I did some research on most of these platforms and here are my comments.

Bondora

Edit: The loans are all with the platform owner. Negative returns realized by Jørgen suggest there is no buyback of defaulted loans.

Crowdestate

Cracks already showing. Some projects significantly delayed, therefore promised returns will not be realized in full. At least one developer already bankrupt (see their Marketplace)

Crowdestor

Very few projects, means high exposure to individual loans. Risky.

Envestio

20%+ returns is just fishy. Most projects are “Tiers” of existing loans. This leads me to believe they are just refinancing the previous loans for as long as they can get away with it. Many previous projects were crypto mining farms based on GPUs. To anybody in the know it is clear that GPU mining is not profitable at current prices. No chance this will get repaid.

FastInvest

Only two, unspecified, loan originators. Too little transparency, too little diversification. No go.

Grupeer

As I write this, only 16 loans available with 3 originators. Too little diversification.

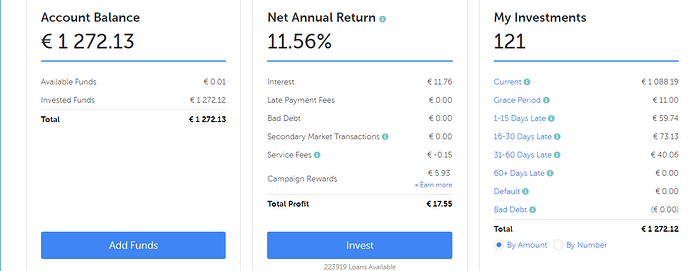

Mintos

230’000 available loans with 50+ originators, good transparency.

Robocash

Looks like all loans are with the platform owner (Zaymer=Robocash). No diversification.

Swaper

All loans owned by one financial entity. No diversification.

Twino

One of the oldest platforms (2009). Apparently reliable, offers buyback guarantee. I can’t find any info about loan originators or the loans available (lack of transparency).

Out of all these platforms, I only found Mintos suitable to trust with some play money. I’ve been with them for 4 months and it’s been going fine (support, withdrawals etc.), but the real return is closer to 11.5%. Here’s my referall link if anybody is interested: www.mintos.com/en/ref/L7M93R . Let’s see if I can get my 19000+ EUR in referrals!!!