Hello mustachians!

In 2020 I agreed to one of these 3a pillar + life insurances by AXA. That was before I started taking an interest in personal finance and reading MP. Now I understand that this might not have been the best decision I’ve ever taken.

I’m ready to take the loss and move onto a new service provider (VIAC or finpension). I’m still awaiting for the agent’s reply regarding the contract termination value I’m able to transfer to the new service provider and an explanation of the fees I’m currently paying with AXA.

In the meantime I’m trying to compare the fees at AXA (based on the contract they gave me) and VIAC to see if it really makes sense to switch the service provider, however I’m not sure I’m doing it right. I apologize in advance, my accounting skills are almost non existent so I’m basically using my basic math and common sense to compare the fees.

For simplicity’s sake I’m assuming that: asset growth is 0%, dividend yield is 0%, cash interest is 0%, the contract starts 2020 (to compare easily to my current contract which started on 2020) and ends 2051 (including the year 2051), the yearly premium I’m paying is Fr 6825.6 (which is the amount I’m currently paying with AXA).

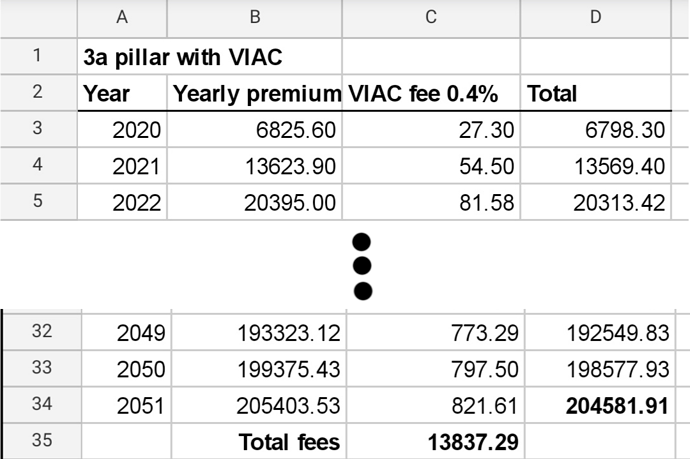

Calculation VIAC:

Duration: 2020-2051

Monthly premium: Fr 6’825.6

If I go the VIAC way, I’ll be choosing the 60% equity strategy which has a yearly fee of 0.4%.

The first year it will be Fr 6’825.6 - Fr 27.3 (0.4% fee) = Fr 6’798.3

The second year will be Fr 6’798.3 + Fr 6’825.6 - Fr 54.5 (0.4% fee) = Fr 13’569.4

And so on…

At the end, total fees would be Fr 13’837.29 and I will end up with a total of Fr 204’581.91

Calculation AXA:

Duration: 2020-2051

Monthly premium: Fr 6’825.6

The contract is split into 80% Sicherheitsguthaben (this is the guaranteed part I’ll get at the end) and 20% Ertragsguthaben (this is put into equity, bonds, etc and is not guaranteed at the end of the contract - can fluctuate). Adding up the premiums I’ll be paying throughout the years, without considering fees, the 80% guaranteed part would be Fr 174’735 and the 20% equity and bonds part would be Fr 43’683 (total of Fr 218’419).

On the 80% guaranteed part they will give me back Fr 154’453 at the end of the contract which doesn’t correspond to the full amount I’ll be putting in due to fees. So the fees would amount to Fr 20’282 (Fr 174’735 - Fr 154’453).

On the 20% equity and bonds part, I don’t know if there is an extra fee so I’ll give them the benefit of the doubt and assume that the fee is already included in the 80% guaranteed part (and hopefully the agent gets back to me with the full fee explanation so that I can adjust this part later if necessary). So I’ll assume the full amount of Fr 43’683 (considering 0% asset growth).

Comparison:

VIAC:

Total fees - Fr 13’837

I’ll end up with - Fr 204’582

AXA:

Total fees - Fr 20’282

I’ll end up with - Fr 198’137

Am I missing something in my calculations? Is there anything that doesn’t make sense in my assumptions? To be honest, this difference doesn’t look as bad as stated in many of the other posts about 3a pillar + life insurance on this forum, that’s why I’m afraid I made a mistake in my calculations.

Any help/critique/suggestions are very welcome.

Thanks a lot!