Thanks @hedgehog, that is a good point. So can I interpret your answer as if the hedging cost is reasonable (not sure what is reasonable but less than half of return for sure) and if the long term aim is to have CHF, then it may make sense to hedge the portfolio (or part of it) ?

How do you intend to determine the cost of hedging?

For bonds hedging makes sense, less so for equities. The problem is right now hedging to CHF is exorbitantly expensive. These things are priced by the difference between government bond yields, you’re not expected to have a free lunch swapping one safe bond for another equally safe one

USD T-Bills are yielding 1.6-1.7% at the moment and the outlook is not good, the rise over last year or so has been stratospheric and probably will continue: FRED data. CHF yields are shit and deeply in the minus. For hedging you will pay the difference - sum of positive USD yield and negative CHF, landing far above 2% annual cost

@cray I do not think I know the answer, I am trying to understand it.

@hedgehog when you say right now, do you mean it is higher than it should be (due something other than interest rates alone) or it is not surprisingly high but high because of interest rates at the moment ? Maybe in other words the same question, can you explain exactly what does it mean to pay the difference of interest rates for currency hedging in the context of ETFs ? I understand, simply saying, an hedged ETF rolls a currency future every month, is this interest rate difference approx. the cost of having these futures ? (I do not know 100% yet how the currency futures work)

I do not know how hedging works but I find it adorable that you bought a hedged product, yet you don’t know how hedging works

I guess I will read up on hedging, not cause I believe I want to use it, but this topic keeps coming on this forum.

From what I know, the existing interest rate differential plays a big part, together with the inflation rate. This very roughly is the advantage you would have of taking a loan in the lower interest currency and investing the money in the higher interest currency.

Then there are the expectations. How will the rates, inflations, economies develop? This is also baked in and changing.

In Europe, an ETF may conclude such contracts with its “parent”, an UBS ETF for example with UBS. I have seen prospectuses (not UBS, did not check), where they explicitely wrote that market rates are not guaranteed for such contracts.

The hedging costs are often partially in the TER and partially not. They are also in the annual report, but again, you don’t know which part has been baked in. The tracking difference might help. Not very transparent. I wonder why.

Moreover, as rates are changing, the cost of hedging is changing. This needs supervision. What are you doing when costs get too high? Sell and switch ETFs? Don’t you think this will already be priced in, hence giving you not so good conditions? This way, hedging can also create risks, imho.

I will stop and not begin to rant about the interest change risk in bond etf.

@Bojack I think it is not hard to invest in something with currency hedging, at the end you know what it is and pros (eliminate currency risk) and cons (it has a cost which you have some approx numbers). I do not know the exact mechanisms, how it is actually implemented etc. and I would like to learn that.

Please check the following etf. TER 0.15, floating rate (so let’s say no credit risk). Can you tell me - why the loss?

@cray an interesting thing is for example iShares equity ETFs such as iShares Core FTSE 100 UCITS ETF has different TERs for hedged versions but for example iShares Global Aggregate Bond UCITS ETF has 0.10% for all versions. In the holdings list, there are Forwards I can see, but I cannot interpret this to reach a point about the cost of hedging. I tried to look at some others to compare the tracking but did not find something interesting yet.

BTW, this paper of iShares has also some high level information about the topic, which explains why tracking is more difficult with hedged ones: https://www.ishares.com/uk/individual/en/literature/brochure/ishares-plc-currency-hedged-etfs-en-emea-brochure.pdf

I am still thinking there is a cost of hedging but it is not particularly bad for a strategic long term asset allocation. I mean you can accept the cost of it and live with it. I think the most important is at what conditions currency hedging is needed. This is another point I am trying to understand other than the actual mechanism of hedging, and I understand this is an ongoing debate.

An alternative to hedging bonds (or to bonds in general) might be so-called bond substitutes. Burton Malkiel suggests that we’re in financially repressive period, when governments will try more and more to put the burden of government debts on bond investors by manipulating the interest rates. The solution of Malkiel is to buy instead high dividend stocks and treat dividends pretty much as bond returns. I’m not sure though how to implement such strategy in Switzerland, but I’d suggest a high dividend index fund.

Another solution, for those more adventures, is to just go 100% stocks (or perhaps go into different asset classes to diversify more). And this is pretty much what I’m doing - I have mostly stocks and little bit of metals.

@1000000CHF but dont commodities have (more) similar characteristics to stocks (than bonds) ? I am not sure if bonds can be substituted with sth else in this context.

I am actually thinking to invest more on dividend stocks, but still thinking

@cray not sure about the loss but something interesting I see on the webpage of this ETF (https://www.lyxoretf.lu/en/retail/products/fixed-income-etf/lyxor-$-floating-rate-note-ucits-etf-monthly-hedged-to-chf-dist/lu1571052569/chf), it writes estimated monthly hedge cost and it is 0.26% which is I think a low value comparing to what I was expecting.

Nothing is a good substitute for bonds, but when bonds suck what can you do? You either keep more cash in bank account or invest in something else that is moderately risky and gives you reasonable return (low-debt, high-dividend stocks are the closest approximations of that).

I will have a look at the linked document you provided. It sounds interesting - thank you!

I agree with your point - it is important to understand what hedging can and should accomplish in a portfolio.

I see mainly the risk that the CHF will appreciate steeper than the currency you are invested in plus the cost of hedging. So it helps in just one scenario. My imagination here is maybe too limited.

Moreover, the Swiss National Bank (SNB) is known to depreciate the Swiss currency when it gets too strong vis a vis the Euro / Dollar. Just to give you an idea of its resolve: The SNB apparently is / was recently among the top ten sovereign funds in the world with its asset purchase program. You are betting against the SNB.

When will the SNB have problems intervening? When two of its goals collide, such as an CHF inflation of 2% while CHF is appreciating. This is probably a hyperinflation scenario. I wonder how much hedging will cost in this one…

Feel free to hedge, these are just my thoughts. Thank you for bringing this discussion up.

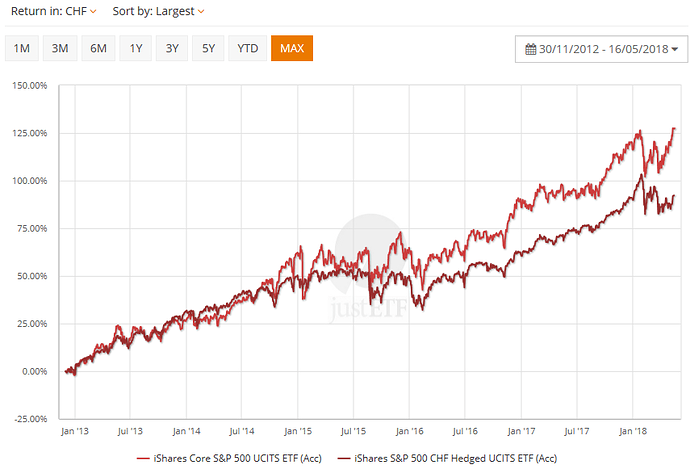

@Bojack yes but is it meaningful just to look at the returns ? I mean the volatility characteristics change when you hedge, so it is not unexpected to see different returns.

Yes you betcha, see the FRED’s graph I already linked, it used to be practically free just a few of years ago and before SNB and ECB pulled this negative yield crap and the grass was greener…

It’s common sense, or if you’d prefer a slightly more academic treatise - Interest rate parity - Wikipedia

Eggzactly

That’s more of a thing for long term bonds. Currency hedging is done (or at least priced) on the basis of very short term bonds like with 1 month maturities, you short USD T-Bills and at the same time go long 1 month CHF bonds, you have to pay T-Bills rate which you’re shorting and negative CHF yield that you’re long. And you do this every month, when one forward contract expires you buy another

Hedging costs themselves are baked into the benchmark. Your ETF’s factsheet most likely tells you something innocent like “we’re just tracking S&P 500 100% Hedged to CHF Index” and that implies that all the hedging costs are already baked in and it’s OK to not disclose anything further. If they charge you any extra TER compared to unhedged ETF, that’s just for all the footwork needed to rotate currency forwards every month, you know hitting a few buttons, buying and selling what computer tells you to, banker’s time is expensive!

Times 12 months in a year equals 3.12% per year, about what I was expecting, and you?

Great explanation @hedgehog , thanks a lot !

Just realized the above estimated monthly cost of hedging I mention 0.26% is of index not the actual ETF, like you said it is baked into the index.

Also, I just found out, and for those interested, Bloomberg Barclays Index Methodology document describes the calculation of the effect of currency hedging into the index return, appendix 2 on https://www.bbhub.io/indices/sites/2/2017/03/Index-Methodology-2017-03-17-FINAL-FINAL.pdf

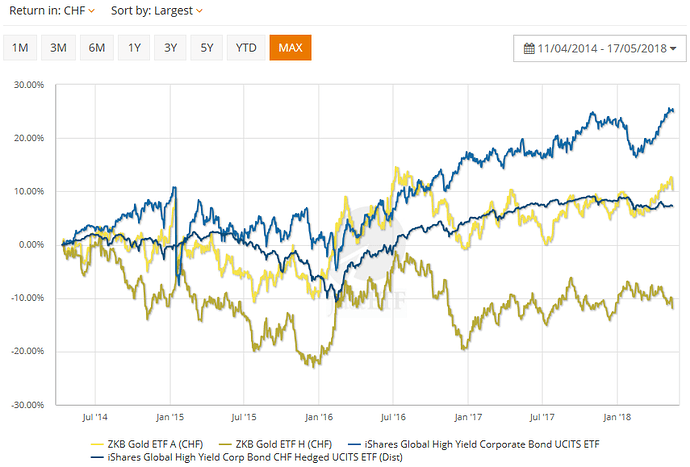

Here a comparison of gold and bonds:

Btw gold etfs date back to 2010, and counting since then, the difference between hedged and unhedged is gone.

How does CHF hedging of gold work and what’s the point? Do I understand correctly that a USD position hedged to CHF should theoretically keep its value in CHF?

BTW, there’s good article on hedging at FT:

“But investors who bought currency-hedged funds in a wide range of overseas equities believing it would reduce risk and boost returns have been disappointed, according to analysis of FE data by the Financial Times. Currency hedged funds in European, Japanese, US and global equities have dramatically underperformed the same, cheaper, funds without currency hedging over the long-term as sterling has not moved the way investors thought it would.”

https://www.ft.com/content/20104c9e-58f2-11e8-b8b2-d6ceb45fa9d0