That is the year end value, use equal start of the year value.

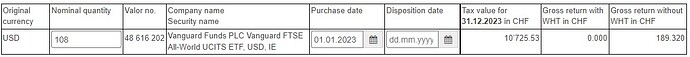

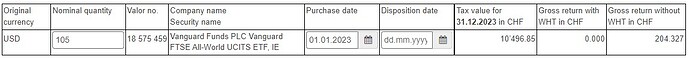

Let’s assume I bought 10k worth of shares early Jan 2023. That would be equivalent to either (source):

VWCE = 108 shares @ 92.93

VWRL = 105 shares @ 95.33

Then calculating the dividends for income tax:

VWCE = 189

VWRL = 204

Could be a matter of when the dividends got distributed (and converted into CHF for ICTax purposes).

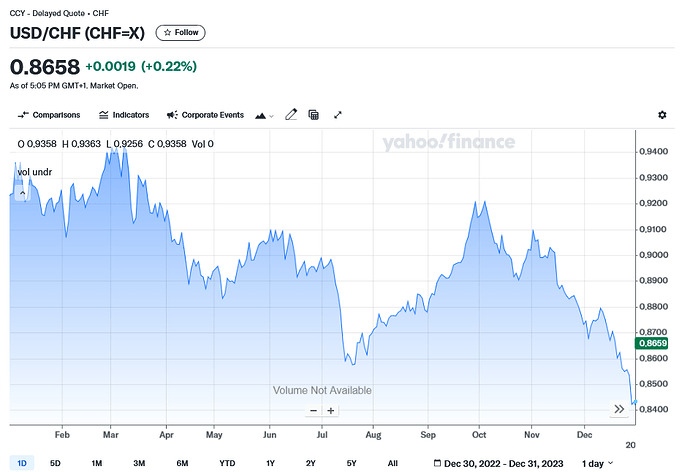

2023 has been a year of significant weakening for the USD vs the CHF, starting at 0.9238 CHF for $1 and ending at 0.8434 according to Yahoo Finance:

$210 in dividends distributed on January 2nd would have been worth CHF 194. The same dividends distributed on December 29 would have been worth CHF 177 (not saying ICTax calculates dividends at the start or the end of the year, the actual values would depend on the date when it is calculated, the numbers shown here are just for illustrative purpose).

In ICTAX, VWRL shows 4 distributions during 2023 converted at different exchange rates through the year. VWCE has 1 big distribution recorded on 30.06 converted at 1 exchange rate.

You need to look at Financial year of the ETF.

All numbers below are from ICTAX & are in USD

They are quite close to each other

| Ticker | Shares | Dividends/unit | Total |

|---|---|---|---|

| VWCE | 189 | 1.959 | 370.3 |

| (1 July 2022 to 30 June 2023) | |||

| VWRA | 204 | 0.41 | 83.47 |

| (1 July 2022 to 30 June 2023) | 204 | 0.73 | 148.36 |

| 204 | 0.15 | 30.92 | |

| 204 | 0.50 | 101.10 | |

| 204 | 0.04 | 7.72 | |

| 371.6 |