Given where we are in the economic cycle, I don’t think 1% is too conservative. It wouldn’t surprise me if in the next 4 years or so we are 50% down from where we are today.

Could you share more details on your idea?

If you are employed as a board member, first you are not retired, and AVS would anyway have to be paid on the employment.

If it is just part time employment (<50% working hours or <9 months) I understand the requirement to pay AVS on wealth still applies but AVS paid on employment can be deducted. Remember there are minimum wages - I doubt working 4 hours a day earning 1 CHF per hour would fly

Board positions would generally not meet the criteria of employment for AHV purposes due to insufficient working hours.

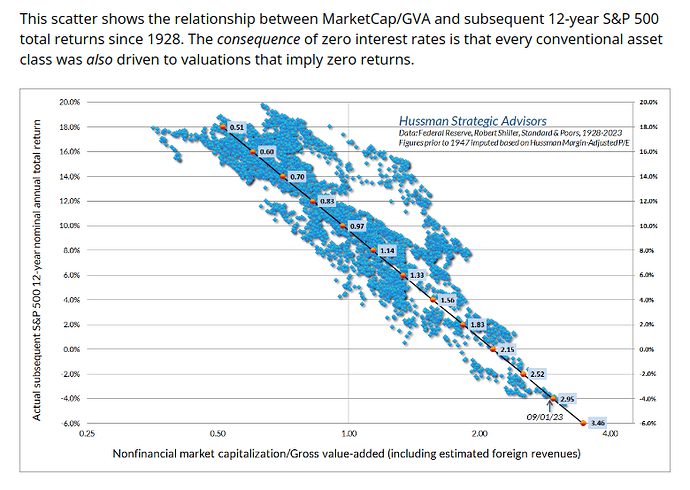

The S&P500 has an average inflation adjusted return of around 6% per annum.

This average is across all parts of the economic cycle. You’d of course expected higher returns at the lows of the cycle and lower returns at the highs of the cycle.

Given where we are in the current cycle, some estimate that the average return for the next 12 years will be a negative 4% nominal return:

If there is a final stock market rally/melt-up in the next 18 months, I will for sure take it as an opportunity to sell out most of my remaining stock portfolio.

But this time it’s different, @PhilMongoose!

(ok, I’ll show myself out)

Assume that it will take a while for you to accumulate enough funds to retire from “active business life” (10 years @ savings rate of 66.6%, see networthify for details - longer if lower SR).

Assume further that you use those ten to twenty-five years productively - building a wide range of skills, and a professional network.

Post FI, establish a corporation (AG / GmbH). Start consulting on the side (to accumulate faster, or serve some specific clients you like, or whatever). At some point, retire from your main income driver, play golf, go sailing, hike through the Alps, etc.

You’ll still have the professional skills and the network to match such that it won’t be hard to find a few well-paid consulting / board positions until official retirement age.

Contract those through the corporation. Hire yourself as full-time director - you’ll have to do the payouts with OASI income levied upon them. You’ll be able to choose how much income you do, as you can always say “No thank you” to incoming requests.

Well yes.

I estimated that I need 3 million if I don‘t want to live like a monk in Switzerland.

We don’t seem to know the same monks. ![]()

3M with a 3.5% SWR allows for 105K inflation adjusted income (before taxes). Even reducing it by the 8.1K OASI contributions one would have to pay in the very worst possible case (since that seems to be what we need to use as a metric…) of a not married couple with all the wealth concentrated in the hands of a single partner and the other having nothing to their name at all, that still leaves close to 97K available, of which only a fraction (dividends/interests) is taxable.

It’s stangely difficult to get statistics on the median (not average) gross (not disposable after tax) income of households so I can’t really compare it on a broad, national basis not taking account of a specific situation but that’s still more than monks need for their lifestyle.

We have a high concentration of very high income people living in high cost of life areas on this board and we seem to tend to consider that that is usable to measure the ability of people to thrive with a given income on a more general national level. I find the “you” and “in Switzerland” in the title very misleading. Early retired people can:

-

make productive use of the available time of 1-2 people to reduce their expenses (less need for external services. If you, for example, still need to pay for your kids to be taken care of with two parents not working then no, sorry, your expectations of what a reasonable standard of living to expect are way off the charts)

-

use their ability to really not having to live in any specific place to live in a not crazy high cost of life area and live comfortably on less than what a senior IT engineer working at Google makes.

If we take all the disadvantages of work (having less time available and less geographical flexibility) and all the disadvantages of being early retired (loosing on some social insurances and subsidies) and consider living an upper middle-class life as a minimal threshold to reach, then of course, yes, it is nigh impossible to reach “in Switzerland” (and in most other places either…).

See this thread here, the table comes from OASI data

While this is true, it can involve a lot of disruption. I think this is an advantage of having kids early: they will already have flown the nest by the time you retire.

Unfortunately, I had kids late in life which means they will only become independent when I near standard retirement age.

Therefore, moving to a lower cost area would come at the expense of disrupting schooling and friendships etc. Not the end of the world, but an additional friction to consider.

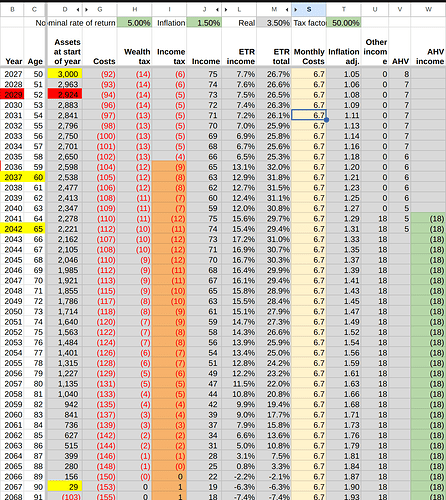

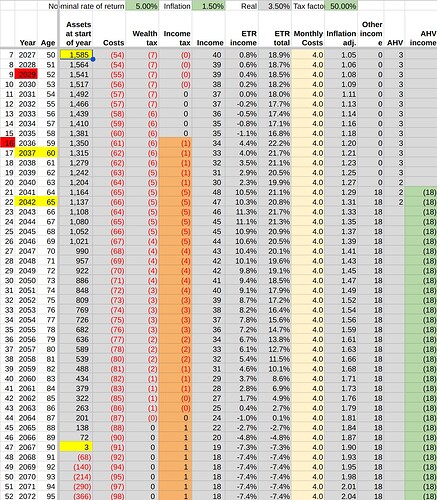

I ran the numbers using 50% of investment return as taxable and got this:

It looks like you can successfully have 40 years of retirement with 6.7k of monthly expenditure. This is using my specifics (Basel Land taxation, child under 16 until I’m age 59, AHV income of 18k).

Living like a monk does not mean you can’t have an ex-wife and a couple children demanding alimony, does it?

IMO and for my expenses yes.

It’s only significant for major expenses which are not already part of core inflation.

In my case that’s Rent and KK.

KK I found to be significant enough to separate out.

Rent I decided to just use the 2% assumed inflation which may actually be a bit high.

Swiss Rent inflation was around 1.2% p.a. last 30 years (Basis 100 1993, now 140 in 2023). Of course this strongly depends on where you “have” to live, rent inflation was surely higher than 1% in Zürich-city. On the other hand if you remain put in your rented flat, the price increase is strongly regulated.

Do you need a ridiculous amount of money to X in Switzerland?

No matter what X is, the answer usually is yes! ![]()

Skill issue.

Most people would benefit from opening a book, perhaps Jacob Lund Fisker’s Early Retirement Extreme or Charles Long’s How to Survive without a Salary

I will take a look at the Health insurance part. For rent, at least that is one element you can hedge to some degree by buying property (though it may be challenging to find a reasonably priced property).

For your rental inflation, you might want to take a closer look at the numbers. IIRC, around 1995 was a housing crash, so perhaps the starting point for your inflation calculation might be distorted.

Thanks! That’s per person so we still have trouble comparing single vs couple vs family households, which is one of the issues here. Ideal would be to have household data but that’s already a big step forward by getting income tax effects out of the picture.

Sure, yes. If that’s the base case scenario, using it to depict the amount of money needed to retire ealry in Switzerland is fair. Most people not actually yet divorced with children would probably consider it as a fringe case rather than the base one, though.

My main point is that if we are going to speak about the amount of money needed to retire “in Switzerland”, we need to either consider very broad situations that would apply to most people, or qualify our statements to show that they only apply to a subset of the population meeting specific life circumstances.

I’m fine with a thread titled “do you need a ridiculous amount of money to retire in Switzerland while paying alimony to your ex-partner and x number of children”, in which case, I am given enough information to choose whether what’s discussed in it applies to me right off the bat.

You can get those from tax data, most cantons have detailed statistics on this by age, relationship status, work status i.e. self-employed/employed/retired, etc

Edit: technically the published data will show “taxable income”, that is, after deductions.