It‘s mostly compensated by the ability to invest more due to lower income taxes. But yes, should be taken into account.

This puts a soft limit on the amount you can pay into your pension fund each year, whereby paying too much will effectively increase your tax.

Is that triggered when you stop working ? would having a low percentage job (20%) prevent this ?

Die AHV unterscheidet zwischen Erwerbstätigen und Nichterwerbstätigen.

Als Nichterwerbstätige gelten Personen, die kein oder nur ein geringes

Erwerbseinkommen erzielen:

[…]

- Versicherte, die nicht dauernd voll erwerbstätig sind und deren Bei-

träge aus der Erwerbstätigkeit inklusive Arbeitgeberbeiträge weniger

als die Hälfte der Beiträge ausmachen, die sie als Nichterwerbstätige

entrichten müssten. Als nicht dauernd voll erwerbstätig gilt, wer we-

niger als neun Monate im Jahr oder weniger als 50 % der üblichen

Arbeitszeit erwerbstätig ist.

You’d have to work at least 50% and the AHV contributions from employment (including the part paid by the employer) have to amount to at least half of what you would have to pay based on your wealth.

If you work less than that, you can still offset your wealth-based AHV contributions with the AHV contributions from employment.

It ‘should’ be the second one if the conclusions here were correct.

You might ask AHV to get confirmation ![]()

There’s formula which determines the equivalent income that is calculated. In my cashflow model, I have the formula set as: =round(AHV/0.084+0.5,0) I’m not sure if this is correct as I didn’t need the additional AHV so didn’t put too much effort into it.

I’ve seen different numbers used instead of the 8.4% - the number in an earlier thread which matched official tables used 10.6%.

EDIT: Found a document which confirms my number but not sure if it is up to date. See last page.

Found the updated version it is now: = [AHV Jahresbeitrag / 0.087 + 0.5]

Within the EU, it used to be for Portugal - possibly no longer with the RNH regime running out:

-

Someone mentioned Thailand but I have not checked the details as moving there is not a practical option for me

-

Portugal was an option but no longer. Pension lump sum withdrawals are now subject to 10% tax (I read it changed due to pressure from EU)

-

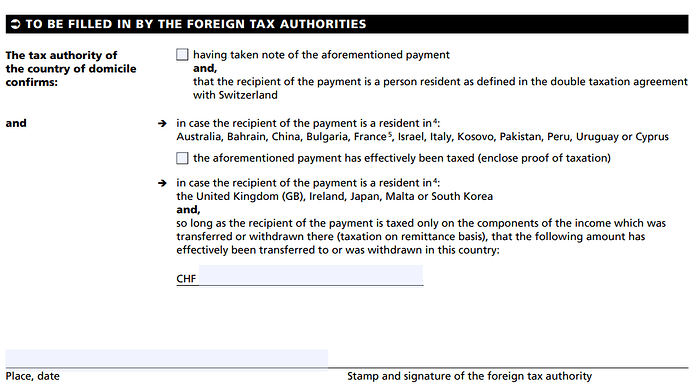

I read there was a practise of moving to certain countries (Malta) without proactively informing the local authorities. I believe the swiss authorities closed the loophole and require a stamped form that you have declared the withdrawal in the new country before releasing the WHT. I am not certain so someone on the forum may want to research this further

The most practical option I identified is moving to UK. No tax payable there, you only have to pay swiss withdrawal tax (is it worth moving to Thailand to avoid 4.8% Schwyz rate?).

@Dr.PI As this is off topic from the original question should it be moved under another thread for example here ?

I recall reading it used to work something like this for Portugal: get a form confirming you have registered the withdrawal with Portuguese authorities, reclaim full amount of Swiss WHT, pay no tax in Portugal.

I did not research the details further as Portugal option is now closed and I did not find another applicable country where it would be practical for me to move to

On a slightly different note regarding AHV. The rent is usually increased every two years to take somehow into account inflation (not necessarily in full, though).

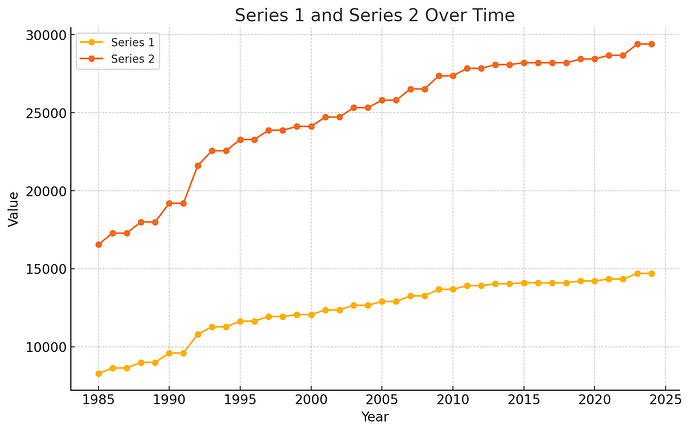

Does any of you know where to find the historical data of min/max AHV rent values ? It would be interesting to back-calculate an average rate to apply on AHV estimates

that would be interesting. in the past, I saw different versions of files which gave an indication, but it would be good to see the evolution in a more structured way. maybe the data is available at one of the usual central government sites?

Just found this link: Skala 44 | AHVG | Sozialversicherungsrecht | Koordination Schweiz

I paste the historical data below so that they remain available even if the link stops to work

Minimalen und maximalen Jahresrente in CHF:

- 2024: 14’700 / 29’400

- 2023: 14’700 / 29’400

- 2022: 14’340 / 28’680

- 2021: 14’340 / 28’680

- 2020: 14’220 / 28’440

- 2019: 14’220 / 28’440

- 2018: 14’100 / 28’200

- 2017: 14’100 / 28’200

- 2016: 14’100 / 28’200

- 2015: 14’100 / 28’200

- 2014: 14’040 / 28’080

- 2013: 14’040 / 28’080

- 2012: 13’920 / 27’840

- 2011: 13’920 / 27’840

- 2010: 13’680 / 27’360

- 2009: 13’680 / 27’360

- 2008: 13’260 / 26’520

- 2007: 13’260 / 26’520

- 2006: 12’900 / 25’800

- 2005: 12’900 / 25’800

- 2004: 12’660 / 25’320

- 2003: 12’660 / 25’320

- 2002: 12’360 / 24’720

- 2001: 12’360 / 24’720

- 2000: 12’060 / 24’120

- 1999: 12’060 / 24’120

- 1998: 11’940 / 23’880

- 1997: 11’940 / 23’880

- 1996: 11’640 / 23’280

- 1995: 11’640 / 23’280

- 1994: 11’280 / 22’560

- 1993: 11’280 / 22’560

- 1992: 10’800 / 21’600

- 1991: 09’600 / 19’200

- 1990: 09’600 / 19’200

- 1989: 09’000 / 18’000

- 1988: 09’000 / 18’000

- 1987: 08’640 / 17’280

- 1986: 08’640 / 17’280

- 1985: 08’280 / 16’560

That is more or less correct, but it varies between DTAs. In the case of the UK, for example, your Swiss vested benefits are not taxable in the UK, so you cannot reclaim the Swiss withholding tax.

The requirement to show proof that the assets have been taxed in your country of residence apply to Australia, Bahrain, China, Bulgaria, France, Israel, Italy, Pakistan, Peru, Uruguay, and Cyprus. It also applies to Kosovo. AFAIK it doesn’t apply to other countries, but I could be wrong.

The general best-case scenario is that you pay the Swiss withholding tax only (in a low-tax canton, of course), because most countries that Switzerland has DTAs with have higher taxes.

Moving to a tax haven is only beneficial within the scope of moving to countries that do not have DTAs with Switzerland. The reason is that in that case, your benefits are subject to both the Swiss withholding tax PLUS the local taxes in your country of residence. Assuming the tax haven does not tax your benefits, you will only pay the Swiss withholding tax.

The main benefit of an early withdrawal of benefits, as I see it, is that you can invest the money more profitably outside of the second pillar. However, vested benefits investment options have gotten much better recently with the appearance of Viac, Finpension, and the likes, so the advantage has shrunk somewhat.

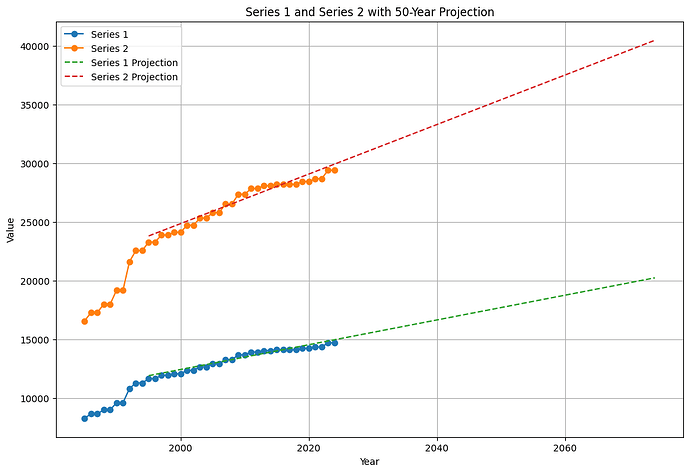

Courtesy of ChatGPT:

It would be interesting to see the charge adjusted for inflation and re-plotted.

AFAIK (to be checked), the Swiss WHT reclaim depends on the DTA and if your new country can attest that you are resident there and you declared this withdrawal accordingly. It is not mentioned that you need to pay taxes on it.

But I am not 100% sure, since most Tax heavens are not interesting for me anyway. Lived long enough in Bahrain - never again.

Ok have read something different somewhere else - I am unable to find the source as quickly again, but already then I was aware that different sources where contradictory.

I guess it depends on the DBA in the end.

Since it was not really relevant for me (I am rather aiming for France for different reasons), I did not look it up more and will leave it to the moment I will FIRE - since rules can change rapidly.

OK so as per ChatGPT ‘50 years projection’ for the max. value, we should expect an approx. yearly growth of 0.5% (from ca. 25k in year 2000 to ca. 40k in year 2070+)

It‘s linked to inflation, probably higher.

Hopefully (as it is stated here)…

Yes inflation from 2000 onwards was relatively low, however I’d rather stay on the safe side and try to use this 0.5% as a reference value in my FIRE assumptions

In case anyone wants to dig further I found “Form Q-IS” or the form that needs to be filled in by the new country tax authorities to reclaim the WHT if your 2nd pillar provider is domiclied in canton Geneva (in Fr, En, De, IT). I believe I have seen a similar form for other cantons.