Dear all,

I tried to convince myself end of last year to go for IB (see here) but in the end I was scared off by the GUI. I ended up with CornerTrader which is fine so far. But recently this great community nailed down [link] how much cheaper it is if you go with IB. So, here is my second attempt documented, hoping to hel out all those shy mustachians in a similar situation!

=> I remember having huge difficulties in navigating the IB GUI or doing actions when I don’t have the feeling I understand what I do. maybe this time goes better!

#Start

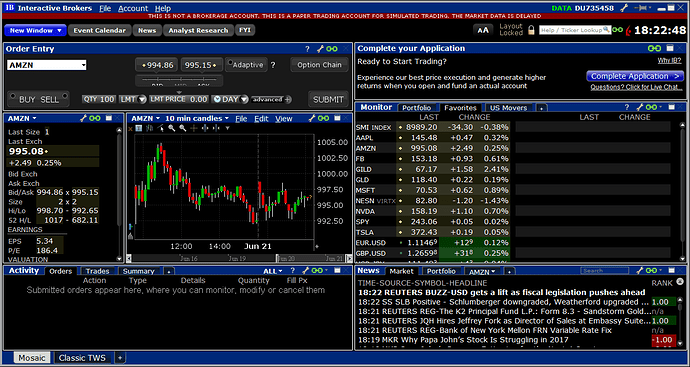

Ok, where do I start? with google! entreing Interactive Broker gets me directly to their webpage. I know from last time, i can sign up for a trial account (paper trading). I download their software, run it et voilá:

the tour continues …

quite overwhelming at first, but hey, they offer a guided tour!

the second slide already explains what all the sub windws are for, great! confusion reduced!

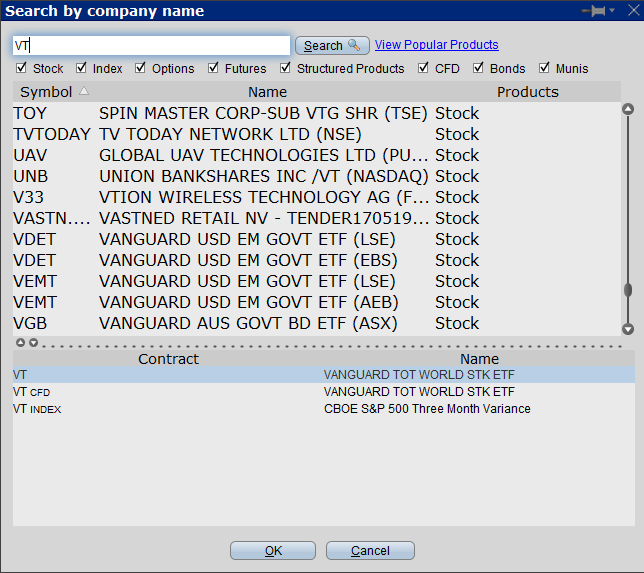

Slide 3 points out how I add tickes to the watchlist, and I instantly add VT:

I guess the upper window just shows all string matches for “VT”.

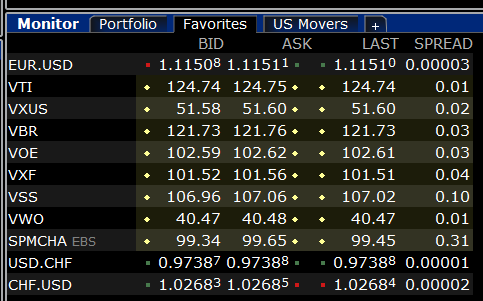

So, I found my way to setup my watchlist, accordnig to my current Idea of my future portfolio:

consisting of the ETFs and the USD.CHF, which would buy me USD from CHF.

Question: what difference does it make if I first buy USD.CHF and then VTI or if I just buy VTI and let IB do the conversion?

Since the papaer account started with USD, I just sold 1M$ to set the “right” start condition. therby getting into debt already^^:

but i cannot find any log for this atm…

[to be continued]

[edit]

so my conclusion is: get the paper account and just implemet your personal portfolio a few times/ rebalance. in the beginning there is more information than you need, but with the paper account, try it out and quickly narrow down the few things you need. it works like a charm!