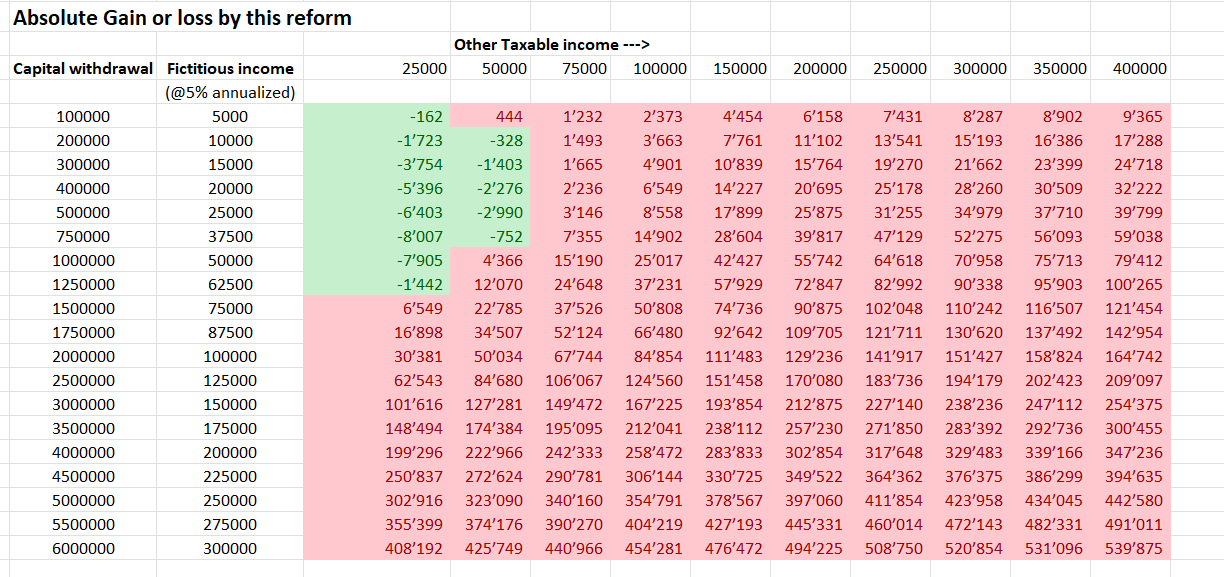

Based on info shared so far by @jay and @capmac , I came up with following calculations. I will need to read through this again to ensure I understand correctly.

I do not see many people who will pay lower tax versus today unless there is some sort of exclusion.

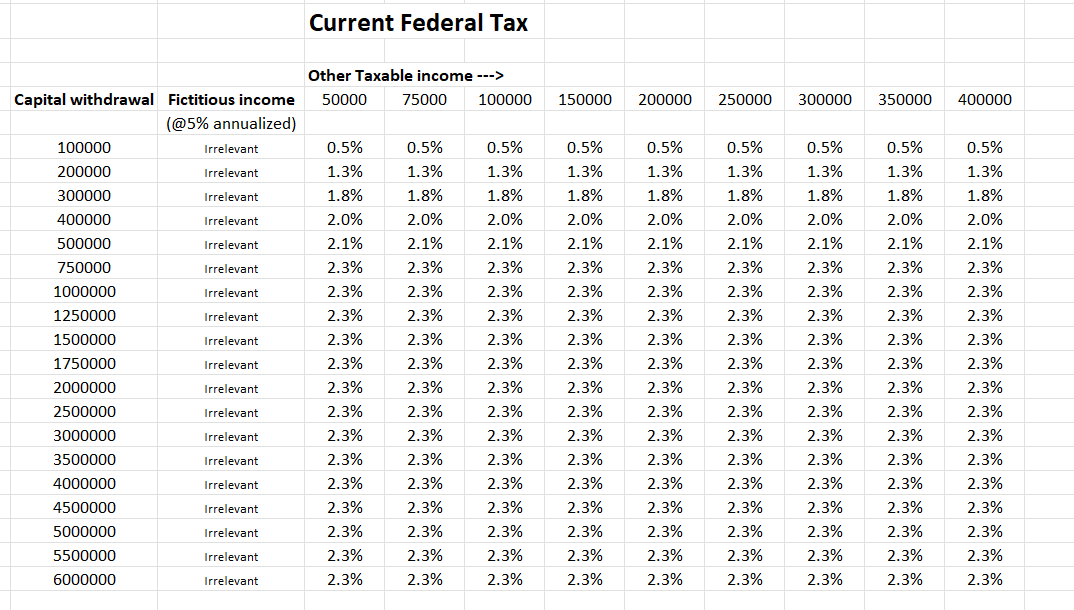

Please note this is only FEDERAL tax. The cantonal taxes are separate and not part of proposal.

For calculations -: i just used Single person, no kids. But i think similar calc will be valid for other scenarios

Other taxable income = Net taxable Income from all sources as reported in tax return at time of making capital withdrawals

Absolute gain/loss