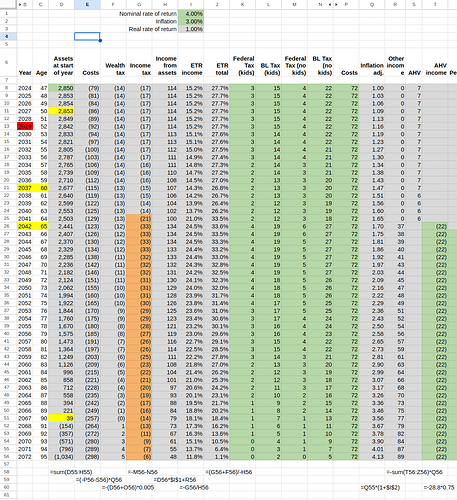

So here it is. For one person in Baselland needing 72k of costs per year you need about 2.85 million of assets to retire at 50 and live until 90.

- Wealth tax is calculated at flat 0.5%

- Income tax is approximated with a degree 2 polynomial using 2021 tax rates for BL (ones I had easily to hand) and 2023 for Federal

- Assumes kids until 2041 (impact on tax rates)

- 4% return on assets

- 3% inflation

- 75% AHV (33/44 years)

- Effective income tax rate varies between ~15%-25%. average: 20%

- Including wealth tax, ETR averages 28%

- Formulas at bottom for those wanting to review the calculation