Not only is the mortgage leverage, but this loan has to be another layer of leverage. It seems to me too much like a house of cards that would leave you without a flat & your stock if something unexpected happened.

No bank will accept a mortgage loan as own capital. It won’t work.

It has to be hard equity capital.

right sorry

With a diversify portfolio, the risk is low. But yes, you’re right

The city center is sure expensive, but you don’t have to go very far to find lower price (Oerlikon, Altstetten, etc.). “Killing” is IMO an overstatement, and even in the center, double income middle class can surely find something pretty nice, it won’t be luxurious or super big, but then there’s no large city where it’s fundamentally different, apartment in cities are smaller/more expensive.

For adjusted income (e.g. in terms of percentile) compare the situation in Zurich and e.g. Paris/London/etc., I’m fairly sure you get much nicer housing in Zurich.

How do they know that the advance payment to the property owner is coming from a loan ?

Very good question. When I applied for the mortgage the only thing they‘ve asked for was previous tax statements, the 60k loan from a family member was not looked into because not yet on the tax declarations.

The cash can be drawn from another mortgage (in another bank)…

Tax declaration. But you are right, there is no way that they’ll find out that you didn’t sell shares.

@Zerte2

As long as the other mortgage stays below 80%.

As mentioned before looking for “Genossenschaftswohnungen”, having good connections, i. e. getting access to flats before they are on homegate etc. Looking for flats in areas where the “Leerwohnungsziffer” is high, which gives you a better possibility to bargain (https://www.bfs.admin.ch/bfs/de/home/statistiken/bau-wohnungswesen/wohnungen/leerwohnungen.assetdetail.9366199.html). Problem is, if you want to live in Zurich there are no empty spaces…

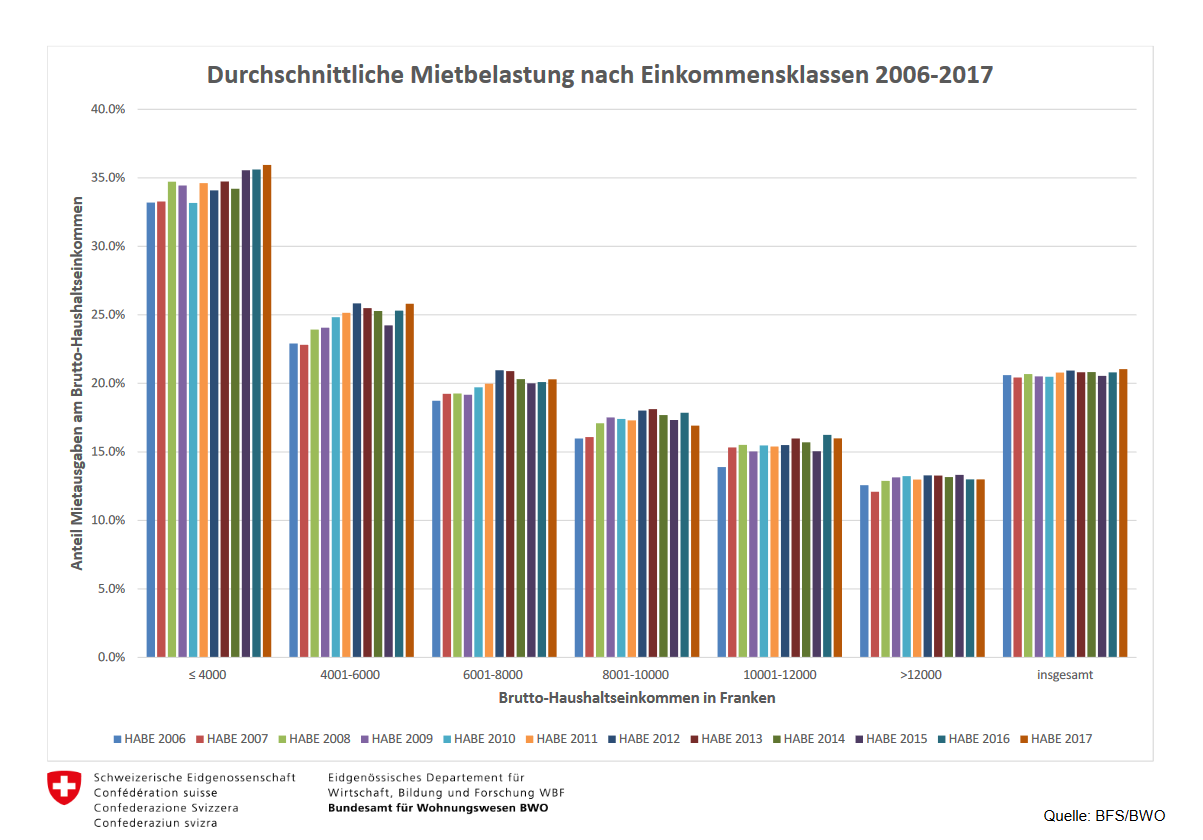

Generally speaking I too think that it is concerning that the “Mietbelastung” has increased steadily between 2006 and 2017 especally for the low-income population but not for incomes over 12’000 per month:

In my experience patience is really the key. It took me a year of applying for places I liked before I got my current apartment. CHF 1700 for a 4.5 room 95 m2. Old-school to the point of being quaint, but surrounded by forest and gardens with no near neighbors and just 15 minutes by public to where I work downtown. It’s a private landlord but I got it through the property managers. Not a Genossenschaft or social housing.

If you have a place to live and are not in a hurry to leave it, simply apply for any apartments you like as they come up. Chances are you will eventually be approved for one of them.

Another option is sub-renting from someone who’s been renting their flat since the good old days when rents were much cheaper. I have close friends who sub-rent a large modern 4.5 room apartment in Zollikon right in the Dorfplatz for around CHF1600 because the primary tenants moved abroad indefinitely for work but wanted to keep their options open (and their low rent). The same apartment would cost around 2.5k at market rates.

Hi! How did you get access to this?

Surprisingly, I just found it on Comparis and viewed and applied in the usual way. One thing I have found is that big real estate groups just follow market rates, but you get more variation with privately-owned properties (sometime above-market, sometimes below-market).