Nope, not compatible at all, now they’re totally different currencies. I sold my BCH as soon as I could, I don’t think that chain is going to last long. I’ll do the same thing after the Segwit2x hardfork, which is probably also not going to go anywhere.

BTW, I found this website with the list of all major Cryptos

https://bitinfocharts.com/new-cryptocurrencies-2017.html

end the top cryptocurrency list.

https://bitinfocharts.com/top-cryptocurrency-list.html

cheers

I prefer https://coinmarketcap.com/, looks more 2017  . It also shows total market cap of all crypto on the bottom, currently over 200 billion.

. It also shows total market cap of all crypto on the bottom, currently over 200 billion.

I’m using CoinCap.io: https://coincap.io/

Do you use coincap for trading too?

heyall,

i know some of you hold bitcoin. after current rises, do you favor holding or rebalancing? any details?^^

i still keep my fingers off, i am to scared to burn my hands

Hi all,

I have started with cryptos a few months ago and even in difficult times for altcoins I managed to make excellent profits. Many friends asked me about it so I decided to write few articles on medium on how to get started. I link the first one here and you can go from there. I hope it helps you to join the crypto revolution. If you ask me, this is the true way to FI.

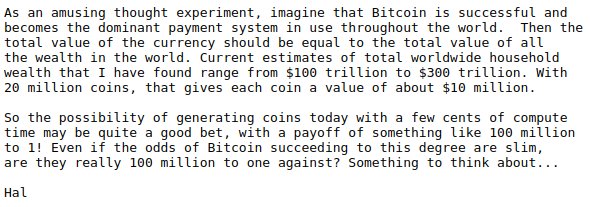

HODL!! I have no idea what bitcoin is going to do in the sort term, if it will continue to shoot up like crazy or if the current downturn is just the beginning of a huge crash. I do think bitcoin has a bright future ahead, though, so long term I expect it will go much higher. For example, here’s a crazy comment from 2009:

Funny but impossible. How can it be the only one? Why should it be 100% ?

Anyway, if you keep considering Bitcoin a “payment system” you’ll be disappointed. It can’t be, it’s too slow. At least not in the way people hope. (it can be fast if it doesn’t store the transation in the blockchain ).

But take my word with a big grain of salt. I didn’t study it. (For example I have no idea how they will store the transactions once all bitcoin is mined)

I’m ok with it only being 10%. ![]()

Well, I guess it depends what you’re comparing it to. It takes 3 days for a bank transaction to clear, bitcoin is certainly faster than that. Anyway, there are lots of innovations in the pipeline to speed things up. For example, the lightning network will enable sub-second transactions by moving them off the main blockchain and settling them afterwards.

The same way they’re stored now. Miners secure the blockchain by building blocks, which include user transactions. Space on the block is limited however, so users can include in their transaction a fee for the miner to motivate them to include theirs earlier. The rules of the protocol also allow miners to include a special transaction for themselves, which is the mined bitcoin. The rules also specify how big this mining reward is each time, and when it will end. Once it does, the miners will continue their work but their source of income will be exclusively transaction fees. The rationale is that while the network is small they need the extra motivation of the mining reward, but by 2140 (when the last new bitcoin is mined) the network will be large enough to be self-sufficient.

What you need to understand is that bitcoin rules are not written in stone. The rules are agreed upon by the miners. Before a block is accepted to the chain, the nodes check if the block meets the rules. This is how the rules are enforced. So theoretically, the miners could decide that there will always be bitcoins to mine. If this decision is not unanimous, some miners would keep using the old rules, and you would get two different chains, bitcoin and “bitcoin classic”.

However, the ones who eventually decide which bitcoin would survive are the bitcoin holders. If miners enforce an unpopular rule, the value of their currency will drop, because people will continue to use the old currency and sell the new one.

And coming back to the question of earning money for making transactions, already today, mining is not the only source of income for miners. They charge you to put your transaction in their mined block sooner. Just think about it: in order to make a bitcoin transaction you need to find somebody with enough computing power to guess the right number that will make their block fit in the chain, and convince them to put your transaction in that block.

Hey guys. I would actually like to purchase a few cryptocurrencies for buy and hold, just in case it’s not just a hype and really a world-changing technology. I would like a place where I could easily purchase a few currencies and then transfer it to my private wallet (not keep it on the exchange). What can you recommend? I know some guys recommended Lykke. Can anyone back it up? Will it do what I need?

I used Kraken, for just buying and transferring to your own wallet it should suffice, they just seem to be in way over their head, so I would not recommend it if you want to do a lot of trading as they are currently hopelessly overloaded. But they take sepa and did not steal my money.

8 posts were split to a new topic: Hardware Wallets for Cryptocurrencies

I’ve also both kraken and lykke and confirm that the first is currently so congested that’s almost useless and has hefty commissions the second is much better has also private wallets and no commissions. I’ve also tried coinbase which as well seems to be assaulted atm and want to give a try to poloniex because quite fair as exchange also having almost every possible coin…

I like to use Bittrex and Binance with 2FA for buying coins (kraken is slow and buggy) - but it does not matter what exchange you use - you can always withdraw to your wallets. But not all exchanges allow to transfer back into FIAT, i use kraken for that, but heard that bitstamp is way better/faster.

I you want to hodl, consider a cold storage device like ledger nano s or trezor, because wallets can be hacked too.

Binance to trade, Ledger Nano S to store, and Coinbase for deposit/withdrawal, but thinking seriously about trying Bity, Swiss based company requesting serious documents to open an account, seems more reliable than Coinbase (disable features one day on two cow of traffic -official version-).

Maybe it has been said already but transfer in Ethereum and not Bitcoin from a site to another, reducing strongly the fees.

would be nice if you could say a few words why. The Ledger Nano S as wallet is pretty straightforward, there are only 3 options and any is good. But why Coinbase for deposit and why Binance to trade? What is Binance anyway, on their site it looks like they have their own currency. Is there no good exchange where you can do everything? Transferring coins between exchanges seems like a lot of hassle. So what, first you send dollars to coinbase, then exchange to eth, then send to binance, then exchange to, say, iota, then transfer to ledger nano?

Maybe one side question: how do exchanges fix a price? I understand they find a matching pair of buyer and seller, but in the end they need to add this to the blockchain. So you fix a price and then you wait a couple of hours to see if it went through? Are the exchanges miners themselves?

Exactly. If you’re buying, someone’s selling

Only when someone withdraws, otherwise only merely need to record the trade in their books, i.e. database, to track every client’s balance

11 posts were merged into an existing topic: MMM on cryptocurrencies