Yeah exactly my thoughts…so just getting greedy is what this is about, of course the distributions could well be DRIPed back into the same ETF anyway.

IMO. The FX moves within a limited band so the impact of FX is anyway limited. Assume a worse case adverse FX move and factor it in. Say it is 20%, then your 10k EF potentially is only an 8k EF. Maybe it is not a big deal, or maybe you can bump up the amount to compensate?

Yeah, the CHF appreciated ~7% vs the USD, or the USD depreciated, over 5 years which is not nothing, but my holding period is unlikely to be that hold, assuming rates come down. Maybe I’ll pull the trigger next month.

Can someone smarter than me explain this please?

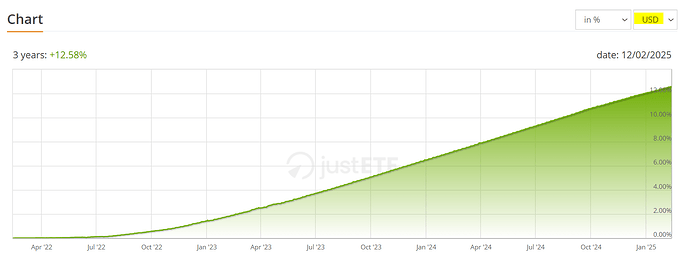

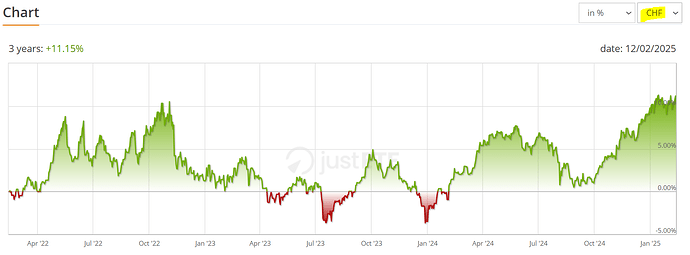

Looking at the UCITS version of BIL, the 3-year chart (since rates have gone up), it’s done 12.58% in USD and 11.15% in CHF, with substantial volatility which is absent from the USD chart:

My interpretation is that the volatility when one looks at the CHF chart is exactly related to the USD/CHF exchange rate.

What I don’t understand is why this fund, given it’s accumulating, looks like it’s simply tracking the exchange rate (look below, the charts look extremely similar), rather than accumulating the distributions for most of the time?

Am I dumb? I could be.

why would you expect it to be different?

I am no longer puzzled by it, I am coming 'round to accept that this simply reflects the substantial exchange rate risk for an investor in CH when they venture away from CHF ![]()

This may mean that a Pictet MMF with 1%/year in CHF may be as good as it gets for us…which by the time one does all the clicks required and loses on fees and taxes we may as well do absolutely nothing other than hold CHF.

pension fund might be an option. you get 1-2% plus a tax deduction and tax free accumulation.

MMFs have much lower yields those days, 0% return at a bank starts being attractive.

(or the 1% from prepaying your taxes)

I think PICTET MMF will now yield 0.5% - TER

And you can deduct 0.3% from taxable income

Yes, but then it’s gone and not available to rebalance or to use in an emergency.

It depends, if you have a mortgage you have some flexibility to take back out, but you are right in general, you would need to maintain a separate emergency fund and separate bond balance that is available for re-balancing.

When someone is constantly investing new money, I think there are many opportunities to rebalance simply by adding new money into stocks if that’s the need

Unless we are talking about 80% market crash , I think it should be manageable. And I also think if it’s really 80% market crash, many wouldn’t dare to buy more stocks anyways