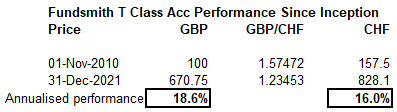

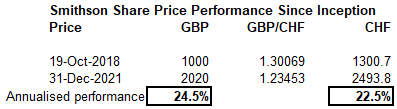

Since the topic was raised in another thread: here are the performance tables vs. benchmark for Fundsmith and SSON in GBP from the respective factsheets, as well as my calculation of annualised return since inception in CHF (FX rates from OANDA). Annualised return is ~2 to 2.5 % per year lower in CHF

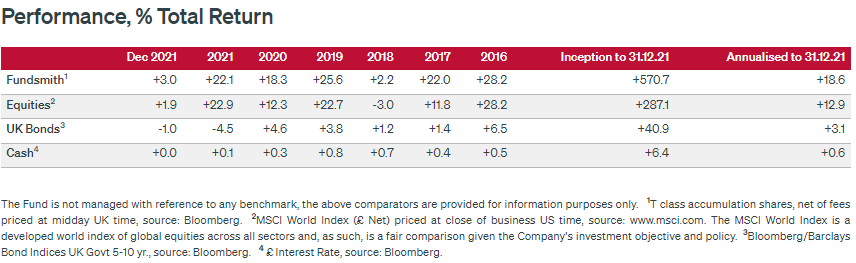

FUNDSMITH IN GBP

Converted to CHF:

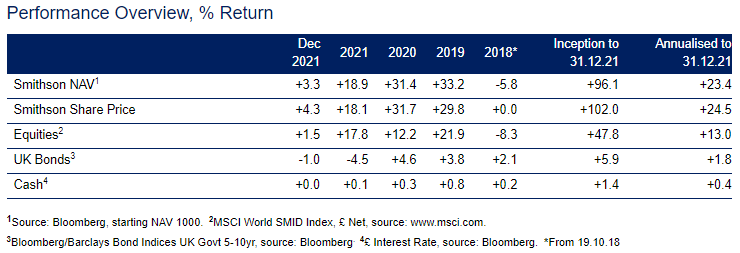

SMITHSON IN GBP

Converted to CHF