Stuff going to IB and 3a are transfers from savings account and ultimately assets in my books.

As assets do you reassess their value over time or leave the amount you transferred ?

I update the net worth at it’s current price once a month, right now I don’t have my 3a invested (bad choices when I setup my first mortgage) so there’s not much movement there but the stocks are priced at latest close.

Hi all, I thought I’d revive this thread because after spending an hour hunting for an expense tracking app I’m thoroughly disappointed.

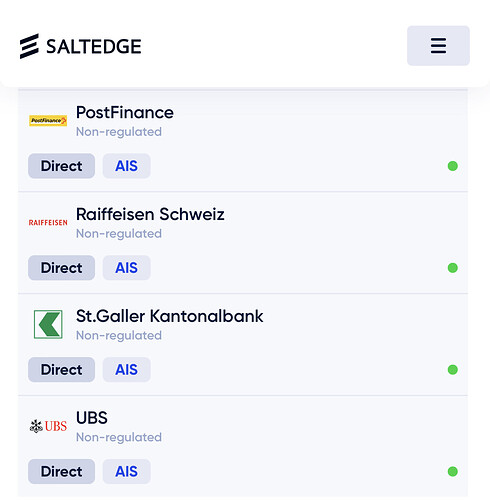

I looked at 6 or 7 and not one of them automates expense tracking! I use my credit card for probably 80% of my purchases each month. I had hoped to find an app that would allow me to upload my statement and automatically categorise the expenses. But all of them require that you enter expenses manually. That kind of shocked me. Its 2023 and no one has a solution for this?

Anyways, I thought I’d post here in case someone has found a solution. I use a Certo card for expenses.

Thanks!

You Need A Budget app allows you to update your monthly statement with all the important fields and you can apply the categories you want accordingly to your preference or personal management structure. At the end of the month, I export from BCVnet, then clean the excel sheet and leave only the main columns (date, amount, category, in or out), save as .csv and upload to YNAB.

Yes, I understand. However, I use my BCV debit card rarely. YNAB does not allow for uploading credit card statements.