Hodl and dca and you will be fine

Really enjoyed purchasing bitcoin for $30k, I had to take a loan to increase my leverage this summer, can’t say I regret it. Still DCA every week, the price doesn’t matter.

Now that most FUDs have been cleared, next target is $100k in December

Yolo

20 fucking characters

Figure of speech ![]() it was just to emphasize how great the opportunity was.

it was just to emphasize how great the opportunity was.

BTW, the second US ETF will launch tomorrow. The first US ETF had the best start ever with $1.1b AUM after only 2 days.

All too busy buying more BTC while it was on sale, no? Funny how nobody was writing here to show off his/her latest bargain though.

To be honest, buying at 30-40k did NOT feel wonderful at the time, although many of us still did. There was always a nagging feeling that perhaps all the naysayers are correct and you are stupidly spending good money on a non-asset. It needs conviction, calm and patience - and faith in the asset itself and its true value.

That’s what he said on 18.02.2021

That’s what he said on 21.10.2021.

Just for reference, so that we can go back ![]()

Don’t get me wrong: I also hold some cryptos, but those were bought some years ago. For me, this money is written off. I don’t count it in my net worth.

Crypto currencies have no true value. What’s true anyway? The only value of BTC is scarcity, and the hope that someone will buy it from you later for a higher price than what you paid for it. It can be an asset (although a highly risky one), but if you want to pay for something, you still need to change your cryptos into fiat money sooner or later.

Again a disclaimer: I don’t want to start a PRO/CON conversation again. I’ve been watching cryptos for some years now, and I think I understand the problems of our current fiat money systems. Still, from my point of view it’s naive to believe that fiat systems are going to crash, and then the BTC/ETH/“name favorite coin here” followers will be new elite. That will, most likely, not happen.

Hi, anyone have any experience using Swissborg Smart Yield?

Update: sorry, just seen @Dtrogen has posted ealier

Nothing. ![]()

Just HODL’d the relatively small investment since 2017-ish (with some recent rebalancing from a colorful mix to just BTC+ETH in the meantime).

Not disappoint with the returns, but I long ago decided I will not be adding more no matter what.

A bit less long ago I decided that it should be max ~5% of my total portfolio/NW (which it is indeed nearing at the moment; but I will most likely not sell either ![]() unless it grows to 15%+).

unless it grows to 15%+).

I am very comfortable with that.

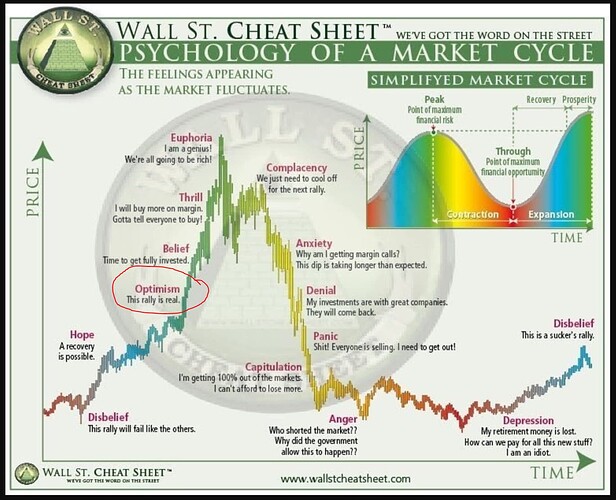

Funny thing is, it was obvious for several months now that we were at the beginning of a bull market. On-chain data analysis are amazing for that, data really tells a story if you pay attention.

Let’s not pretend that there is not a whole country using it now ![]() “but they are using dollars”, no, the underlying infrastructure is the bitcoin blockchain and it is infinitely more effective than anything else.

“but they are using dollars”, no, the underlying infrastructure is the bitcoin blockchain and it is infinitely more effective than anything else.

Can you elaborate more on that? What tools are you using, which resources are good?

We both know that this argument does not survive some simple fact checks.

- they still have the USD as the main currency. I doubt that any merchant will label products in BTC only. It will still be “TV costs 1000$”, but you can choose if you want to pay in USD or BTC

- El Salvador has a lot of citizens working abroad. Using BTC to transfer money back home is a proper use case, but if 0.01 BTC are 660$ and were 300$ three months ago, it might be tricky to pay your bills with BTC only

- paying with BTC is a mess (please don’t start discussion about Lightning protocol etc). Original BTC was never meant to be used for 1000s of transactions at once.

- on a side note: there are currently protests in El Salvador. I don’t know the background (and if those protests are somehow planned by someone in the background), but me personally wouldn’t want to live in a country which has one of the highest rates of non-natural deaths (due to gangs, high number of guns and weapons etc)

“earlier” ^^’

haven’t post for long, but cool to come back from time to time.

If you have any question, we can dm or talk in the right topic^^

It’s mostly happening on Twitter, you can check people like willy woo, william clemente, planb, etc. You have several very interesting people to follow. As for the tool, Glassnode is the obvious one, you can play with it as they have a freemium model.

Well that’s the whole point about El Salvador, they are using the lightning network exclusively, and it works! Plenty of videos on Twitter at McDonald’s or Starbucks.

LN has now a capacity of over 3000btc ($200m) and the number of users and nodes is increasing rapidly. I have my own lightning node and channel, it is super simple to create. Twitter is rolling out their own integration as well, so you shouldn’t dismissed this second layer too quickly.

Thanks for the recommendations. Much appreciated!

I just checked Twitter “El Salvador McDonalds”, and indeed you can pay with BTC (link here). BTC was around 51k USD when the picture was taken, so the person paid roughly 5 USD for the meal.

I’m just wondering how the McDonalds store is accounting for BTC in their balance sheet. Or if they change back to USD once per day? I still think the price you see in the store is in USD, and you can choose to pay with BTC. I just hope that those users won’t regret the payment in BTC one day, when 100k or 200k are reached ![]()

Anyway, thanks for the more detailed information. If they are really using lightning network, it’s indeed better suited for quick payments.

Speaking of crypto ETFs, who wants to give their money to institutions who sell Bitcoin for USD 8,200 on an algorithm mistake?

Enthusiasm is cool but institutions gambling again with other people’s money doesn’t lead to good things in my book.

I think these are all very valid points, and very important when assessing whether any specific token is worth investing in. And believe me, there are a LOT of scams that also have a price even though they completely lack a use case (i.e. actual value - they don’t actually DO anything). People think they are fun, invest, so the price goes up. Best examples are the “meme coins” Doge and Shiba Inu but there is an endless number of silly tokens with zero value, no developer and 100 billion tokens in circulation. Completely laughable, and those two coins don’t even pretend they are valuable. I fully expect them to go to zero one day, when people lose interest.

Other tokens are clear scams or ponzi schemes, their only purpose is to raise capital for the people who shill them on the internet - examples are HEX, XRP, XLM… look at the developers and their history.

As for the 51% rule, this obviously is correct and this danger is much larger when the blockchain is centralized (just like a central bank - all decisions are made in one place). So the more decentralized, the better. That is why Bitcoin, with thousands of independent nodes all over the world, is the safest technology. It is the most decentralized by far and the least easy to control. Quantum computing is one of the recognized dangers down the line - for anything on the planet controlled by computers.

I must say I also used to think that our known/familiar currencies were less risky than Bitcoin, my thoughts were pretty much similar to yours. But if you look at the insane rise of the money supply in the last two years in the US and in Europe, and chart the S+P500 against that money supply, you see it is basically rising in parallel to that. If the US (in the case of the S+P500) has printed something like 30-40% of all US dollars (of all time) in the last 18 months or so, that means a debasement of about 10-15% over the next couple of years. They are litererally printing trillions as if they were candies. It’s like a company with, say, 10000 shares, that suddenly starts “printing” another 2000 new shares every year and releasing them into the market - it’s clear that the value of each original share will go down very, very significantly over time. It’s the same with money printing and it’s been seen time and time again around the world. It’s just not as obvious in the developed world… until it is, like now.

Once you are looking for it, you see it very clearly: real estate prices are just mad, our grandparents could afford to buy a house and pay it off in their lifetimes, now practically nobody can anymore. The coffee my mother-in-law buys in Germany was 3.99euro, now it’s 5.29euro - she has always watched prices like a hawk, and constantly tells me of specific things that have gone up massively. Gasoline/Energy prices are rising, Teslas cost 3000USD more each in the US, it goes on and on, construction materials are up hugely. So let’s see, is it really all “temporary”?

I sincerely hope to be wrong in this instance, because pensioners including my own parents will suffer horribly, and everyone on a fixed income like a salary. I also still work very part-time by choice, and my salary is not rising at the same rate as prices are going up.

After my initial excitement in cryptos, I haven’t been following what’s going on in the last months. I still keep my initial investment of €10’000 in BTC & ETH (currently worth €74’000). But I’ve been considering selling for a while. Correct me if I’m wrong, but crypto is not a productive asset. In fact, it costs a lot of energy to maintain the transactions. As mentioned before, it has no intrinsic value. Fiat currencies also don’t, so I don’t hold them for too long.

So why would I be holding crypto? You could say it’s like holding gold (which also has little intrinsic value) for a doomsday scenario, that is, if everything goes to shi*. I think the store of value function makes sense, but probably still the majority of crypto holders do this as a get rich quick scheme. That is, I’m not sure if they will keep this crypto until their death and just chip away small amounts for their daily expenses. Or will they rather wait until a certain price point (e.g. $100’000) or portfolio value (e.g. $1’000’000) and cash out and buy a house or turn to more conservative investments.

So I think these two forces are driving the price growth. One is sustainable, the other isn’t. You can’t rely on speculators, only on the long-termers. Which one am I? I don’t know myself. Like, on one side I want to cash out my profits. On the other side it feels smart to keep holding a few % of my NW in an alternative asset. I don’t know… does my ramble make sense to you?

I believe the value is there, where the trust is. If there were signs that some crypto is getting taken over and this new owner starts implementing unpopular changes, people would ditch that branch of the chain and start using the “fork” which would be the continuation of the old rules. That being said, I’m not sure how much inertia there would be in the system and how messy a transition would be. I can imagine that since the exchanges and financial services are connected to e.g. Bitcoin main blockchain, it would take a lot of work to add support / switch to the alternative coin. So if a malicious party takes it over, I’m not sure if a consensus on what to do next can be reached easily. It would probably be some kind of “order out of chaos” scenario. First the value of the “tainted” Bitcoin plummets, then a new champion emerges. And all balances are taken over from the point of the fork, so it’s not like you even have to convert the old useless currency.

I think the government taking over a certain crypto is similar to putting a toll on a road, but you can build an infinite number of alternative routes. I guess as long as the governments have enough purchasing power, they can keep screwing with cryptos. I guess in order to make cryptos more resilient we would have to reduce the power of governments. That would mean for example people settling transactions directly in cryptos and not paying taxes. I wonder if we are ever going to see that on a large scale.

The real value of USD has always declined and the decline has been managed by the Central Bank

I agree with everything you say about this being unfair for pensioners but I don’t understand the case for BTC being a better solution and for people to ditch USD and swap to BTC. USD is backed by the central bank whom people trust to intervene if USD inflation spikes or if there is a bank run. On BTC there is no oversight.