But of course. Why you even consider his input?

Well, it might sound obvious, I feel that. But since I was arguing these points with him and he still kept his position in regards to the more appropriate option, the one with 10-years, then I was wondering if: 1) I do not see the elphant in the room or 2) my sixth sense I had since the beginning (he’s a blabla-guy) had a foundation.

Also, looking at some comments above - especially the one from @stef, about the advise of consider a minimum of 5y, ideally 10y - which I guess are offered without any sort of speculation, I wanted to see if anyone else does have a similar pov.

well, consider again. Even if the Saron is raised to 1.5%-2% and you add bank margin of say 0.7%, you’ll still be cheaper than your quoted 3%.

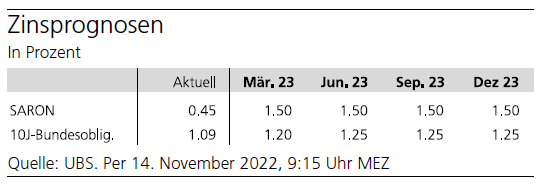

By the way, UBS revised their SARON forecast again on Monday, predicting 1.50% from March 2023.

Why should Saron increase to 4-6%? Inflation isn‘t a big issue in Switzerland. 1.25-1.50% might already do the trick. We are not in the US. Swiss prefer low inflation and low interest rates and that‘s what the SNB is aiming for longterm.

Bank advisors will always tell you to go with the longest possible option. That way they lock you in longterm. Since 30 years banks are telling you that interest rates will rise in the future. You can look up every UBS forecast from the last 2 decades, always the same story. Of course the are right sometimes, bust mostly they aren‘t. It‘s just a sales story.

I have fallen into that “what if…” trap before, not 1 but 2 times. As you mentioned yourself, situation could evolve in your favor as well. If we start considering extreme examples like Saron going to 4-6% in our decision, why would 0 or negative rates be out of the question?

Renewing mortgage contracts is part of the game. At some point you’ll be retired and have to deal with that problem anyway, The rest is just even more FUD.

… and rightfully so. It’s condescending and totally unacceptable… It’s your money that’s on the table, not his or his company’s.

Your advisor looks like a second-rate insurance broker trying to convince his customer to upgrade to the most expensive formula. He ticks every box: all the typical “what if” FUD, the overall patronizing attitude “I thought you were a smart person”, “how lucky of you to benefit from my expertise”. And unfortunately, I have no doubt that these techniques work wonder on pressured people buying their first property.

And don’t you think that the next rate hikes are already priced in? Just assume a reference rate of 1.25 or 1.5 in March 2023, add 0.5-1.0% to it, the total comes very close to a fixed 3y rate.

Maybe I’d suggest you check this short video : https://www.youtube.com/watch?v=RSLwO1m8Fzg (an english version is also available on the same channel).

The author (Fabio Canetg) talks about SARON and fixed rates from a bank’s perspective, I think he sums it up quite well.

Hi @Cortana , by 4-6% increase, I was referring to the 10Y-FIX % (e.g. now 3%, to go up to 4% or 5% and so on). I likely made not clear on my previous post, sorry for that.

Hi @kane , fair point yours. However, I tend to match the SARON with the lowest mortgage period. For instance, 2Y-Fix @ 1.8% or 3Y-Fix @ 2.2 % (actual estimates, including forwarding).

So, If I already anticipate SARON will be 2.2% from November 2023 onwards (when apartment keys will be likely released), then I would tend to opt for a low-Fix term.

Hi @stef your feedback is very relevant to me. I really thank you for that, I can see you can really “feel” me and my situation.

I couldn’t be more agree with you wih the “what if”. Indeed, was the attitude I obserbed, which has a very strong grip to mortage-dummies like me (at the beginning, now a bit less, especially after benefitting of inputs from the forum here).

FYI, just off-topic, same consultant convinced me to sign a 3A Pillar with life-insurance policy: rationale of that:

- this will “speed up” the mortgage acceptance. Bullshit, but unfortunately I believed in that.

- you “need of it”, as your current 3A is only a way to accumulate and not invest. If you don’t to it now, the benefit of this will be lower in the future. And your pesonal condition might change (e.g. health issue), which will make you no longer eligible for that. Partially right: insurance policies are not always best option.

So, now, connecting all the dots, I see that as a sort of marketing script:

- I sell my support for free, I can support you on all stages (even if you decide to change, I will escort you to new offers - I very well remenber this sentence) → yesterday when I recalled him about his words, he told me that it’s unusual that people change in such way contracts, it never happened to him, this is not his way to work (by what means…) and blabla.

- once hooked, let’s sell a combined product with the justification this is the right option and will help the mortgage expedite → yeah, here I did the mistake on trust him at the beginning.

- if the fish realizes himself into the net, then I sell the arguable points: 1) let’s observe the market and we react, 2) let’s change the product (instead of FIX, let’s see SARON or Variable, 3) if you want to exit, then you need to call the hypotek service and start the process yourself → I did call the service yesterday and they expleined me that this can be triggered by the consultant himself, but even by them.

- if the fish compares with other offer, let’s use the card of the “dossier”. Don’t look at the published rates on the web, these are only indicative and you likely won’t get them. We have your dossier, and what I offer you is the concrete figure. → Yes, this is right, but he presumes I do not do the same talk/calculation with others, which have also my dossier and know about the affordability and so on. And again, same is applicable for his institute: if I compare the rates on the web, I have sort a common denominator because these are the “best” rate applicable. Of course, this won’t guarantee I will get them because many dimension are influencing (as said, affordabiliy, location, age, and so on): but again, if my “dossier” is good for his institute, why the same cannot be for others?

Unfortunately, and that’s the sad part of the story, when you lose confidence and trust on your counterpart, whatever he/she says (even if it’s right), you hardly believe that and tend to see a trap on that. That’s why I wanted to present my case here, to receiving external opinion and avoid any biases from my side. Altought, mine is only one-hand story. If you might listen the consultant’s one, could be more balanced ![]()

In addition to that, another reason why I consider a short-term fix.

The apartment is on custruction: a contractual clause, says that for each month of delay, a 0.05% will be added for the entire duration of the contract. Example: Mortage starts on 11/23, with a rate of 3.00 10Y. If for whatever reason the apartment will be delayed and released on 02/24, results is that rate will increase 3.15% for the entire 10Y.

The consultant informed me of course of this clause and offered his work-around: let’s put the release date with +3 month in advance, so the risk is covered (so instead of starting 11/23, starts 02/23 → Yes, sure. But also forewarding rate will be included for that, which of course won’t be 0.15 but relatevely smaller, but still counts.

I have been through this before and remember how confused I was. When consumed by too much doubt, you just want someone to point you in a direction. Unfortunately, that makes you an easy customer for less scrupulous brokers and advisors. Developers are serving them perfect victims on a silver plate; they are new to all this, doubting themselves, in desperate need for advice and on top of that, breathing a sense of urgency into them is extremely simple.

Also, I am currently in the process of renegotiating at 800k mortgage expiring in April 2023.

But enough with that ![]() … What are your current options and how much time is left to decide?

… What are your current options and how much time is left to decide?

Hi @stef, again, you read my mind.

We already signed the contract with the notary last June, when we deposited the 2 Promise of Payments (20K coming from 3A, and 840K from the current institution).

Current options:

- I am in contact with 2 Banks (UBS, ZKB) and 1 Pension Fund (PostPK), with Dossier already opened. They are aware of the situation (existing contract in place with Promise of Payment, but no yet fixed rate).

- I regularly check the market trend:

- Post-PK has the most attractive rates (2.14 3Y, 2.33 5Y, 2.53 7Y, 2.68 10Y), plus forwarding of 0.10 as of today. There was also another PK, even more attractive (1.84 2Y, no forwarding if within 12-month), but they shutdown new mortgage business

- UBS and ZKB have different rates and conditions. UBS offers 8-year period at the price of 4, but this is not an incentive with me, and unfortunately, UBS does not publish their rates on the website. ZKB offers the Start-Hypotek with a discount of circa 0,25 of the standard rate (2.23 3Y, 2.47 5Y, 2.65 7Y, 2.85 10Y). For both, forwarding figure not yet at my disposal, but I do assume sort of 0.10-0.15 for both.

- looking at these options in a 3-year cluster, including projection of forwarding I see: current institute 2.80, the competitors are respectively 2.25 and 2.40. Knowing my mortage figure is 840K, every 0.10% increase it turns into an 840 CHF/annum. Comparing the offers (existing and ZKB for instance), is 0.35%, which is almost 3K CHF/year difference. Expected saving is 8K in 3years (including 1K penalty)

With that being said, the scenario I have in mind is the following:

- Blocking a 3Y Fix with the best option in the market (this requires having “active” dossiers flyng aroudn and be on top of them to block the rate timely).

- Start the mortage hopetully at the agreed time (November 2023) having contract covering till November 2026. In case of delay of aparement release and penalties (this is an external factor, influenced only by the specific bank policies: some of them apply penalites, some others will just ask you to start the payment at the agreed schedule), I will react accordingly - even if penalities consist on increasing mortgage rate by 0.05%, this is calculated and acknowledged (with goes differently if contract is 10Y of course).

Already in 2025 I can see how the market trend, and eventually block the rates by November 2025 (in both case they’re ramping up or down). Nobody has the cristal ball, so can say if rates go up or down.

The mere take away I see from the 3-year fixed.

I block a “favorable” (compared to 10Y) rate for 3 year, and benefing of the discount rate (2Y vs 10Y, approx 0.30-0.50%. → example, 2.40 %

If the % goes up in 2026, for instance by +1.5%* for a 3Y, and assuming a renegotiation of same 3Y-Fix, I can say: from 1-3Y 2.4% + from 3-6Y 3.9% = 3.15% for a 6Y period. Today a 6Y-Fix is around 2.75%.

Side effect: +0.6% not potentially saving in this windows, -30K CHF losses in 6 years.

If % goes up in 2026 by +0.5 %, same calculation: 1-3Y 2.4% + from 3-6Y 2.9% = 2.65% for a 6Y period

Side effect: none. -0.05% Potential saving, +2.5K CHF gain in 6 years.

If % goes down in 2026 by -0.5 %, same calculation 1-3Y 2.4% + from 3-6Y 1.9% = 2.15% for a 6Y period

Side effect: none. +0.6% Potential saving, +27K CHF gain in 6 years.

Sorry my usual script walls: long story short about the 3Y scenario and projection. Assumptions: 3Y Fix renovated by another 3Y Fix.

Consistent increase of % (+1.0) will naturally penalize, with exponential factor. + 7KCHF/6years, compared to a 6Y-Fix today.

Medium increase of % (+ 0.5) will be compensated.

Medium decrese of % (- 0.5) will bring positive balance. -30K CHF/6years, compared to a standard 6Y-Fix today.

Not sure If I miss something in my rationale, but I can see below, it’s a risk appetite approach with such gambling. Looking at the figures, assuming they’re considering all basic aspects, I guess it’s a controlled risk approach. +1.0% increase will be 7K away from my pocket. But an (we can also call it unlikely) -0.5%, I would benefit of 30K CHF can remain on my pocket.

Your initial question goes back a few weeks and received very good answer, already. Maybe I can still contribute some food for thought, yet no recommendation.

Why don’t you ditch the consultant once you have better offer?

- You already contaced other options directely.

- Make an summary of the offers for both SARON and 10-year to make them comparable. Highlight the best one and mention it to the other banks, ask if they can improve their offer.

- Narrow down the offers and repeat step 2. once or twice

You might well end up -0.5% or more for a 10-year fix compared to the initally quoted rate, provided your numbers add up.

Either way, it lets you compare just how competitive your consultants offer is. They will negotiate with the banks, but won’t pass on the result and pocket it themselves.

Red flag for me is the combination of “go for 10 years because it’s safer” and “don’t use too much own capital because you could invest it elsewhere”.

Nobody knows. Expected increases as of today are already priced in, always were. In the next 6-12 months, it could go either way, just like it did in the recent past. Historically, short-term was cheaper, yet even at today’s rates, your upside (rates get lower) is smaller than the downside (they increase much further).

Those are important questions to ask when considering SARON vs. fixed term, independent of where you sign and at which conditions.

I skimmed over a comment that you could afford 5%, and in another post you say there’s no extra cash since you want it to use for furniture etc. And you have pledged part of your Pillar 2, but not withdrawn it.

Just another thought if you go with SARON: you should consider not only if you could still afford a payment of 5%, but how quickly you could ammortize.

Myself, I have missed the golden window to fix a 10-year fixed term at below 0.8% and with the higher rates later opted for SARON instead. Yet if the SARON rate gets really out of hand, I could and would ammortize a good portion quickly.

Last point, not only consider the financials but whether your partner are you can still sleep at night without worrying about the decision you have to make.

Hi @Brndete , many thanks for your contribution.

Well, I’m a kind of a person who likes to debate, and also in front of situation like that, before taking a decision (e.g. dicthing someone), I would prefer to have a consistent view on that, as I might have blind-spot. It’s likely it will go this way, as the more I see that, the more I’m convinced my direction was distorted since the beginning with his approach.

About the right time to block, I fully agree with you. Right/Bad decision in this case, cannot be anticipated, only time will say. To my control, is only the regular monitoring of the rate and trends and block at the right time the best offer (at the moment). This is on my to-do list since 2 months.

About the fear level and the affordability. My budget forecast see that till 5%, it will be something we can afford (of course, with a recalibration of our expenses and other investemtns). But it does not mean, I’m willing to pay that - I try my best to find the optimal trade-off. Extra-cash is currently reserved for the furniture et similia, but if required, portion of that can be highjacked to add more cash-flow to the mortgage (see above, recalibration). Pledging of 2nd Pillar was an express request of the consultant, he really imposed that: other banks, knowing same exact conditions, did not ask for that as the affordability ratio was OK for them. However, only 1/3 of the 2nd pillar is pledged.

The SARON, part, I need to confess I require to dedicate more time as many of you are suggesting to keep this one still in the equation.

About the sleep at night, of course this is something I aim for. And that’s why, blocking today a 10Y for 3.0% it makes me like out of the game, as I can’t control that anymore. And to whatever fluctuation (in the negative area), it will remind me about the option, and create turbolance on my way of thinking about that. Where, with the lower Fix, it still gives me the option to control (and the better and worst scenario)… not sure how much is valid my argument, as this is mostly a behavioral aspect

You are on the right track. I missed your previous post before I posted, it was a few minutes a part. You can of course also play back better offers you receive to this consultants to challenge her.

In my case, I talked to banks and pension fund first before comparing with a broker. The broker was interested, but when I told them the currently best offer, they honestly mentioned that they can’t do much better without sacrifising their cut.

Neither am I, if I can avoid it. My reasoning was, that with a mortage below 1% I would let it run and invest my savings somewhere else. But if interests would go tomorrow to such a rate, I would make ammortization a top priority.

For the next 10 years? It makes sense to keep the amount you want to spend in the next 1-2 years. Afterwards, you can either save your money to pay back the bank or invest elsewhere, if you expect higher returns. Generally, I would decide on a personal split between risky and non-risky assets.

@Cappuccino. You got a couple of very nice answers from @Brndete regarding risk mitigation. There is not much left to add from my side. You obviously don’t feel comfortable with a 10 years fixed rate, so there is no reason to choose this option.

Maybe consider creating an account on the Valuu platform. Just fill the forms up to the step where they start showing you actual offers from their partners. It only takes ~30 minutes, probably less if you have the numbers readily available. It’s a fully automated online process that doesn’t require human interaction.

That should give you a nice overview of what kind of deals are possible based on your own financial data. You may find something interesting there, or at the very least, some tangible data to negotiate with your partners of choice.

One suggestion: don’t get paralysis by over analysis.

We can’t predict the future, we just need to carry on. Looking back on, you will always find a better way to do things but the risk here is that you are paralyzed by too many ideas and debates that you risk losing the boat. Ultimately, a small percentage difference in interest rate is not going to change the world.

I have a friend of mine that he was unsure whether to buy a new car diesel or petrol and he debated about consumption, usage, gas prices and etc. 8 years forward he hasn’t change car yet. While mustachian, he was paralyzed, now he is thinking into eletric cat directly :-). One day he will be left without car and rush into buy one at less optimal price ![]()

If you are concerned about the extreme, cut in the middle with 5y fixed mortgage and in 2028 you will have learnt more about property market in CH and mortgage and perhaps change strategy, either Saron or longer fixed duration.

Hi! Does anyone know how to find the rates and their graph?

I use Swissquote (bonds > interest rates) but I don’t see any graph.

Is there an existing symbol (for Google Finance, Apple Stocks App or Swissquote Analysis Tool)?

Which rates you are talking about? SARON you can find in internet (I did once), but I don’t think there is a corresponding data stream for financial software. Yield of reference bonds with various maturity should be possible to find for CH, US, UK, Japan, Germany, other European countries.

The SNB website is the easiest:

https://www.snb.ch/en/iabout/stat/statrep/id/current_interest_exchange_rates#t2

You may also check SIX site for overnight and compound rates. Just note that they are only available as csv datasets. If you want charts, you’ll have to play with excel…

https://www.six-group.com/exchanges/indices/data_centre/swiss_reference_rates/compound_rates_en.html

Thanks Dr.PI and Stef!

I found CHFIRS10Y and CHFIRS5Y

Is this the right reference?

Then I compare it with the bank rates (2.03% 5Y at VIAC) and note the difference…