My bet is when sovereign funds will start investing significant amounts directly in btc similarly to Tesla. I would love to see Switzerland first, but who knows!

Who knows, indeed? I’m sure the SNB would love to see its balance sheet deflate somewhat in the longer run by buying some BTC, it’s been way too high for way too long. ![]()

That’s the thing: it’s not a question of how high is BTC valued, those who go in for the money would jump on any ship that goes to the moon and drop off it as easily (think post bankruptcy Hertz stock?). For BTC to be really convincing, it has to deliver on actual use cases. It’s starting to happen, so who knows? But it’s still a far shot from wide adoption. I’d rather see a less energy consuming crypto emerge but since I have no money in the game, I won’t get to choose.

In many way it is.

Just one that could go on to infinity (well, the end of the century at least).

They shouldn’t.

Free enterprise is on thing (and may need to be regulated) - but governments should know better than to fuel global warming by squandering resources like this.

Governments decide their own energy policies and hopefully they move to renewable fast enough so we don’t hear this argument again.

Tesla has a billion $ in unrealized net profit with their bitcoin holding, a sovereign fund could use such profits to incentivize said government energy policies. They could also swap some of their investments in gold or fossil fuel energies (or any other dirty industries) to benefit from Bitcoin adoption. They definitely should ![]()

So-called “renewables” aren’t free or particularly efficient. Solar panels or wind turbines don’t just grow like a plant in your mom’s backyard garden. Neither do the batteries used for energy storage and the minerals (cobalt, lithium) they’re made of.

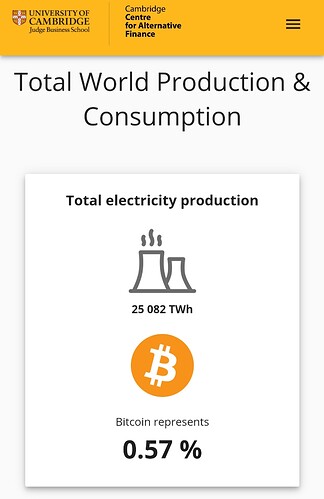

If Bitcoin were a country, its electricity usage would have be, according to estimates, in the world’s top 30 countries. Today, having increased fourfold over the last three years only. At this rate - and sovereign funds investing in it will only fuel this - it will be a major driver of the increase in worldwide electricity consumption and become one of the top three electricity-consuming countries before the end of the decade.

The idea that this will become a magical catalyst in replacing fossil fuels in electricity production is just ludicrous.

Renewable energies and reduction in (average) usage are the two keys towards an ecologically sustainable future in energy production and consumption.

Hugely increasing the world’s electricity consumption and spending that energy on guessing mathematical hashes (that have no other real-world use whatsoever) just to make a few investment funds rich is not.

Between my mom’s garden, batteries, country electricity usage and some magical catalysts, you are hard to follow…

But let’s keep looking at the tree among the forest.

So you have the moral high ground on what is useful and how we should use electricity? I am all for banning Justin Bieber’s youtube videos, way too much energy consumption with all these views!

0.57%. So what? That the same source that has estimated Bitcoin’s energy consumption to be more than 20 times higher than just 5 years ago.

Let’s look just another 5 years ahead and multiply 0.57% by 20, shall we?

Let’s be honest here: I’ve made money with Bitcoin and I’m still holding Bitcoin myself. I am a beneficiary from higher prices/exchanges rates. I’m not taking a moral high ground here.

But I can admit that what’s good for me isn’t necessarily good for our planet.

Between “Bitcoin is a technology, it will revolutionize the world” and “Wohoo, look how much money you would have made last year holding Bitcoin, Bitcoin earnings come from its growth in price irrespective of its actual uses!”, you are yourself, also pretty hard to follow.

So how is Bitcoin itself poised to offer solutions to the problems we have or will have in the future? I can see Ethereum or others playing this part, but Bitcoin? As you state yourself, its use is making people rich, but that use has limits and can’t be drawn to infinity.

Bitcoin was born after the 2008 financial crisis for a reason: removing inefficient third parties from the equation. That’s what the technology is doing and this is why it will (it has already) revolutionize the world. And because it is working so well at doing it, and because of its scarce nature, the adoption of btc is driving its price up.

Most recent example, why do you think Turkey is banning Bitcoin payments (and other crypto)? Because the Lira is failing, inflation is increasing and the government is afraid that people protect their values outside of their weak economy. Same for China, Nigeria, etc.

If I come back to ecology, Bitcoin electricity consumption is not an issue, the way electricity is created is, and this is a government-level energy policy. I still think this is a valid use case for a sovereign fund:

Switzerland is producing too much electricity and exporting it, why not using it to mine Bitcoin and use the proceed to fund renewable energy? And if you don’t like solar panel for some reasons, just plant trees, build bike lanes and whatnot.

That’s a classic fallacy, until we’re 100% renewable we can’t ignore that extra energy consumption is slowing down the transition. If we truly want to speed up the transition we should likely both reduce consumption and shift to renewable, doing only the shift (esp if energy consumption is growing) would make it harder to reach our climate goal (that we’re already unlikely to meet ![]() )

)

There’s a much simpler solution that does not involve throwing energy away. Print money (emit debt) to finance it, it’s as much magic money as relying on bitcoin (it’s not like bitcoin is different it’s still imaginary value).

Money printing is used for canceling debt, not emitting it. For example the Fed is buying debt emitted by the Treasury.

Isn’t sovereign debt denominated in local currency ~equivalent to money?

The problem I see is that you are using a transitional situation and considering it to be permanent. What you are describing is digital gold and, indeed, Bitcoin has some of the same flaws as gold when it’s used as a store of value: it doesn’t produce value and is an environmental disaster.

The rise in price of Bitcoin, a.k.a. Tesla’s unrealized profits, doesn’t come from a creation of value, it comes from an increase in demand for Bitcoin that rises way faster than Bitcoin supply. Since there’s no creation of value, the pool of demand is limited: there can be no rise to the moon, at some point, Bitcoin would flatten and/or drop. For those entering at the wrong time (which we can’t plan), unrealized profits would become unrealized losses. What you put forward as a given (profits) is actually a complete bet: Bitcoin, in your model, is a lottery ticket.

As you present it, Bitcoin is a tool for redistributing wealth, but not creating any: some people are loosing the money other people are making, this isn’t apparent now but since the price of Bitcoin is dependent on how much assets are stored into it, it will become if people try to sell too much of it and it meets a lack of demand, at which point what holders now consider as a given (the value of their Bitcoins) will drop. This happens before the Bitcoin is even sold and when its price is still shown as higher as what a seller could actually get for it. This has a name, it is the model for the greater fool theory.

There is no long term future in your model, only unfettered temporary gains due to a crash at some unpredictable future point.

Not at all! How is (for instance) Uncle Sam paying all salaries and bills with a deficit of x trillions?

It’s also important to note that the energy transition comes with a cost. I’m working on some projects and we are facing oppositions because the common good (more renewable energy) meets individual interests (Not In My Backyard kinds of demands). The projects are weighted and, for good projects, the common good has good chances to win over individual interests but those, even legitimate ones, are still sacrificed.

It’s hard to defend a decentralized currency because we consider we can’t trust governments with our money but to consider that it’s the governments’ job to sit on individual rights and take whatever they need to produce the energy required for this decentralized currency.

Isn’t BTC so inefficient that it consumes energy like a country to process its (quite limited I guess) transactions?

Switzerland is a net importer of electricity for a third of the year (in winter).

That happens to coincide with the time out of the year that hydroelectric output is lowest.

It not only obviously not very efficient to mine Bitcoin during only two thirds of the year. It is also a very limited perspective to only look at Switzerland electricity trade balance and conclude “Oh yeah, we could stop exports over the summer and just mine Bitcoin with it” - when these electricity exports can substitute for nuclear and/or fossil fuel-based generation in other European countries. Not many countries in Europe will have such a high share of hydroelectrics, due to topography.

That’s a basic misunderstanding of how the blockchain works. You are not consuming energy for a transaction, you are consuming energy to secure and validate +$1T in market cap every 10min. Individual transactions do not carry energy costs.

So why do you assume that the energy mix of Bitcoin will be fixed? One day, hopefully, energy consumption won’t be an issue anymore, especially as every future bitcoin halving will likely provoke a decline in energy expenditure.

You are describing a perfect open market with a known monetary policy in which only the demand and supply impact the price. The fact that you don’t see value in a full stack monetary network without third party is okay, but historical data is not really in favor of your theory. Time will tell.

I know you like inflation, I see it as a tax on my future purchase power because more monetary supply means that “something” will inflate in price as well someday, whether it is financial assets or commodities or both. Considering the states of the market stocks, dogecoins, real estates, etc. I think we can guess where the money surplus is going.

I don’t assume that. Energy consumption will always be a problem. It’s the law of conservation of energy: energy consumed requires work, it will never be “free” and, as such, will always be a matter of opportunity vs cost. Bitcoin has to prove that its opportunities are worth its costs. Right now, you are only adressing its use as a store of value, which is what I’m adressing (it doesn’t work at that because the vast majority of the current demand doesn’t want to store value in it but to make a quick million bucks on greater fools).

Except that for a currency to work as a currency, it’s better for it to hold its own value so that you can buy equivalent goods through time. For that to happen, Bitcoin would have to both be widely adopted (you can trade with it) and reduce its volatility. This is also why gold is a terrible tool for trade and you don’t see people exchanging it for goods on market places: it does a decent job at keeping its value over long periods of time but is terrible at it on shorter intervals because of a high volatilty.

But as you say, time will tell. Just don’t pretend that there are only terrific gains to be made perpetually holding BTC: without clear use cases (which would go against quick increases in value), the system needs fools and bag holders to function. The higher the price when one enters the craze, the higher the chance that this was actually the wrong time and to be the one paying the dinner (not saying there won’t be winners still, just that there will definitely be loosers too and that those loosers could be us).

Historical data is not able to support this claim. So far, the halvings have only had a very short-term effect in mining activity (couple of weeks or months) - but provoked outsized increases in price of BTC.

Electricity consumption is not free. Someone has to pay for it.

As you said: “you are consuming energy to secure and validate +$1T in market cap every 10min”.

Long-term, it’s going to be the holders of Bitcoin that will be paying it.

Like any good pyramid scheme, it has just not become apparent yet. Because (like Wolverine said) demand has been outstripping supply at previous prices.

Of course there are people who to pay a tax according to market conditions (electricity prices) rather than one (interest rates and money supply) set by central banks and politicians.