You can also look at Ford. The yield is currently 7%

There is EWA (MSCI Australia) with 5.53%

https://www.etf.com/EWA#overview

The catch is the 45% financials component and a huge housing bubble in Australia, thus a potential for a fat loss if it crashes.

there are some good ETFs with pay high dividend. I have also an “fun-money-” part in my portfolio and I have found that the “SDIV - Global X SuperDividend” ETF is the best for me. The Yield is above 8% at the moment, and the best part, the ETF pays monthly. So now I have a monthly Income through the ETF. I use it to cover my 10 USD brokerfee from IB, since my Portfolio isn’t big enough to get the fee cut out

Unfortunately the ETF has a TER of 0.58%, and as you know you need to pay taxes on the Dividends, but for me the monthly payout is it worth. (And we are talking about fun money after all)

If you want go a little bit higher, there is P2P-lending. Bondora and Mintos are the big 2, but there are many others. Mintos starts at 12% for “secured loans” and it goes above 15%+ for unsecured loans in Bondora. I’m Investing in Mintos for about 2 Years now and never had a bad experience. But you need to know the risks of P2P-lending.

And if you want having real fun, there are some spicy high yield leveraged ETNs from UBS ETRAC

I think the name of the MORL-ETN says it all: “Monthly Pay 2xLeveraged Mortgage REIT ETN” with his yield of 21% and monthly payment. There are a lot more in the UBS ETRAC-family with different underlyings, but you need to absolutely understand in what you are investing.

Its tempting and risky, but in the end of the day it depends on you where your fun money goes in.

At first I thought this is interesting but then, 8% minus 30% marginal tax is 5.6%/year. 5Y return of the SDIV is -25.8% or -5.16%/year. How is that working out for you? And that is in a period of a great bull market.

Hi, I have only been living in switzerland for a few years and I was on withholding tax so I am still not fully aware of the swiss tax system. Therefore, I was wondering why what essential wants to do doesn’t make sense from a tax perspective.

In Switzerland, dividends are taxable and capital gains aren’t. So, simply, an instrument that distributes 5% per year would be inferior to an instrument that increases in value by 5% per year (but “accumulating” ETFs do not get around this issue).

Thanks for the reply. What do you mean by “but “accumulating” ETFs do not get around this issue”?

he means to say that an accumulating ETF still has dividends but reinvests them. And you need to pay tax on this hidden dividend as well.

Thanks a lot for the answer.

I have a position in VDY ETF. Mainly it was to simplify my portfolio by consolidating all my individual Canadian holdings into an ETF.

PAK has 5 year return of -50% and NGE has -65%. TUI is even worse -83%, and BAT not terrible, not great: -8% (but last year -25%). As Julianek said - good return on capital, no return of the capital.

How did these investments work for you in comparison to S&P500?

There’s also stuff like COWZ and AMLP.

Area Capital Corporation has been doing fine for 20 years. They provide lending and financing to other companies. They aren‘t bleeding cash for manufacturing or service operations - the negative cash flows are rather result of them growing their „business“ and balance sheet.

These business development companies also must distribute most of their income (which they do through dividend distributions) to enjoy exemption from federal tax in the U.S.

I clicked here and there and got to this ETF:

iShares Listed Private Equity UCITS

+66% in 5 years. Anyone knows it? It\s not high divided, but surely higher than VT

I have a 2% allocation to it in one of my VIAC portfolios and most of that return got eaten by CHF appreciation.

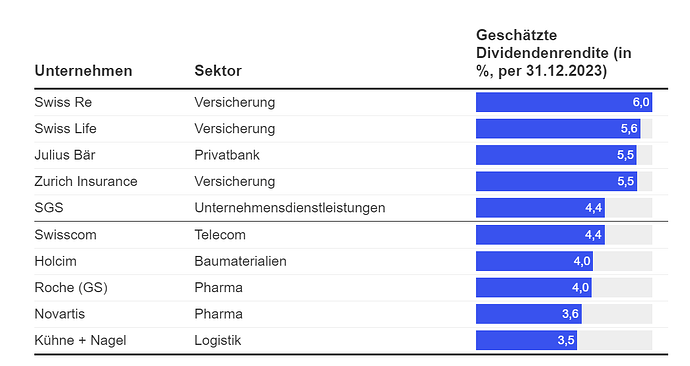

I havent really looked into dividend ETFs in a while, but you can create your own if you invest in these Swiss shares, hat all have more than 3.5 % dividend yield:

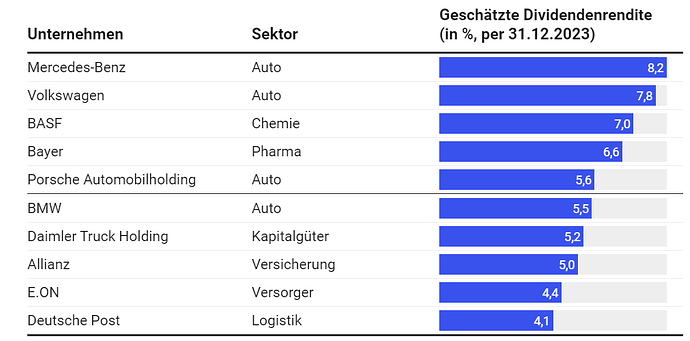

If you add a bit of Germany, you should get a fairly good long term yield:

Tobacco

Mining

Insurance

…seem relatively safe bets to me. Not sure about the future of single German car manufacturers though.

I am surprised that nobody have cited the JEPI etf, they have a nice 8.37% dividend yield

Insurance is very risky, if you ask me. Have a look at how their Equity developed in 2022. Most Insurance Companies lost 30-50% of their Equity (Zurich -30%, SwissLife - 40%). You don’t see this effect as they report their P&L based on holding bonds “to maturity”. But de-facto, they took a very big beating on the shareholders equity. Clearly, things can go well but if we lets say faced another Interest Rate increase like we already had it (lets say to 3.5% in Switzerland), nearly all Insurance Companies were bust.

Technically, the players could just sit this out, increase premium to have a decent return and after a few years (as bonds mature), they were good again. Unfortunately - the Insurance Market doesn’t sleep and there are players with deep pockets that won’t allow them to recover on the expense of their policyholders.

Well what you write is certainly correct and valid, insurance and banks can and do use interest rate swaps to hedge moves in interest rates. Therefore the exposure to this specific risk should be lower.

Silicon Valley Bank for some reason stopped hedging this risk, the rest is history.