There’s also Chia (from Bram Cohen) which uses proof of space which sounded interesting.

QE is terrible. Central bank buying assets is terrible. Did western economies really recover from the 2008 crash? European economies develop at a near-zero pace. There are many zombie companies, because the old inefficient order thing things has been kept alive by bailouts. Money from nothing leads to inefficient allocation of capital & work. Badly managed companies should have been allowed to go bankrupt.

In case of banks going bankrupt, I understand the state intervention in the following sense: in order not to cause mass panic, a bank going bankrupt would be taken over by the government, liquidated, and the missing cash could be then “printed”, so that the people didn’t lose their life savings. But the bank itself should then cease to exist. Instead the banks were kept alive, have been given bailouts and keep operating. Instead of preventing “too-big-to-fall” problem, banks are being merged to make for even bigger problems.

Chapter 11. This is a well working process for restructuring firms. In recent history GM and Chrysler went through that - does anybody even remember?..

I don’t get how you can be in favor of QE and not being extremely concern about the depreciation of your assets, sounds very counter intuitive.

Proof of Stake vs. Proof of Work is a good debate, both have pros and cons. I personally dislike POS for the lack of equality (the more you stack the more you get) and the risk of double spend, but it is not necessarily better or worse than POW. I guess ETH 2.0 will give us some answers until maybe we develop a new protocol in the future!

I really love this piece from Myret Zaki about inflation, where she discusses why inflation is poorly measured. A good read in this time of QE policies.

What do you mean? AFAICT unemployement is nowhere near the levels of 1929 and while it hasn’t necessarily been great everywhere, there hasn’t been a similar depression (1929 with 15% gdp drop, vs 1% in 2008). A deflationary spiral would really have been better in your mind?

At a few times in 2008 and 2020, we would have been close to a full blown liquidity crisis (I have relatives working in treasury/central banking who spent some very long days coordinating things in both instances…). While there might have been individual cases where some companies should have failed (and note that there’s been ton of work since to recapitalize banks, add safeguards and avoid the too big to fail problem) there were also a ton of company/institutions that were in relatively good shape but were lacking liquidity. So your solution was to sacrifice all of those and start from scratch, that can take decades to rebuild those things, with huge unemployment and unrest (when did we really recover from 1929? we had to have a world war in between…)

(and the same thing in 2020, which was even an endogenous cause, so can’t really blame it on anyone in particular, again the solution is to get tons of companies to fail, have high double digit unemployement likely followed by unrest?)

In a society tied to gold standard (which is what some bitcoin proponents aims to), none of those tools are available, and yes we probably would end up in a massive depression, personally I prefer the outcome of 2010 or 2021 than 1930. (Wikipedia has even a whole section on it: Great Depression - Wikipedia)

I recognize that the economy is not necessarily like math or computer science and might be closer to biology, but IMO we should still recognize what are the mainstream views on economics and anything that’s more niche (whether it’s the austrian school of economics or hydroxychloroquine) probably deserves more scrutiny before being taken as gospel.

Is there a middle way between the rigidity of a gold standard and limitlessly monetizing and postponing financial issues, which is possible but not compulsory with fiat currencies? Difficult since we can’t really replay the past with different scenarios. The mindset in 1929 was different than in 2008 (if you teleported a softie from 1929 in 2008 he would have looked like a hardliner). Assume QE was and is the least of all evils. Fair enough. Since the main topic of this forum is how to live 40+ years without salary, you have to think about a scenario where this monetization begins to come to the surface. Perhaps parallel, private currencies? Dual currencies (one for buying bread and paying taxes, another one for investments)? Inflation-resistant assets? There are different ways, mixes, etc.

It would have been a quick shock followed by a quick recovery. The 1929 crisis has been extended through interventionism, new deal etc.

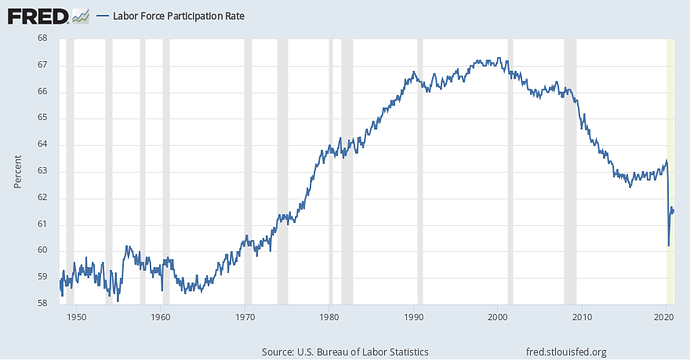

By the way, here the wonderful recovery of the US labor market…

For major economies what is the problem you’re trying to solve? When did real returns of a conservative portfolio have been negative? What likely changes would make this become different in the future? (esp. the type of changes that don’t imply a massive planetary crisis and unrest)

And why would you want to try that against a high risk + volatile asset?

(And why not focus on the climate emergency which will matter a lot more for your well being and safety for the next 40 years)

That’s a nice high school exercise, thanks for sharing.

Given the definition of labor participation rate, which factors would influence it so that we’d see a long term drop in the 2000.

How could this effect be removed, while still using labor participation? And also the difference with the various other statistic around unemployment.

(Maybe better to try to solve it before checking wikipedia, it’s more fun)

Don’t be so cryptic…

…just as they can be seized or frozen by (supposedly) “democratic” countries.

Country that are (supposedly) democratic - such as the US - are in fact doing this regularly.

And certainly not only for nefarious “Mafia” type of crime but also politically charged ones.

Because Russia doesn’t control the flows of these currencies.

Do you think USD would have worked equally well for Edward Snowden’s association?

They already are melting, aren’t they? The great trick they invented is just to do at a level of (relatively) low inflation and zero interest.

Prices for essential goods and services such real estate, food, public transport (and in Switzerland health care) are inflating much faster than the official rates of inflation throughout most of Europe.

EDIT: Didn’t see that Oliv had already posted a link above, which outlines what I was getting at.

Sure I thought sometimes the Socratic method can be useful.

So it’s a totally useless statistic for your point since it’s mostly driven by old people (boomers) and people being out of the labor force (e.g. the opoid epidemic). The wikipedia pages lists a bunch of things that impact the labor participation rate. A mimimum to correct for it for the point you wanted to prove would be to at least have an age cutoff to remove people in retirement, but it would still be a bad statistic for that, if anything it just shows what it is, the fraction of the adult population that’s working there’s tons of reason besides economical why they wouldn’t (age, health, longer studies, etc.)

You probably want unemployement rate instead (which also have issues, but at least not those).

Sometimes you really seem to be full of yourself. The patronizing tone doesn’t help.

Alright then, I assumed the rate divides working people by people in working age, my bad. But I know the US unemployment rate is problematic, because it ignores people who gave up on finding a job after some months. These people would then again be visible in the labor participation rate, a hidden unemployment.

Btw in 2000 the median age in USA was 37.2, now it’s 38.4. Does this really explain such a sharp decline in labor participation?

Sorry about that, but to be fair I tend to be annoyed when random graphs or pseudo stats get quoted, it’s so easy to show anything and people who won’t dig into what it actually mean end up being misled. I would hope that people try to at least understand more about about the issues than picking the first link or graph that seem to validate their claim, especially when pushing heterodox economics.

Unemployment in the United States - Wikipedia cites a bunch of potential causes.

Edit: by the way, for a real argument on how QE might have hurt or not fully recovered it’s much more interesting to look at Europe. Unemployement was much higher, recovery slower and the sovereign debt crisis did a lot more damage. Too me it is a failure of monetary policy because the euro can’t have a proper one without real integration (so to have a good lever, you need to either go out of the euro or integrate all the eurozone countries much tigher, how it currently is will lead ot failures).

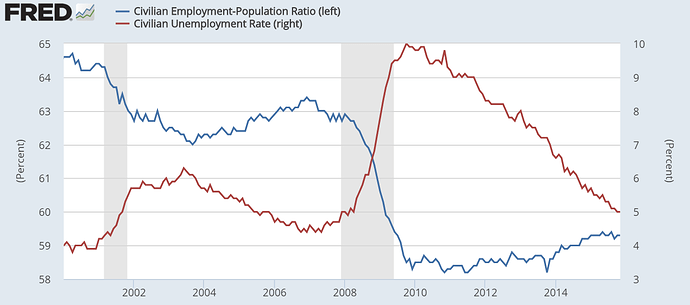

Alright I see your point, but I really feel your criticism is undeserved. I do read about this stuff, but it’s hard to keep it organized it my head, so it gets mixed up. So I put the wrong chart. Here is the right chart.

employment-to-population ratio - This is a statistical ratio that measures the proportion of the country’s working agepopulation (statistics are often given for ages 15 to 64[2][3]) that is employed

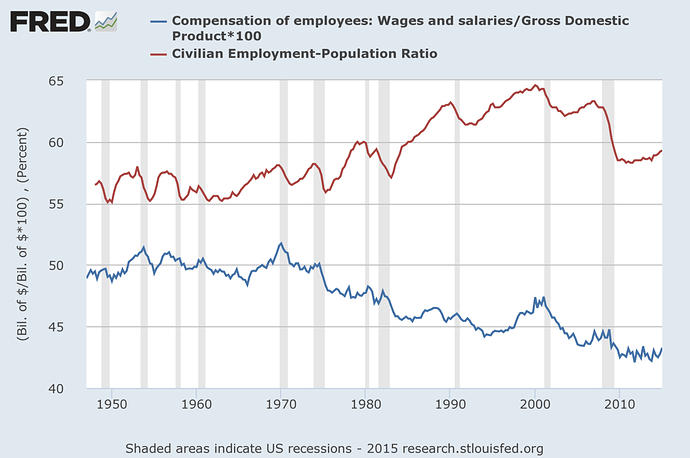

So as you can see, employment rate peaked in 2000 and never recovered after the two crashes. Moreover, the share of wages in GDP has been dropping. Now will you admit that the labor market has not really recovered from where it was in 2000, or will you still maintain your superior tone?

I guess we should look at studies which explore the gap between employment to population ratio vs. unemployment rate, I suppose there can be many reason (people doing longer studies, people out of workplace due to health/addiction issues, e.g. opoid crisis, etc.).

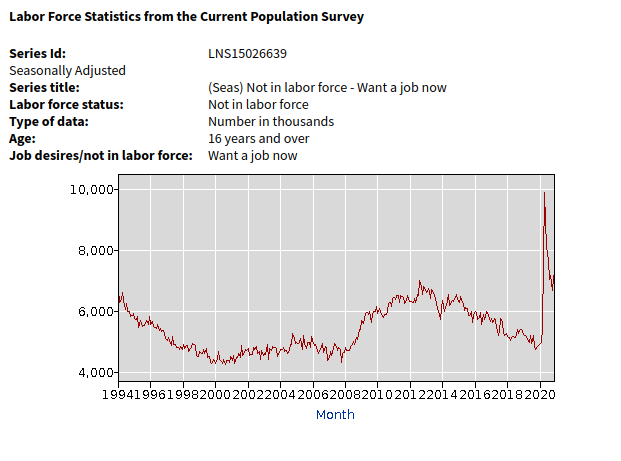

I think one statistic which reflects what you wanted to show is the amount of people who want a job:

(from bls.gov)

From what I understand your concern with the unemployment rate figures, is that since people also need to take active step to search for one it might be biased (it’s a common issue for the ILO unemployment definition), so this statistic should reflect more the reality?

Note that it’s not a rate so it likely looks “worse”, but it any case it still mostly recovered before covid and was better than the 90s.

But this doesn’t indicate that labor market is an issue, or that it’s caused by somehow bad monetary policies (which would have been better under the gold standard).

For example Labor share of income: A new look at the decline in the United States | McKinsey points to the most commonly recognized factors. One way to read it is that workers benefit less from the economy (switch to automation, intellectual property based, less bargaining power of employee, capital getting higher reward, etc.)

(I also looks similar to the type of stuff that Piketty explores, the divergence between rewarding labor vs. rewarding capital, even if we don’t agree with the proposed solutions, the data exploration is sound).

From the future of bitcoin to the unemployment rate  , I will NOT say it is something that bitcoin can fix. Even if BTC replaces USD as a reserve currency.

, I will NOT say it is something that bitcoin can fix. Even if BTC replaces USD as a reserve currency.

Next stop: 50k ![]()

Probably by the end of the day when the news spread that papa Elon is buying in.