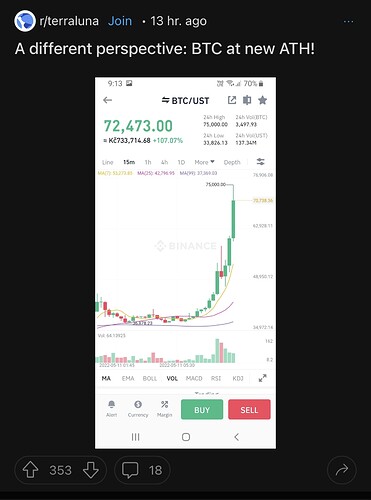

“”“”“Stable”“”“”"coin ![]()

Thank you very much for the tip! I see 25% p.a. locked stacking at Binance, max 200 UST. Crazy indeed!

Also staking UST with swissborg ![]()

Terra/Luna is a well established project and they were offering the 19.5% through Terra app since a long time now… just previously UST was only accessible via Terra (Anchor protocol) and KuCoin I guess….

Recently UST became accessible through a lot of major exchanges so it became much simpler to get the earnings… and it’s very profitable for all of them as well…

I guess it’s as legit and stable as a stablecoin can be… from the fundamentals I cannot any major problem / risks ( I mean similar like Usdt, usdc etc…)

yeah sure… 20% interest just means i have 5 years till i need to give you more than just your money.

Also do they have any obligation to keep the ust peg 1 to 1? Like what happens if one day the just say “sorry folks code went bad”?

How does the LFG profit? Is it greater than to just run off with all the money?

I honestly dont trust this “algoritmic stablecoin” backed by a crypto, that had to buy another crypto to be stable. Also looking at the circulating supply it does not seem that LUNA is getting burned, the supply seems still the same?

Yes but it should show on CMC but the number is almost the same as when LUNA price was 1/100.

Also to buy the BTC they announced they did not have to sell any LUNA but just “converted” or “locked/burned” LUNA to UST and bought BTC?

Well, it sure as hell, is an interesting one, but i would not get into it.

And now I see 21.66% for 90 days and 18.95% for 30 days. So the yields seem to be falling.

Moreover, I noticed that at Binance the yield on Locked Stacking subscriptions that I subscribed before have also dropped! So money are locked, but yields aren’t. Nice! Forces me to rethink my yield generation strategy.

That’s an interesting point indeed!

First time I see the % within the locked period in locked savings to be changing in Binance…

Not sure if Binance just uses the earn functionality from the Anchor Protocol and takes a cut. If it’s the case, then it might be due to a recent governance proposal that passed. There will be a dynamic rate which is more sustainable, but in the short term, we should be seeing a the earn rate drop 1.5% every month until it’s sustainable.

Not available anymore at Binance. I already maxed out the subscription for 90 days, others are sold out and not available. The party is over?

Well as I understood from the community / governance voting’s it was suggested something like reducing the APR 1,5% per month until it gets to a sustainable level… not sure about the details or the implementation plan…

Still you can put USDT at the flexible savings (you can withdraw anytime you want) with pretty decent 10% APR

This is about Binance? The limits for the 10% interest rate tier are 2000 USDT and 500 BUSD, so I have a long way to maxing it out.

Its Bitfinex.

Binance has Busd.

Here another perspective on the UST case… ![]()

(I’m not really following the situation, and I don’t know enough about it… so I won’t be able to engage the discussion.)

Yeah - I read that thread also. They almost made 1 billion by this attack - and ruined LUNA forever.

Funny (not) thing: someone mentioned this potential attack to Do Kwon already in November 2021, but I guess the inflated ego of Do Kwon simply didn’t allow him to listen. Karma can be a bitch sometimes.

well its back a 25c now. lol

Buy the dip @Cortana ![]()

Well, who’s buying LUNA now hast quite an impressive DCA. I took another tiny bet…

the supply will just grow and grow and grow till the price its completly gone or till no one wants to sell ust anymore.

The algo will produce luna till it can. Buying luna is like burning money at this point (with extra steps).

That said i bought a few 100 for shits and gigles.