I guess more reasonable deductible options would be 1000, 3000 & 5000.

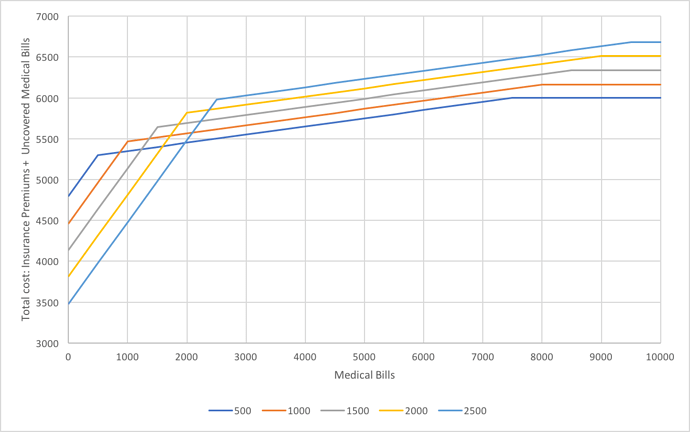

The current choice is retarded. Just have a look at this chart. I put here the insurance premiums of Assura from Comparis.

Clearly, if you expect medical costs under 2000 per year, you go for 2500 deductible. If they are above 2000, you go for 500 (or 300). So the options 1000, 1500, 2000 are completely useless, confusing, and there is anyway not so much difference between them.