I’ve done a lot of reading on the internet on this subject and so far what I read argued that it doesn’t make a big difference (the fact that the fund in SIX has a much lower volume and hence a bigger spread is more concerning to me). But at this point I don’t have any links I can share. I’ll post them if I come across the info again.

Come to think of it, I don’t think I’m doing the right calculation of how the management fees impact the investment value over time. Not sure how to model that either

Can’t you simply consider that the fees amount would be invested (and compound over the chosen period ?

Here is what I have so far, feel free to comment: https://docs.google.com/spreadsheets/d/1BSQSwR_Dcv9pEsfSEm9LV7awHXedMaDVNWqHLMJIWWE/edit?usp=sharing

As far as management fees impact goes, I’ve reflected that on the actual unit price (it goes down by the respective management fee percentage every year). Hopefully that is a good representation of the reality.

Notes: didn’t consider inflation, dividends reinvestment, currency fluctuation nor conversion costs. Assumed 4 purchases per year (you can clone the sheet and adjust cell B13 to your own preference).

Nice sheet Pedro !

A couple of quick comments:

- Columns F:H would be better to keep the values multiplied by the “Purchases per year”, so when you sum them (last row) you get the money effectively paid during the period

- You should probably also consider the stamp duty if/when you sell (in case you’re not able to live only with the 2% dividend). Assuming for simplicity that you are going to sell everything the last day (exactly after 20 years) it would be about 1’800 CHF.

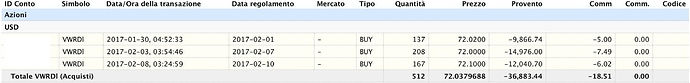

IB minimum transaction costs are difficult to estimate… I’ve purchased three times since I’ve opened my IB account and paid following transaction costs:

- 5.0 USD (9’900 USD Purchase)

- 7.4 USD (15’000 USD Purchase)

- 6.0 USD (12’000 USD Purchase)

Thanks for the input @weirded ! Fixed point #1. Regarding #2, the stamp duty is already accounted for in cell B36 (referencing cell $B$9). Cell B36 is basically telling you how much you’d be able to get out of the broker if you redeemed everything at that point.

I talked to my adviser at CT and he told me the rate is spot + 0.5%. Not sure how you got those numbers!

Which rate do you mean ? In my previous post I was talking about purchase fees at IB (not CT)

Edit: you mean post 14 ? (Comparing Vanguard All-World in LSE vs SIX). I was referring to post 13 where @ParaStachian gave a conversion rate sample (30.12.2016)

Yeah, I don’t know why the forum didn’t make a reference to the original post, since I clicked in the Reply button there…

In any case, not sure if we can rely on CT’s rates being that good, since the advertised rate is 0.5%. I find it hard too good to believe that conversion costs at IB are just 2-3 USD!

Also, I’m not sure if the transaction rates I’ve put in the sheet for IB are correct. I’d appreciate it if someone who has experiencing trading with them can quickly check it and report any errors.

I didn’t notice that cell B36 had a different formula. Am I wrong or you also changed the formula in the meanwhile (adding O35 instead of the original N35) ? Or am I going crazy ?!  I was writing a comment on it based on a saved Worksheet version and suddenly seen other values…

I was writing a comment on it based on a saved Worksheet version and suddenly seen other values…

I past here a print screen of the purchases (might be interesting for others too…).

One more thing worth mentioning: international bank transfer costs. With IB you transfer CASH from Switzerland to Great Britain. Until now (tried with PostFinance and Migros Bank) I couldn’t manage to pay less than 5 CHF for a transfer.

According to @MrRIP with UBS you can transfer for free…

Will try to do next transfer with my last option (SwissQuote account) and see what happens…

@weirded: You’re not going crazy. I added that to account for the money lost on conversion from USD->CHF.

@ I have insisted having a real answer. Because the internal rate is managed by Vanguard and not the broker…

Even if I have all my money invest with Vanguard, the European support is just a mess

Wait, 0.05% trade fees? Wow, the ETFs I buy are ~0.1% trade fees…

Same cost as stated on their web site (https://www.interactivebrokers.com/en/index.php?f=1590&p=stocks1).

“LSE International Order Book and USD-denominated stocks”,fixed USD 0.05% of trade value, minimum USD 5.00.

On SIX it’s 0.1% (minimum USD/CHF 10.00).

U.K is in the SEPA zone. Shoudn’t be a simple SEPA order which cost less than 1.00 at UBS and 1.- at Raffeisen

AFAIK SEPA (Single Euro Payments Area) is for transfers with EUR as currency.

With Migros Bank I should pay 0.30 CHF and I pay 5 CHF -> no SEPA…

My mistake, you are right. Sepa is only for EUR.

CHF International transfer costs:

2.- with Postefinance

3.- wIth Raffeisen

5.- with UBS

N.B. @wapiti with PostFinance you pay 2 CHF to them plus another 6 to 12 CHF to the “intermediary”, depending on how much you transfer (according to their hotline it should be 6 CHF up to 10k and 12 CHF above it).

I transferred 10k and received 9.994 on IB. The 2 CHF commission are then subtracted from your PF account at the end of the month.

Do you know where the money is located from the jusist point of view? is it under US law?