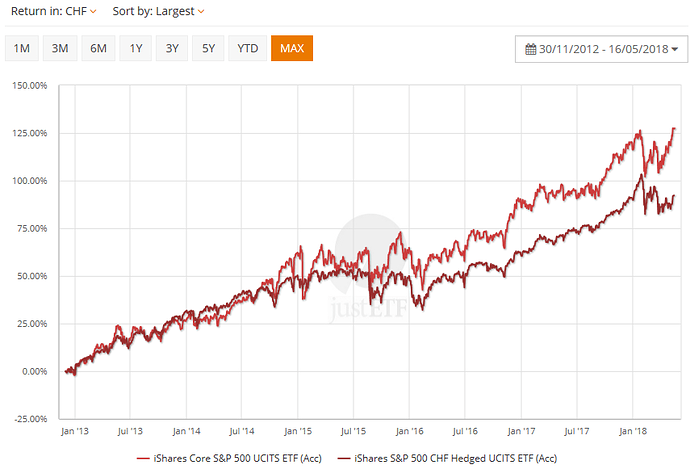

Check out this return comparison of iShares S&P 500 unhedged vs hedged.

@1000000CHF but dont commodities have (more) similar characteristics to stocks (than bonds) ? I am not sure if bonds can be substituted with sth else in this context.

I am actually thinking to invest more on dividend stocks, but still thinking

@cray not sure about the loss but something interesting I see on the webpage of this ETF (https://www.lyxoretf.lu/en/retail/products/fixed-income-etf/lyxor-$-floating-rate-note-ucits-etf-monthly-hedged-to-chf-dist/lu1571052569/chf), it writes estimated monthly hedge cost and it is 0.26% which is I think a low value comparing to what I was expecting.

Nothing is a good substitute for bonds, but when bonds suck what can you do? You either keep more cash in bank account or invest in something else that is moderately risky and gives you reasonable return (low-debt, high-dividend stocks are the closest approximations of that).

I will have a look at the linked document you provided. It sounds interesting - thank you!

I agree with your point - it is important to understand what hedging can and should accomplish in a portfolio.

I see mainly the risk that the CHF will appreciate steeper than the currency you are invested in plus the cost of hedging. So it helps in just one scenario. My imagination here is maybe too limited.

Moreover, the Swiss National Bank (SNB) is known to depreciate the Swiss currency when it gets too strong vis a vis the Euro / Dollar. Just to give you an idea of its resolve: The SNB apparently is / was recently among the top ten sovereign funds in the world with its asset purchase program. You are betting against the SNB.

When will the SNB have problems intervening? When two of its goals collide, such as an CHF inflation of 2% while CHF is appreciating. This is probably a hyperinflation scenario. I wonder how much hedging will cost in this one…

Feel free to hedge, these are just my thoughts. Thank you for bringing this discussion up.

@Bojack yes but is it meaningful just to look at the returns ? I mean the volatility characteristics change when you hedge, so it is not unexpected to see different returns.

Yes you betcha, see the FRED’s graph I already linked, it used to be practically free just a few of years ago and before SNB and ECB pulled this negative yield crap and the grass was greener…

It’s common sense, or if you’d prefer a slightly more academic treatise - Interest rate parity - Wikipedia

Eggzactly

That’s more of a thing for long term bonds. Currency hedging is done (or at least priced) on the basis of very short term bonds like with 1 month maturities, you short USD T-Bills and at the same time go long 1 month CHF bonds, you have to pay T-Bills rate which you’re shorting and negative CHF yield that you’re long. And you do this every month, when one forward contract expires you buy another

Hedging costs themselves are baked into the benchmark. Your ETF’s factsheet most likely tells you something innocent like “we’re just tracking S&P 500 100% Hedged to CHF Index” and that implies that all the hedging costs are already baked in and it’s OK to not disclose anything further. If they charge you any extra TER compared to unhedged ETF, that’s just for all the footwork needed to rotate currency forwards every month, you know hitting a few buttons, buying and selling what computer tells you to, banker’s time is expensive!

Times 12 months in a year equals 3.12% per year, about what I was expecting, and you?

Great explanation @hedgehog , thanks a lot !

Just realized the above estimated monthly cost of hedging I mention 0.26% is of index not the actual ETF, like you said it is baked into the index.

Also, I just found out, and for those interested, Bloomberg Barclays Index Methodology document describes the calculation of the effect of currency hedging into the index return, appendix 2 on https://www.bbhub.io/indices/sites/2/2017/03/Index-Methodology-2017-03-17-FINAL-FINAL.pdf

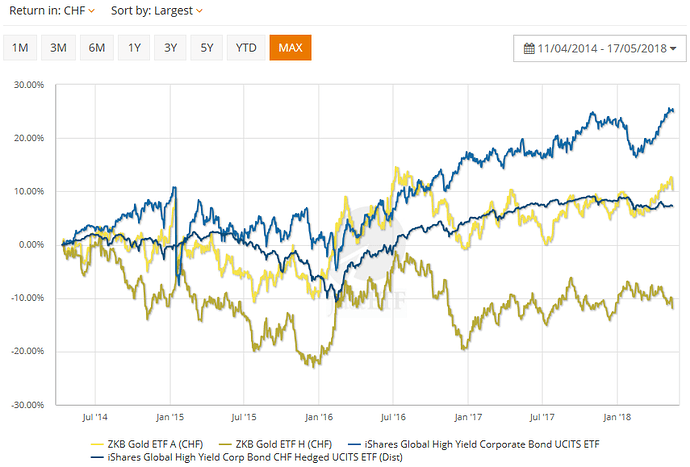

Here a comparison of gold and bonds:

Btw gold etfs date back to 2010, and counting since then, the difference between hedged and unhedged is gone.

How does CHF hedging of gold work and what’s the point? Do I understand correctly that a USD position hedged to CHF should theoretically keep its value in CHF?

BTW, there’s good article on hedging at FT:

“But investors who bought currency-hedged funds in a wide range of overseas equities believing it would reduce risk and boost returns have been disappointed, according to analysis of FE data by the Financial Times. Currency hedged funds in European, Japanese, US and global equities have dramatically underperformed the same, cheaper, funds without currency hedging over the long-term as sterling has not moved the way investors thought it would.”

https://www.ft.com/content/20104c9e-58f2-11e8-b8b2-d6ceb45fa9d0

Lets say I plan to live my entire life and retire in Switzerland.

Is it worth it to have a small percentage of your portfolio in the swiss market say 10-15% to mitigate exposure to other currencies?

The argument against that would be home bias and increased risk, because my income comes from switzerland. That got me thinking, what catastrophic event could occur only in switzerland that would tank the local market, lose me my job, but leave ROW untouched?

An argument for this strategy would be that Switzerland has performed quite similarly to any World index, I also believe it will continue to perform better than europe and say japan in the longterm and better than EM shortterm.

Maybe switzerland is quite a sound investment, what are your opinions?

That is an interesting statement…

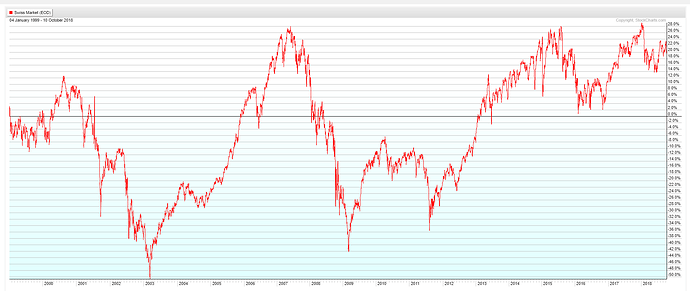

Below is the total return performance of the Swiss market over the last 20 years. 22% over 20 years makes 0.9% per year on average. I am not sure it even beats inflation.

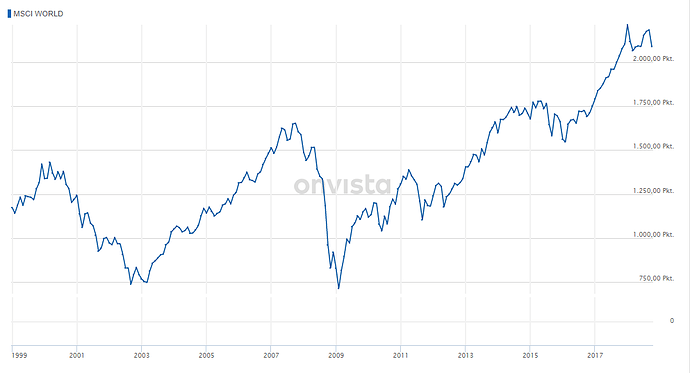

MSCI World on the other hand went from 1141 to 2044 on the same period, which makes 83%. Not incredible, but already better (3% per year) (I could not find on this graph if it was total return (including dividends) or not).

Maybe Switzerland will continue to be a stable country, as it always has.

Or maybe the Swiss National Bank will have printed so many franks that the whole Swiss economy will tumble.

Or Maybe Switzerland will do just fine, but US will collapse with all their debt.

Maybe Japan will wake up from two decades of non-returns and become a competitive stock market again.

Or maybe not.

My point is, if you start indexing, you do not want to guess what will happen to a given country over the next decades. So your best hedge is to buy companies making earnings everywhere in the world, so that what happens in one country has less effect on what happens to others. This is what a world index does. This is what the S&P500 or VTI does as well in a certain measure, since all those companies make money all over the world (even if they are incorporated or listed in the US).

All this global flow of earnings is the best hedge against any currency risk.

Don’t forget that, over the long term, the valuation of an index is how much value and earnings its companies are creating. It does not matter in which currency it is expressed.

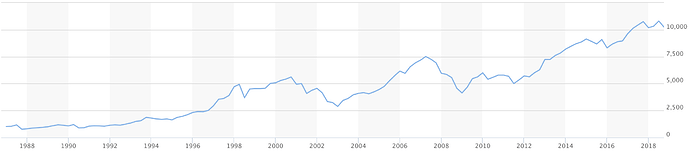

Where did you get that chart?? The best measurement I have for the Swiss market is the SXGE index - Swiss Performance Index Total Return. That’s the top 200 companies. Here’s a link to the chart.

And here’s the actual chart:

Starting at 1000 in 1987, reaching 10800 in mid 2018.

CAGR = (10800/1000)^(1/(2018.5-1987)) - 100% = 7.85%

Not bad, I’d say.

I can tell you my case. I plan to retire in Europe. Didn’t limit myself to a single country, it helps with FIRE to be flexible. I hold 100k of VEUR at Corner Trader and I don’t intend to make any further buys all sells there. I did it because of the following reasons:

- I already had money with CT prior to IB and needed to do something meaningful with it

- Keeping money with CT provides some broker diversification

- VEUR can be purchased with CHF, without currency exchange

- VEUR is not affected by American withholding tax stories

- VEUR should in some way reflect the European economy, so if it fares well and prices go up, this ETF will offset this, if the ETF does badly, then probably the economy will not do so well and the living costs will be lower

It’s a tricky problem to solve. I stick to USDs as I’m not sure yet where I’ll retire (and what currency I’ll need). But if I were sure that I’ll stay in Switzerland, I’d rather keep and increase the bond/cash portion of my portfolio in CHFs over time. I’d rather keep the equity part in USDs to not expose myself to risks and costs of home bias and/or currency hedging.

On the other hand, I’m planing to diversify the broker accounts, so I’ll keep some CHF investments at CT eventually anyway (but this rather will be global portfolio of ETFs, I don’t want to overweight Switzerland).

Reviving the topic to see if anyone was an updated strategy for the USD decline vs the Chuff!

If you think you can get better return than what the market is already pricing, you definitely should make an FX bet ![]()

I consider it a discount atm getting more ETFs for my CHF. Do expect the CHFUSD to keep lowering long term but it will go back to the slower rate and even out. Right now its a discount, is my optimistic thinking. Nor am I bullish on European and Asian companies outperforming, so not increasing VSUX/VEA allocation.