That’s pretty interesting. But can I do a zero-interest loan as well or can it be challenged anyhow? Do I declare that in the section related to my wealth or is there any special appendix? Quickly looking I don’t see any dedicated field in the Basel-Stadt tax declaration, but if you can share some insights how you handle that in the Zurich one - I will try to find the equivalent.

Yes I think you just declare it as an extra line in your wealth section - after all, it’s no different from a bond in your broker account.

I don’t have any supporting evidence here, but my gut feeling is that 0 interest should not be a problem and the documentation also - if you need a contract just sign something basic, but maybe you don’t need one at all as @dbu mentioned.

Thank you for update.

Just to understand how should your father pay tax to Basel when he does not live in Switzerland? Would he receive a bill?

And does it mean your father need to pay tax in both countries (where he lives & CH) ?

- he should visit the website: Erbschafts- und Schenkungssteuer | Kanton Basel-Stadt

- print the gift tax form

- fill all the details (amount, date, donor, donee, who is going to pay a tax)

- send it to Basel TaxAdmin

- wait for a payment slip (ofc sent by post, not by email

)

) - pay the tax

So generally he has to be aware that he is obligated to pay. If he doesn’t do it - Basel-Stadt can reach to you, as a local donor, one day and ask for the tax (+ relevant interest). So if you don’t care enough to understand what are the implications - you can wake up one day with a very pleasant letter in your mailbox.

Yes, exactly - as long as there’s no DTA regulating that (and as we discussed above - that’s the case for most countries).

I knew that you’d eventually talk your way into paying tax!

For those playing along at home an alternative course of action could have been:

- Confirm the advice in writing from the guy who said no tax.

- If he says, oops, I got it wrong goto 5.

- If he confirms, great. No tax to be paid. Wait 5 years. if nobody notices, then statute of limitations applies and there’s no tax to be paid. END. else:

- Someone realises a mistake was made

- you pay tax + interest.

only five years ? Would have thought it is longer (like 10ish)

The confirmation of the fact that taxes had to be paid came from the same tax office that told the OP on the phone that no taxes were due. So please elaborate more on the point 1: should’ve OP discovered the home address of the person they spoke to on the phone and send them a mail at home asked to confirm it into writing?

When you talk to someone on the phone, the first thing they state is the name. At the end of the conversation, you can ask for their email (if you don’t already have it). OR you can give them your email and ask for confirmation in writing.

But as you just said above:

- Someone realises a mistake was made

- You pay tax + interest

so what’s actually the point? Yes, you can try to court them and say “I have a proof they misguided me!”, but do you really believe you wouldn’t end up paying the tax anyway? That’s definitely not a path I’d ever want to explore.

I think tax office know what they are doing and what they say. So either information in first conversation was not so detailed and hence tax office made an incorrect assessment or Deloitte is wrong.

so what’s actually the point?

When you got the advice in writing, you are good to go. There’s no need to keep asking different people until you get a different answer.

do you really believe you wouldn’t end up paying the tax anyway?

Yes. Obviously, they hadn’t paid and nobody came for them for a year already. I’d wager another 4 years would have elapsed without incident.

It is enough I was redirected to a person not so specialized in gifts to get the wrong answer - the tax office is not a Delphic oracle, just people with different levels of knowledge in various topics. Mistakes can still happen, especially during a quick call.

That’s exactly what can be said about looking for that one desirable answer that will contradict all others - but in this situation, that answer is the one about not having to pay tax, not the other way around.

No one came because the tax return in which the gift would be declared has not yet been filed. I guess that explains a bit - obviously.

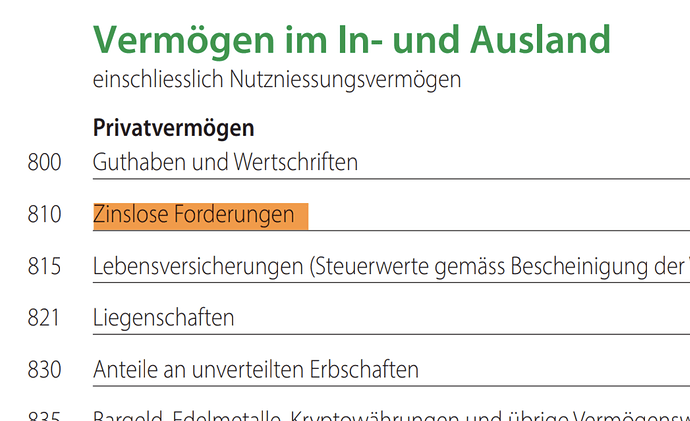

Here ya go, Basel tax decl., field 810.

And do definitely make it Zinslos/interest-free, else you’ll be taxing that (pseudo-)interest payment from your Dad as income!

PS a very simple IOU is sufficient - from who, to who, amount, from what date, perpetual or end date, and 0% interest. Signatures would be nice, but not essential. No need to attach to Tax Decl., but keep handy in case they ask for “proof”.

Thank you so much! I should just declare the same loan amount (assuming that’s the only one) in this field each year, as long as loan is not yet returned, right?

“Perpetual date” - hah, that was yet another question I had in mind - if a loan with no date is also acceptable. I’m definitely not a specialist in such perpetual assets, and e.g. for bonds we can read that:

A perpetual bond, also known colloquially as a perpetual or perp, is a bond with no maturity date, therefore allowing it to be treated as equity, not as debt.

so I had doubts if that wouldn’t be treated as an actual wealth transfer. In my case it doesn’t really matter, because I would put an end date anyway, but I wonder out of curiosity.