So if I think drinking water is as unacceptable as murdering people then I just need to prove that murdering people is unacceptable to ban drinking of water? Sure it is a free world but you have to make an effort to come up with better arguments if you want anyone to listen. But like you said already, you could care less.

There is no equality of outcome, pursuing that is meant to fail. What’s worth pursuing is equality of opportunities, which is part of the purpose of taxes.

You’re twisting my words, man.

I said I cannot care less whether I win the debate or not.

I’m very happy to read the opinion of others, otherwise I wouldn’t be here…

I see. But even if we can agree on this farfetched scenario where children are assets and taxable, you have to pay the tax office in cash. Not in gold, property, or children.

This thread is worse than a car wreck.

I’m all in with equality of opportunity but I see more and more that is all about equality of outcome (equity is the word that appears).

I cannot help seeing taxes as a fee to the mob so that they protect you: you pay they handle it. Then the moment that you as law-abiding citizen need to turn to the state then you (IMHO) realize you’re not getting what you were paying for.

Anyway I must also admit that in Switzerland it’s not that bad if we take into account how it works in Denmark or Sweden.

I’m guessing we have lived in differing contextes and your experiences led you to be wary of the state. Seeing it like that is understandable and there are people in Switzerland that live a situation where the state is really acting to take their ability to handle their life away from them. We don’t live in a perfect world, though it’s far from the worst that could be and we should keep working on making it better.

Do you have specific examples of that situation? I know the paperwork is sometime disappointing, the delays too long for support to be there when it would have the most impact and that some situations give way to downright refusal by the relevant office to give you services you should lawfuly get access to but, in my experience, those cases are not the majority and there is a way of appeal if it comes to that (that, once again, not everybody has the same ability to pursue, hence why it’s important to keep pursuing a more equal access to opportunities for all, hence why taxes).

I don’t want to enter into specifics but let’s say you nailed it with your last message…

Now yes, good afternoon guys!

Question:

Answer:

Opinions are like arseholes, everybody has one. Both should be examined regularly and thoroughly. It helps to keep a check on mental and physical (I’m referring to prostate examinations if it is still unclear) abnormalities. But this thread reads more like putting fireworks up the arsehole and in the ears and blowing them up on purpose. Which, is bizarre!

Some subjects are best discussed on a sunny day in person over a beer or coffee.

I admit the quality of discussion in this thread was not the best, also from my side. But your comment belongs here with no doubt

Thanks for making me feel at home in this forum and this thread

I’m afraid there is no avoiding that.

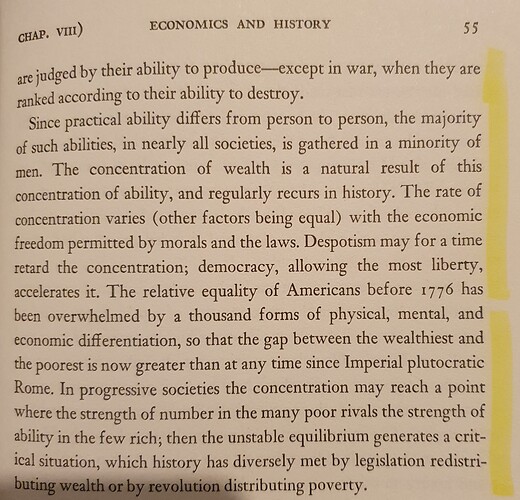

(Quote from Lessons of History, by the Durants - fantastic short read btw)

It may culminate in a revolution or redistribution (*), but right after that it’s back to square one, it seems.

(*) Taxation is one of those we came up with, I suppose. Relatively stable for now.

That there are more capable and less capable people doesn’t force a widening of the poor/rich gap. For example, the capable rich people could decide that a gap too wide is a liability for the safety of their assets/lifestyle and voluntarily decide to lower the disparity of incomes between the rich and the poor.

Meanwhile, in Switzerland, it takes 5 generations for the descendants of poorer people to gain as much as the average.

Source: UBS Center | Economics. For Society

Exerpt:

“For example, children from families in the bottom 10% of the income distribution usually need 4.5 generations to earn even as much as the average. In the Scandinavian countries, it is only two or three generations; in Switzerland, the United Kingdom, and the USA it is five, in India and China seven.”

That means that being raised in a poor or rich household bears a big impact on the ability of capable people to express their abilities. We are loosing geniuses because they are born in the wrong household.

Sure, there will be a gap between rich and poor people, but it doesn’t have to be as wide as it is. There are factors we can’t master (people being naturally more or less skilled) and those we can.

Focusing on those we can would have an impact. For example and as has been already indicated, I can’t understand that inheritance isn’t taxed at all in my Kanton (Wallis) - that money could finance dedicated support for children to do their homework, for example (because there’s a difference between the child of engineers coming home and having dedicated space to work, support from their parents and them taking time for it and the child raised in a poor family packed in a flat too small with noisy siblings not taken care of - talking only in the point of view of the children’s ability to build and express their potential, here).

Anticipating a potential retort: I should figure among the people who’d get a sizeable inheritance from their parents. I’m still advocating for it to be taxed.

The thread opened multiple cans of worms, but my initial idea was: keeping public spending intact, I believe that it would be better to replace income tax with different taxes. I base this idea on the articles I read and interviews I watched.

In short, here are the arguments against income tax (they are valid for Poland [2]):

- the state taxing itself: half of the tax proceeds come from taxing pensions and public sector jobs. This money just flows in and out of the government’s pocket.

- low share in state’s income: income tax share in state’s proceeds is only about 15%

- complex to calculate: complex tax declarations have to be filed by citizens and then checked by government clerks

- expensive to enforce: 80% of the tax office workers deal with income tax, their salaries cost billions

- lost time of taxpayers: it’s calculated that the equivalent of 16’000 taxpayers FTEs is consumed by preparing the PIT declaration

A full case for the abandonment of PIT (personal income tax), CIT (corporate income tax) and all social contibutions (complete abolition of employment taxes, no AHV contribution etc) has been made by the Polish lean-government politician, Slawomir Mentzen.

Here the key points (again, the numbers apply to Poland):

- current income of Poland from these taxes is 363 billion PLN

- the state pays itself 80b through taxing public sector jobs (teachers, policemen etc), so just paying the net salary lowers both income and expenses

- abolishing child support (20b), fighting unemployment (20b), social assistance (45b), culture (10b), sport (6b) - according to him this money is not well spent and does not achieve its goal; citizens will know better how they want to spend their money when it’s left in their pocket

- introducing a head tax (per capita), 250 PLN per month (60 CHF) => 100b

- increased real estate tax: 20b

- leaving more money in people’s pockets would increase spending and VAT collection by 24b

- a few more smaller tax increases

I agree that this proposal is pretty radical, but just think about what it achieves. You have an employment contract that has almost no gross-net wedge. This makes is very attractive to actually hire people. Work is no longer punished by huge overhead.

There’s not enough reason for the normal Joe to put considerable money away, especially if you have to pay wealth tax. The system wants people to spend most money, but won’t offer as much benefits for people with same issues and same overall income, that choose to save money.

And let’s not start on paying wealth tax on the house/appartement you live in and pay ‘Eigenmietwert’.

Eigenmietwert is stupid, but only if you agree that deducting mortgage interest from income tax is too. And yeah: no income tax means no stupid deductions, no smart guys knowing what to deduct.

By the way, I said it already: promoting spending/consumption is short-sighted and stupid. I agree that saving and investing should be promoted, not consumption. Excessive consumption is bad for the environment. It is also a distraction for the talented people, who could work in research & development, pushing the World forwards. But instead they waste their creative power on creating marketing campaigns etc.

That one is puzzling, isn’t Poland like most country where many people pay no/little tax (esp. those who benefit from this support)?

How would abolishing income tax help them? They won’t have significantly more money.

Assuming an employers offers a place to live as part of the salary, shouldn’t you pay income taxes on the value of the rent?

Eigenmietwert is not different, if you rent, you need to use after tax money to pay for it.

Most pockets will be nearly empty, and a small number of pockets will have most of the money.

Isn’t that the reason for income tax in general and progressive income tax in particular?

I agree that taxation should be simpler with less of the complicated sets of deductions.

In Poland the income tax progression is not as strong as in Switzerland. Again, we’re stepping into a tricky territory. He discussed these matters in hour-long interviews, and I don’t think I can wrap it up. It’s a belief that the state allocates money inefficiently (plus, the goverment worker has to get paid), so even if you’re left with a bit less money, you will still be able to get more value from it, because you will spend it on what is important to you, not what is made available by the government.