Probably both are correct. According to comparis, “While the first mortgage has an unlimited term, the second mortgage must be paid off within a fixed repayment period. This can vary slightly from lender to lender, but the second mortgage is typically paid off within 15 years or by retirement age, whichever is sooner.”

I’d go for option 1 - 20% down via pension fund/ 3a/ whatever and rest as mortgage with direct amortization. Complexity helps the banks, not you (e.g. you end up with more expensive/ less flexible products, have to have them with them).

This is the key point. Max 15years for anyone further away.

when we are younger we have less options as well but if I were to do a 2nd mortgage now, I’d still use indirect but try to find the bank with the best options to invest rather than pick a bank and subject myself to shitty options (trying to avoid the complexity as you 100% correctly mention)…

It should be noted that this 2nd mortgage is just a mathematical construction, not a real 2nd mortgage. You can buy a house for 1M and have one single mortgage of 800k. 666k is the goal within 15 years or retirement, whichever comes first. Either directly by reducing the mortgage on a quarterly basis (together with interest deductions) or indirectly by pledging your 3rd pillar and the contributions to it, or both.

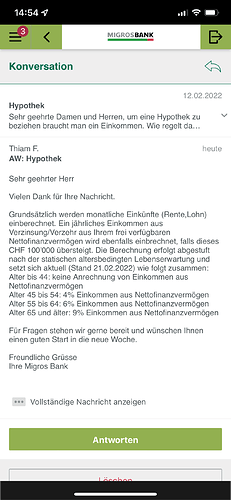

Did ask Migrosbank and the they provided the following guidelines:

- minimal age 45

- minimal wealth 100’000 (does not make sense, way to low)

- 4-9% of your wealth will be calculated as your virtual salary

4-9% is a huge difference and those additional factors will be discussed in a onsite meeting with the bank.

I wonder if this is unique to Migrosbank and for new mortgages or just remortgages?

Thank you for the input which is very helpful to me. We are renters and one of our biggest hesitancies about Retiring Early is that if we need to move we would struggle to buy or even rent without a salary (would need to liquidate productive assets to buy)

The explanation from Migrosbank still did not make 100% sense to me. Started a new question via e-Banking and voila, here a much better answer. The percentages are age based.

I don’t really understand the age factor. If I have 5 millions at 40 years old, they will count a virtual salary of 0 but if I have 1 million at 50 they will count a virtual salary of 60’000 ? I don’t see the reason why not consider a virtual salary earlier than 45.

Before 50 our lifestyle is all about blackjack and hookers ![]()

![]()

![]() sorry that was totally off-topic and unprofessional but I could not resist

sorry that was totally off-topic and unprofessional but I could not resist

The safe withdrawal rate is lower if your remaining life expectancy is very long. I.e. making the percentage depend on age is not completely unreasonable. Not counting anything below the age of 45 is a bit too conservative, though. On the other hand, 9% at 65 is really high.

Well even with no returns at all, this stash would be available for 11y, plus eventual income from AHV/PK and what else.

I guess the risk for the bank is pretty low.