For now, I have no money left in my Wise account, and I don’t know how to send money because I still can’t verify my identity through the app. I’ll try again later from their website. I think I’ll choose Yuh as a backup once the situation with Wise is resolved, so I’ll have two different card providers (Wise = Visa; Yuh = MasterCard).

Did you sent the money with a different bank account than before? This happened to me when I initiated the transfer with Yuh:

Wise requested additional documents to verify my name. I think Yuh only uses and provides first and last name, whereas Wise also checks for the middle name of the sender, which obviously could not be verified. I also had to cancel the transfer because the document upload with wise returned errors.

Long story short: I now use radicant for Fx.

I have free account at BCF (main) + Neon for FX, Radicant for emergency and Certo One as credit card. Using sometimes Revolut to send different currencies to friends abroad.

No, I have always used the same account to deposit money into my Wise account.

It’s true that my middle name isn’t listed on my main account (I only use it on my identification documents), whereas Wise includes it. I think this causes a discrepancy since the sender and the recipient names aren’t exactly the same. In any case, I will clarify this at the beginning of the week when I initiate a new transfer to Wise and explore the possibility of submitting my identification documents to them.

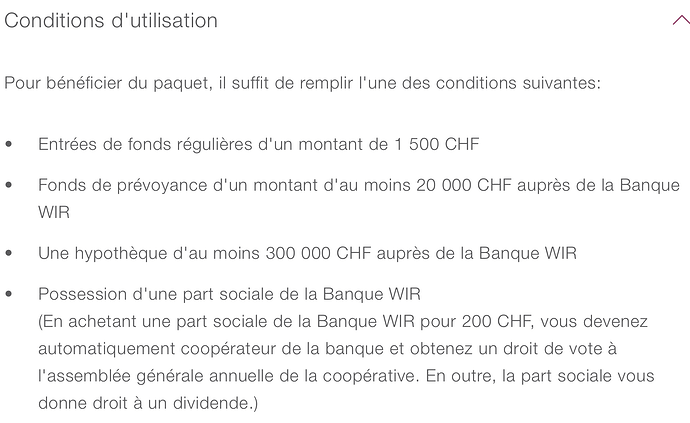

So, I’m wondering if anybody has seen this offer here: Banking vom Besten in einem Paket | Bankpaket top | Bank WIR - Bank WIR

If it’s correct what they claim, then the included Mastercard Debit could be one of cheapest option for payments in foreign currency. According to the info they

a) apply the interbank rate

b) have no addtional fees and commissions for payments

So, this could be on the same level/or even cheaper than Neon, Revolut and Wise.

Does anybody have experience with this?

Kinda sounds like radicant.

Thank you! Thats exactly what I was looking for!

Dear all

I’ve been a passive reader here for some time, but now I’d like to start a dialog.

I will be traveling for several months (including Australia, New Zealand and Japan) and will be using several currencies. So far (as I have now found out) I have been using the relatively expensive UBS me banking package with V Pay and the Gold credit card.

To optimize my payments (regardless of bonus programs), I have considered the following methods and would like your opinions:

- Withdrawing money in local currency:

neon debit card - Pay by card in local currency:

neon debit card(Mastercard reference rate) orWise debit card(Wise rate) - Pay with a “real” credit card (e.g. rental car):

Cumulus(no processing fee, but approx. 2% Migros Bank exchange fee)

Thank you!

Have a look at the Banking & credit card combinations thread

https://forum.mustachianpost.com/t/banking-credit-card-combinations-2024-edition/12879/25?u=xmj

I was asking pretty much the same thing there ![]()

Short answer as @xmj said, consensus in the specific thread would be

- Wise

- neon

- Radicant

(- Cumulus as backup and/or best real credit card to use abroad).

Pick the best that fit your needs/what you prefer.

I’m alose curious if anyone have experience with this service. Seems they are pretty agressive with marketing lately but never hard if they banking package offer before.

A small hint - Often you can use the “real” c.c. to make the reservation and let them have their “security” for the rental duration, but then when it comes to paying, you just ask to use a different card, for example one of your debit cards (with better conditions for you).

For them, it’s same same.

Wait, why not Revolut.

Edit:

Ok there are reasons for Wise as well. I only use it for occassional holidays and convert money before the weekend, hence for me its better. For travelling a long time Wise is probably better.

Source:

PoorSwiss Review

https://thepoorswiss.com/wise-vs-revolut/#16-conclusion

Thanks for the comments and @xmj for pointing out your thread!

@rolandinho I’ve never thought of that before and will certainly try it out!

Hi,

Use Wise or Revolut to withdraw cash (200CHF per month free). If you think you need more maybe think to get the premium or metal abo from Revolut, could be a good option.

Then Neon or Radicant (or Revolut with abo regarding upper) for daily shopping.

Then Cumulus in case you really need a credit card.

Like Radicant and Neon but 0.0% interests. Radicant 1.25% (so far..) and 0.75% for Neon

UPDATE

Well,

it seems it not what we thought:

In my experience they don’t easily let you do that, or actually they do, as long as you buy their overpriced insurance policy.

I’ve never gone with the banking packages. Anyway I looked at it, it was always cheaper to avoid the expensive credit card and go for the basic offering. I’m with UBS and did the following:

- UBS basic personal account

- Have small mortgage with UBS to get reduced fees

- Have just the basic card for withdrawals so you don’t pay the Maestro/Visa/Mastercard fee

- Paperless statements to avoid the paper surcharge

- Don’t go with the UBS credit cards, instead:

- Revolut / Wise for foreign transactions and oveseas ATM withdrawls (I’m not sure if these are still the best cards out there, I don’t really use them enough overseas to spend time on it.

- I use Certo One for all other Swiss expenditure. You currently get 50 CHF signing bonus and up to 1% cashback (see: the poor swiss’ review)

- Do FX transactions via IBKR to get best exchange rates and low fees and then load these onto the revolut card (may need to go via a bank). This can be cheaper than converting with Revolut/Wise directly.

A few times the bank tried to get me to sign up for the banking package to ‘save money’ but you save only relative to getting all their other individual parts separately esp. the credit card with high annual fees.

How do you do this without receiving a “currency conversion warning”?

Apparently, many receive this warning when they use IBKR just to convert currency: interactive-brokers-currency-conversion-warning

I’ve never received that warning. But then again, I’m just withdrawing small amounts for expenses. I’m not depositing 500k, converting 500k and then withdrawing 500k.