When I called them I was told that this form is not to be used for overseas investor so I never really checked it in “detail”. It looks like for overseas investors there is no obligation to make any monthly payment, at least there is nothing stating the opposite and for us the relevant document would be this one:

In any case, Fundsmith certainly doesn’t seem cheap for what they’re doing (buy & hold, largely).

He seems to be arguing that they’re overperforming (maybe primarily) by taking on additional risk. Concentration risk, namely, by being concentrated in just three sectors only.

The question I would ask though: Is there a problem with that - and what exactly would is be? Is there an assumption that all sectors are equally risky (over the long term) - and is it true?

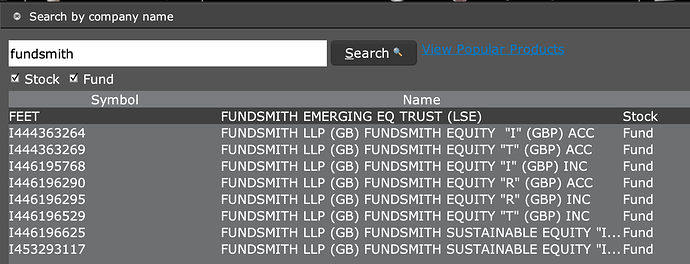

I can see the “I” class funds in my IB account:

I still need to enable the non-US fund trading permission to be authorized to buy/sell funds, but this is another topic.

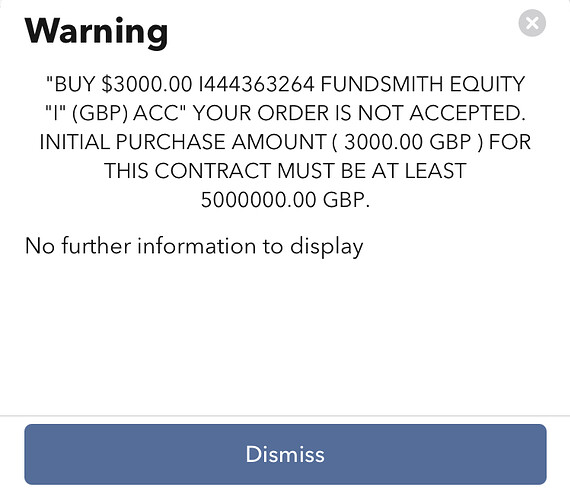

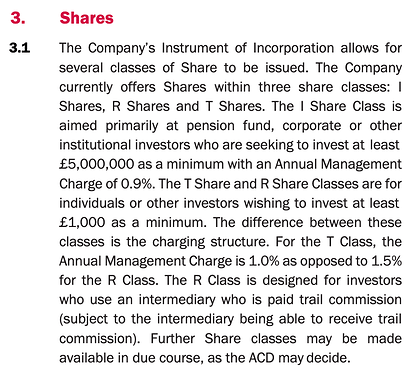

5‘000‘000£ is the minimum amount for this share class, as set by Fundsmith.

No surprises.

So what’s the permission I need to request in IB to buy Fundsmith T ACC? Mutual funds?

Does one need to buy GBP upfront or does the platform buy me the required amount of GBPs to complete the order (IB)?

Also, does it matter if I buy the GBP-based one or the EUR one (in case the pound goes into obilivion under the successful management of Boris)… ?

Fundsmith is, afaik, only available in GBP. No EUR offer.

And similar to any other trade on IB, you must possess the trade currency.

…at IBKR.

They do have a Luxembourgish SICAV, which is available elsewhere.

I am excited as I finally got my overseas account with Fundsmith opened beginning of this year but my excitement quickly dropped down after seeing how I got ripped of by my Swiss bank in order to transfer £3000 to Fundsmith’s account in the UK. I calculated that for that transfer amount I paid a total of CHF 68.56 in forex and transfer fees. Holy shit! Somehow that does not feel mustachian at all… I checked afterwards with TransferWise how much I would have paid with them and that would have been CHF 16.19, much better but still quite a lot. So basically where my Swiss bank rips me off is in their horrible CHF<->GBP exchange rate. There is CHF 16 for the OUR then a CHF 3 fee for payment abroad I guess pretty standard but all the rest is the forex fee (compared with the actual day market forex rate on xe.com).

I’ve sent an email to Fundsmith to find out if they accept payments from TransferWise and I’ll keep you guys posted…

As I stated above: Fundsmith did accept my TransferWise card.

As for the 16 CHF costs for TransferWise, that’d be about 0.45% - less than half of the fund’s yearly charges (1.05%). Nothing I’d worry about on a long-term investment. If the fund’s costs itself are worth it you, I wouldn’t worry about those currency exchange costs, relatively speaking.

Side note: You could top up your Revolut account with CHF, convert a certain amount “for free” (but check and compare the actual rates) and maybe use your Revolut card for investment at Fundsmith (otherwise make a domestic GBP transfer from Revolut to TransferWise).

I am still not 100% sure about that, maybe you gut lucky because when I inquired by phone end of last year they told me no but the person on the phone didn’t seem totally convinced about that. So to be sure I asked them by mail for written confirmation.

Then we still have the same problem but in the opposite direction. Once we want to withdraw they pretty sure only accept an “official” bank account and because we as non UK citizen can not open a bank account in the UK we will have to incur the GBP->CHF exchange fees from our Swiss bank account I presume.

Why use your CH Bank for forex and not Revolut or IB?

+1 to Revolut, all currencies sent which are NOT CHF will originate from a REVOXXXXX IBAN under your name.

Revolut seems to be an option as long as Fundsmith accepts it. I will also check that.

Now I have a free (standard) plan with my Revolut card which allows me as far as I know a maximum of 1000 USD exchange for free per month. After that amount I read they will charge a fee of 0.5% (reference: https://www.revolut.com/en-US/help/my-accounts/exchanging-money/what-foreign-exchange-rate-will-i-get). Is this correct?

That’s how I understand it, yes. I personally have a Metal plan for the Cashback outside of Europe (not like I’ve used it in 2020 much -.-)

As CH free Revolut user, you can exchange the equivalent of CHF 1250 each month. Pretty transparent, when you check the app.

Here is the official answer of a Fundsmith agent regarding the usage of TransferWise to send the money to their account:

I am afraid that we would not be able to accept transfers from that service as it would be classified as a 3rd party payment.

The account has to be in your name in order for us to complete the necessary checks on our side, and anything received from a 3rd party would be rejected.

So I wonder how long you will be able to use TransferWise and if it is really wise to use it for Fundsmith, if you pardon me the pun there ![]()

I guess the point is that he uses the Transferwise card, and not a simple Transferwise account. With the card (which is some prepaid credit card if I remember well), the KYC problems are solved since than it will be traceable.

As you say it must be a traceability issue. In the mean time I have also asked about using Revolut and they answered me the following:

Revolut should be fine if you are using it to transfer us money for a trade.

That’s good news and if you stay under CHF 1250 in a month, probably the cheapast option.