (of course, things are worse if you just started investing but even then, we’re up bigly from where we were 3 years ago).

Edit: I’m not saying this should make you feel better, each of our situations is different, but I’m putting it there in case it could.

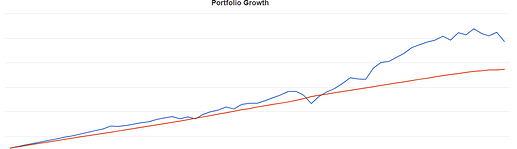

Graph with DCA of 1k every month, starting from 2017 and no rebalancing or inflation adjusted values.

What’s the red line?

SHY from the first link of Wolverine. If I set CASH, it won’t change much.