I tend to agree with him on this one though.

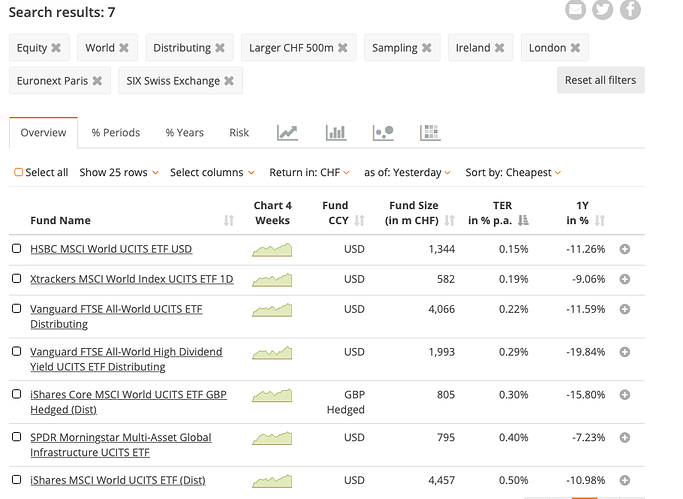

As I now got my IB account and click around in it trying to learn how to use it. I wanted to find the ETFs and stumbled on this on the justetf page:

Iknow a lot of people here are fans of Vanguard FTSE All-world buy actually HSBC MSCI World seems to somewhat cheaper. So I just wonder why Vanguard and not HSBC etc?

Is it only the size of 1.3 billion to 4 billion? Or is it something else ? (I know all the story about Vanguard being owned by fund owners etc. as described by JL Collins)

Could you find a better fitting thread for this question? This is the Coronavirus thread, we’re discussing Elon Musks Tweets here!

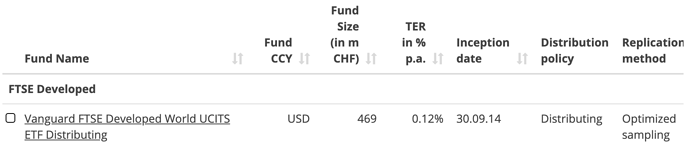

Your question has been asked X times before. You’re comparing apples and oranges. MSCI World = FTSE Developed World:

FTSE All-World = Developed World + Emerging Markets, that’s why it costs more.

Back on topic, futures down, swiss market down as well.

Is it because of the unemployment numbers?

I would say that it is mostly due to the fact the problem will last more than two month. Until now there was an hope that the activity would start relatively quickly. Now we know that the immunity of the population is small and the slow down of a lot of activities (transport, tourism, sport, large events…) will last at least 12 month.

On this aspect there is an interesting interview of the CEO of WIZZ air who is against financial support to airline companies and who claims he has enough cash to survive 18 month of grounding.

Meanwhile, SWISS seems as if they’ve gone practically broke as of now. From what I gather, they have stopped processing refunds altogether - and as such are blatantly violating European law.

Also, I am having an open booking with them, the first leg of what was supposed to be flown yesterday - which they now refuse to show on their website: with the exception of acknowledging the E-Ticket number, all information is gone: Flight times, status, price, airports…

And their rebooking policy seems sneaky, too. Seems they will only credit the ticket value towards the new booking. And rebookings are only possible through customer card - question is at what prices they’re going to sell the rebooked flights. Who says they don’t make them more expensive than promotional prices on entirely new bookings?

My flight with SWISS in April was cancelled so I called SWISS on Mar 30. They cancelled my booking and said that I should expect a refund in 2 to 3 months, because they are overwhelmed with rebookings and cancellations. It seems really weird to me that they were able to put the cancellation into the system, but some other department has to review it and approve it. The money that is at stake is 2000 CHF, so not a small sum either.

My assumption is, if they were to pay back for all the cancelled flights, they would not have enough money.

Even prior to that they already stated on their website to be “unable” to process refunds. Also, as you say, it doesn’t make sense. Except if that “other department” needing to review and approve is their finance department tasked with liquidity (as opposed to customer service).

“Please be aware that our focus is currently on handling urgent requests (i.e. rebooking & cancellations)”

I doubt that many rebookings are that “urgent” at the moment. And processing a refund, it is probably easier to return a payment than rebook (different price, plane, possible airports, etc.).

Personally I’d be highly surprised if you got your refund in that timeframe.

They might rather be holding off, awaiting “emergency legislation” (that they’ve lobbied for) suspending the obligation to provide cash refunds - and instead provide you with travel voucher/credit instead. Problem is: It’s EU law, not purely domestic law.

Back to the markets:

S&P 500 now at the same leve than it was a year ago.

For MSCI World it’s 15-20 months

NASDAQ is comfortably higher than a year ago - which were already all-time highs back then.

I went “all-in” for one of my three VIAC portfolios in April.

I went out of stocks for today’s rebalancing again.

That portfolio is now up 13% since inception in february 2019.

Which underestimates actual performance, if you were to annualise it. (Since it compares the sum of pay-ins with current balance - and half of the pay-ins were only made in march 2020. As was more the biggest part of all that realised gain since then).

I’m out for now. No, thank you very much.

No worries, the cavalry is on its way

https://www.bundesverfassungsgericht.de/SharedDocs/Pressemitteilungen/EN/2020/bvg20-032.html

The Court found that the Federal Government and the German Bundestag violated the complainants’ rights […] by failing to take steps challenging that the ECB, in its decisions on the adoption and implementation of the PSPP, neither assessed nor substantiated that the measures provided for in these decisions satisfy the principle of proportionality.

Interesting!

Did you also cash out (all of) your investments outside of VIAC?

And the market restarts it relentless climb up… good 1.77% on S&P500 today

And I’ve maxed my monthly withdrawal on my bankaccount…

Probably gonna have to invest at a bit higher prices

VGT and EMQQ both +2.5%. Need to take the stakes higher and use those as a benchmark from now on

There was a short interview on Inside Paradeplatz with Klaus Wellershoff - ex Chief Economist with Swiss Banc Corporation (ex Bankverein) and later same role with the UBS for many years. Unfortunatelly the questions are in Swiss German dialekt and the answers in German (es Wellershoff is German). Had the chance to see him 2x in podiums and he is not somebody with a “loud” nor “end of the world” voice. But he explain in simple words, that probably nobody of us here had lived through such a recession which will come. The last one was “the great recession” in 1929. Really interesting but also scary.

Lukas Hässig of InsideParadePlatz. We LOL at his writing style at the Bank. He always has this tabloid-style doomy tone, always smells trouble and exaggerates everything. But I gotta admit, he really has connections, because he often described really precisely what was going on at our bank  .

.

Well, I’ve never considered selling everything. Just a piece to calm my nerves. In any case, I haven’t sold anything. I stopped logging into IB and checking this forum. I almost forgot savings of my life are melting and a depression of the century is coming. I feel much better now.

This guy dug into my previous boss’ divorce situation. He’s the most tabloid journalist in this country.