You cannot purchase US-domiciled ETFs on Degiro.

In the past @hedgehog has posted a link to a MSCI paper, where they showed that in many cases GDP to stock market return is uncorrelated (or even negatively correlated in some cases). Common sense says that there’s something to it - US is “only” 25% of World GDP, yet historically (not in all periods though) it outperformed rest of the world in stock market returns. This is obviously because American companies sell their products to the entire globe. Similarly, if you would only analyse prospects of growth of Japanese economy, you’d rather cut it off entirely from your portfolio, but taking into account the fact that, for example, Toyota is selling internationally (and has international supply-chain) one might still consider investing in Japanese companies.

So to sum up, I’d just add my 3 cents: (1) it’s not that simple, (2) because it’s not that simple, it’s better to stick to the market-cap, (3) I’m not saying equal-weight is a bad idea, I just think market-cap is a reasonable default option.

To clarify: I am not saying that allocating by GDP per se “feels better” to me.

But I prefer the “result” (as posted by cortana above) at least a bit over allocating by market cap.

Why is it “better”?

It’s just different.

I’m not saying it’s particularly bad. Yes it’s probably a reasonable default option. But at the risk of really going in circles here: I still fail to see why it’s supposedly “better to stick to”.

If it’s not simple (which it certainly isn’t), any other sufficiently diversified allocation might be just as good. Or better. Or worse. At least I mitigate that cluster risk of investing more than half in one single jurisdiction (by market cap) - which has a comparably and historically high valuation at the moment.

The expected return of both strategies is the same, cap weight is simpler to implement. Why spent time and energy to deviate from it?

There is another reason to keep US > 50%:

Good factor etfs that offer exposure to size and value are mainly available for the US market. They have a significantly higher expected return and make the effort worthwile to deviate from a market cap portfolio.

Is there a good ex-US variant of VIOV, IJS, SLYV?

I haven’t found one with decent factor exposure.

All smart beta etfs I found have so little factor exposure that they are not worth their TER

I ditched VT completely because of VIAC.

My plan is to invest in VTI and VIOV (maybe a 50/50 split) in IBKR and cover Canada, Europe, Pacific and EM with VIAC. As soon my assets in IBKR are big enough, I would ditch EM in VIAC as well and cover that with VWO. Leaving only Switzerland, Europe and Pacific in Viac.

Target AA is: 60% North America, 14% EM, 12% Switzerland, 8% Europe ex CH, 6% Pacific.

Because with market cap you get more exposure to diversified portfolio of bigger, well established companies, which should be the core of any reasonable long-term buy and hold strategy.

Market cap is always the most efficient portfolio too. You can’t get the same expected return with less risk.

So it only makes sense to do something else if you want to increase your risk and also your expected returns, like a SCV tilt or maybe higher allocation to EM than market cap weight.

Small cap and value can reduce the overall risk of the portfolio while increasing the return.

What do you mean? They usually increase volatility (which constitutes the definition of risk in finance).

How much SCV do you have?

SMB(Small minus Big) and HML(high minus low) don’t correlate with the market factor. So if you add 20-35% of SMB and HML to your portfolio, you will reduce the overall volatility.

I did some research over factor over the last few month and haven’t adjusted my portfolio yet. Will probably also ditch my home bias in my IB portfolio. I might end up with 40% IJS(Small + value) and 30% IUSV(value) in the US allocation, so I end up with an exposure of 0.16 HmL and 0.19 SmB for the overall portfolio. HmL has an average past return of 3.8% over market and SmB 1.9%. It is recommended to use 50% of the factor premium for your expected return. So 0.160.53.8% + 0.190.51.9% = 0.48%. That should cover the wealth tax and any non-recoverable withholding tax and the cost of the ETFs.

Again, I’m not particularly bent on allocating according to GDP. I still maintain investing more than half your portfolio into a single country’s stock market is a cluster risk (the political being one of them). I am also rather leaning towards size factor - it’s true that more “interesting” ETFs do focus on the US.

…and then, to a lot of crap as well. The biggest sector in that is still Financials - which, despite being “established”, I do not consider a necessary “core of any reasonable long-term buy and hold strategy”.

“Big and established” as they may be, that’s not preventing them from falling down from there.

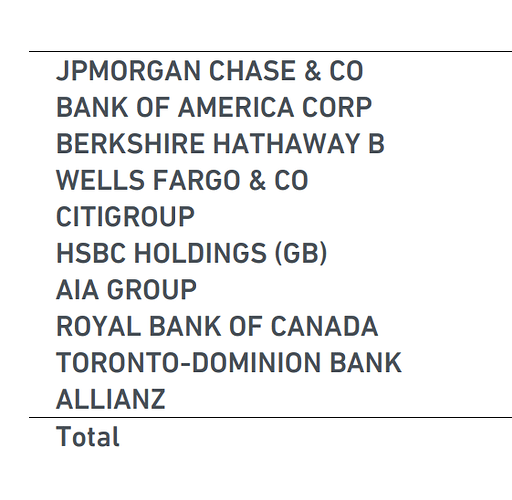

You really consider crap these:

I don’t. I see them as part of the core of any reasonable long-term buy and hold strategy. I know there’s a lot of bias against financials (“banksters”), but I consider that drunk uncle on a family dinner, average Joe ignorant bullshit talk. Finance plays a crucial part in the capitalist economy and it has significant potential for growth (indeed, the growth of all other sectors is inter-dependent with finance). It is true, that due to existing monetary and fiscal policy (fractional reserves, public debt, etc) this sector is much more crisis-prone than traditional industrial sectors, but I don’t think it’s an argument strong enough to get rid of these companies from the portfolio (especially that these companies are so tightly connected to the financing public debt, that the governments will never allow them to “fail”). In any case, there’s also a great deal of utility and innovation that increases the growth potential of this sector, so I’d prefer to keep them in my portfolio and enjoy some fruits of these developments. (Although, I understand that more conservative investors would prefer to underweight the financials.)

PS. Indeed, you all would invest in single stocks via broker employee in UBS taking 3.5% or more for his service, if we didn’t see all the innovation in finance in last three decades.

Btw, SPI Extra in Viac. Is it still Mid/Small Caps on a global scale?

The problem with small cap stocks is that they usually have a bit of exposure to growth. This negates the size factor more or less.

A good video about it:

I’ll be more specific and call it “banks” and (to a lesser degree) insurance. That excludes Berkshire, which is basically a giant listed hedge fund.

And dividends or not, considering that half of the remaining stocks are worth less than they were 20 years ago, that’s what I would call rather “crappy” a sector. Mad props to the Canadians though!

(AIA group wasn’t listed back then. I think it would only be fitting to substitute AIG for them. From which they emerged, and who have been one of the world’s 10 biggest companies by market cap not too long ago)

Sure - but I like traveling on airplanes as well.

That doesn’t mean the providers offering such services (inexpensively to consumers) are a great investment.

Berkshire is the odd one out in your list, but the rest I’d consider crap i wouldn’t want to own. Banks aren’t like normal productive businesses, they have very low return on capital and rely on high leverage to turn a profit. They’re valued pretty much by their book value and known to have sometimes very exotic stuff on the books, for which there’s no telling how it’d behave in a crisis scenario!

Nah, even Buffet changed his mind and bought an airline.