The forum is so quiet these last days (I expect everybody is exhausted after TAX declaration) that I create a post on the topic that attracted my attention: Commodities like oil, gas, minerals, cereals, steel, and so on.

Has anyone such position and is anyone able to explain why.

I have my opinion on the topic but will give it later in the week in order not to destroy the enthusiasm of people who are long in commodities.

Happy rainy week-end.

No, I don’t have any. When you own stocks, the commodities prices (oil, minerals ect) will automatically affect the stock prices of the industries relying on commodities.

Gold is maybe an exception…

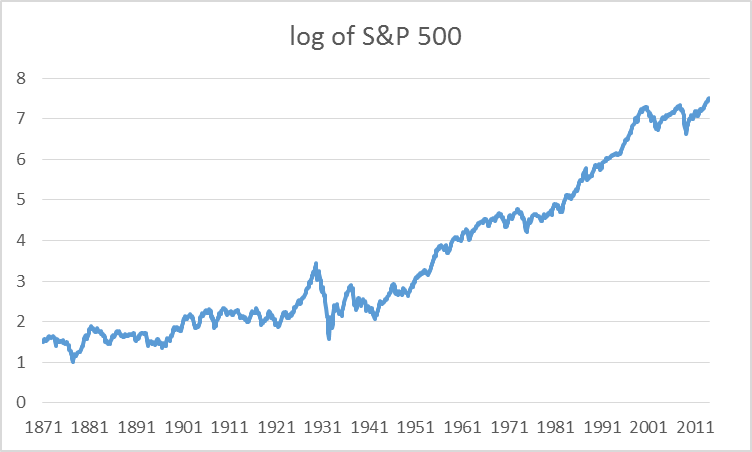

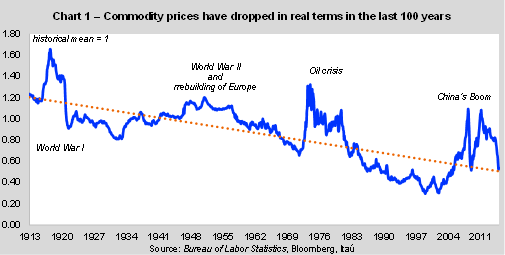

for the long-term investors like me, commodities behave like

whereas stock do more like

so unless you have a short-termed diversification or hedging goal, it is hard to find good reason for commodities. intrinsically, they don’t work for you as a dollar invested in a company does.

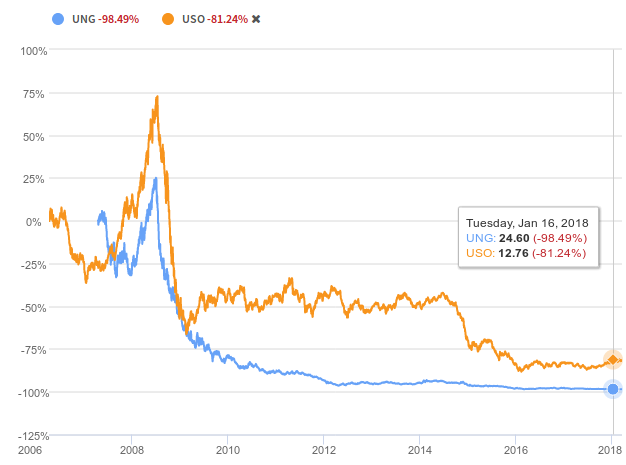

Thank you to nugget for the plot showing that commodities do not produce anything and in fact have lost 80% of their value in one century. This is in fact a quite good performance because today it is possible to buy ETF on commodities that loose 80% of their value within a decade.

The ETF on commodities are based on 30 days futures contracts that are finally sold at the spot price. The problem is that the market is most of the time in contango state and the futures contracts are paid more than the expected spot price. That means that at each cycle the found buys a bit less commodity and the value of the asset of the found is decreasing in time.

Here you see two examples of ETF tracking the price of oil or gas and the result after ten years is simply devastating.

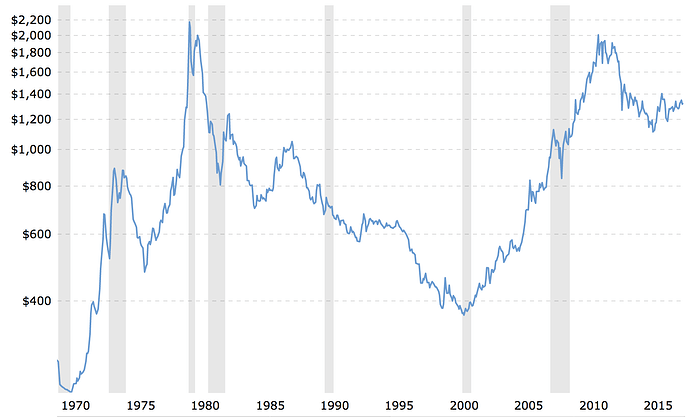

Interesting discussion. Since gold was mentioned, I wonder what justifies gold prices. Here’s an a inflation adjusted gold price chart:

From 1970 to today (2018), the average real rate of return has been 3.7%. Pretty impressive for a non-productive asset. Gold is just sitting there in the vault, doing nothing and the price goes up. Do you have any ideas why gold is still so expensive?

- Is it because official inflation statistics have been falsified (which would mean life was better back then)?

- Is it because many more people got ultra rich and they want a piece of gold as wealth protection?

- Is it because gold price is still in a bubble and one day it’s gonna pop?

- Is it because gold has gained on political importance over the years?

- Is it because those who have gold, usually don’t want to sell, so the price is dictated by price of mining?

These are completely theoretical reasons which I just pulled out of my… head.

Edit: I gave it a second thought and have yet another theory. In 1971, the USA ended the USD to gold convertibility at $35 per ounce, thus ending the Bretton Woods system. Since then, the gold price has been freed and private gold ownership liberalised. So somewhere between 1971 and 1979, gold reached its fair price and then went into a bubble. So if a fair price of gold is something like $1000 (inflation adjusted), then gold indeed ain’t a good long term investment.

There are some people like Robert Kiyosaki and Mike Maloney

https://www.youtube.com/user/whygoldandsilver

who are warning about the coming inflation and stock market crash because both US and the EU are printing money now, so gold should in their opinion protect your from that. However if you’ve got stocks already, they will protect you from inflation as well. Moreover if you have your money in CHF, one could expect that CHF will strengthen in case people from USD and EUR flee to it as a safe currency. So maybe CHF is in a sense as good as gold…

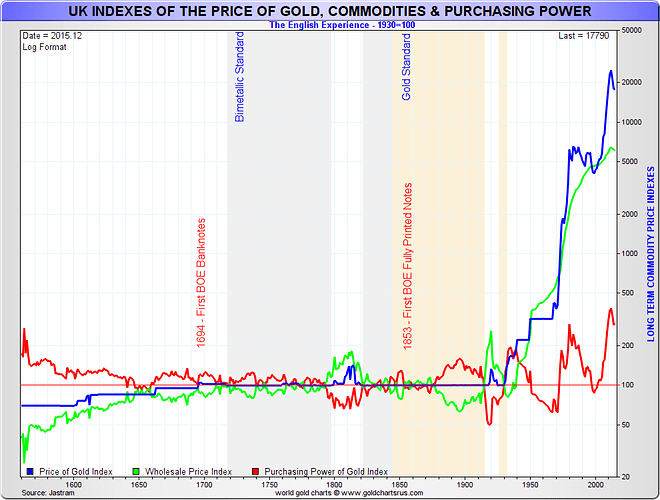

Gold has the longest history of value preservation in the history of humankind. I think the reason why the value of the gold increased over time was that for most of the history it was used as money, thus increasing demand with economic expansion, but the supply was pretty much restricted (except for the New World discovery period).

For the future, it’s more complicated, as the value of the gold is derived purely from the conviction of people that it is a safe haven asset. If people will stop believing in that, the value of gold will drop. It might even drop to zero if (1) central banks will drop it as the reserve, (2) people stop investing in it, (3) Indians and other nations stop using it for religious purposes, (4) people stop using gold jewelry.

I think (1), (3) and (4) are highly unlikely, and (2) is pretty unlikely, and thus I keep some portion of gold just in case if QE rounds of last 10 years will turn into hyperinflation or WWIII breaks out.

I do not own any gold nor commodities, so not a lot of skin in the game here.

However, here are my thoughts on the topic; first on commodities, and later on gold.

-

First, we can note that contrary for instance to the stock market or the bond market, the commodity market relies uniquely on supply and demand. (in other markets, other factors influence the price, like the performance of the underlying company or its credit quality)

-

For most commodities (precious metals like gold being an exception), the global economy has profited from production gains, so it costs much less to produce more and more of the commodities over the long term. Therefore, supply has a long term tendency to grow more easily; as a consequence, the long term tendency of commodity prices is to go lower and lower. That is why it is not really a good idea to invest in general commodities as a buy and hold investor.

-

Therefore, to earn money on the commodity market, you have to be an active investor :

- either by buying ETFs at “lows” and selling at “highs”, whatever that means. As it as been noted previously, one disadvantage is the structure of the ETF that has to roll its future contracts and the contango effect, which lower the value of the ETF. Hence it is not very practical.

- or by being directly active on the commodity futures market.

- Which brings me to my next point : it seems that the commodity futures market is where I found the biggest number of successful chartists. See for instance the “Turtles” group of traders. (or here ).

Therefore I would tend to think that in this market, even the weak form of the EMH does not hold since there are documented ways to make consistently money. Please note that this is however a full time job where you have to be at your desk all the time when future markets are open.

Now for gold:

- The particularity of gold is that its supply is limited, since it is a rare metal. New production is almost negligible, so what drives the price of gold and precious metals is its demand.

- Call it irrational or not, gold has been the refuge when shit hits the fan for thousands of years. One of its nice properties is that it is inalterable and inoxydable, so it keeps its properties and holds its value.

- To answer Bojack’s question, the fact that gold went up so much “even if it does not produce anything” since the seventies, is that government have been printing lot of money/issuing a lot of debt (the result is the same, an global increase in the amount of money). Since you have more money in circulation but still the same amount of gold available, the price of gold goes up.

- So as @1000000CHF said, gold is very good for protecting yourself against catastrophe scenarios, but that’s it.

- And finally, some nugget of wisdom from Buffett :

“Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce - gold’s price as I write this - its value would be $9.6 trillion. Call this cube pile A. Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobil’s (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?”

One point where I disagree :

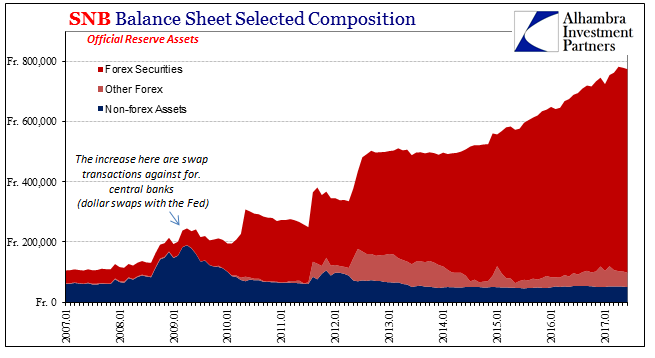

Hmm. Looking at the behavior of the SNB in the last few years, i would not necessarily count on it. The SNB has been printing CHF like crazy and, in this way, is behaving a lot like other “sick” economies. Perhaps it will be a safe haven, perhaps not, but printing hundreds of billions of francs is definitely not a way of saying “our currency is managed in a conservative and healthy manner”.

But my chart is inflation adjusted, so it is supposed to have money printing factored in. Unless you believe that official inflation is fake, which opens a big can of worms.

I guess what can really realistically drive gold price up is that it’s just this cube, limited in it’s supply, and the world wealth is constantly increasing. Generations of people are constantly producing more than they’re consuming and there is a capital/infrastructure buildup. So if gold is to retain a constant share in the World’s wealth, then its price has to go up at the World’s wealth growth rate.

Btw. Governments are printing money, but the real value of goods in the economy is also increasing, so not every printed dollar turns into inflation.

I think they are doing this to weaken the CHF so that Swiss companies can still export something to the EU, but not because of debt or keeping the zombie companies alive as in some southern European countries.

The reason might be different, but the end effect is all the same. Switzerland cannot afford to keep the CHF strong, because eventually nobody would buy Swiss products, as they would become too expensive. I wonder how will SNB manage to reduce the balance sheet without making the CHF too strong again. Right now they hold hundreds of billions of foreign currencies.

The reason is different, the long-term result might be the same - the debase of the currency.

Since the supply is restricted and the chart is inflation adjusted, there’s only one explanation - there’s increasing demand for gold. I think there few reasons for that demand - (1) some banks increase reserves, for example Russia’s central bank; (2) population of India was growing a lot and I read somewhere that Indians buy lots of gold for traditional and religious reasons; (3) there might be more and more gold bugs as central banks are printing like crazy and some investors might be afraid of the hyperinflation (stocks are good hedge against moderate inflation, but they really suck with high one, like the one in US in 1970’s).

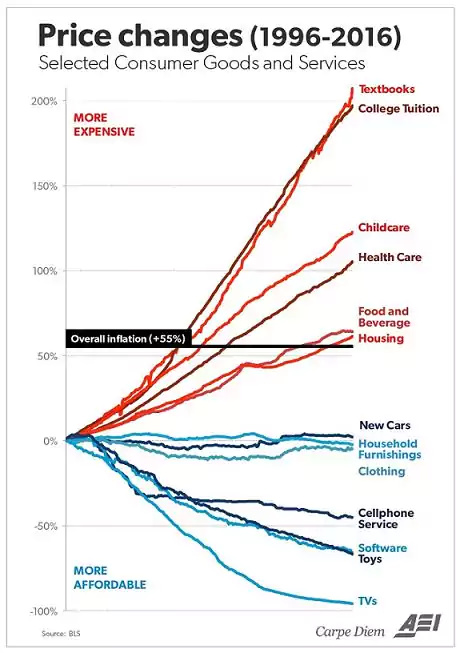

Unfortunately, governments “print” money faster, than the factories increase their efficiency in producing goods (except for electronics and few other goods). Here’s a good chart showing how inflation destroys (human civilization and) affordability of services:

PS. “Print” should be always in quotation marks, as governments almost never print money. They just allow - and support by influencing interest rates and acting as a lender of the last resort - commercial banks to create deposits out of thin air. Here’s a good description of the process by Bank of England’s economists.

So what is the reason in you opinion? As I understand it, it’s because everyone is printing money, the Swiss have to do it too. So eventually this will lead to inflation and maybe commodities will be worth more than paper money.

Why would they have to print money? It may make the big exporter richer, but it makes everyone else living in Switzerland poorer. So this is totally at the expense of the Swiss people.

And, as said previously by other members, at the end the effect is the same as in other countries : it keeps zombie companies alive with free money, and it creates huge mis-allocations of capital. This will end up in a big credit contraction, but i would not know if the result will be a bull or a bear market for commodities.

Problem is, when we listen to macro-economists we hear credible arguments about why some market will go up, and also why it will go down. This is the problem of macro-economy : because you can not reproduce experiments, you cannot make falsifiable predictions, which makes it a pseudo science. Therefore, I do not try to forecast what will happen with a market or another. I just buy cheap assets. But it takes more time to implement than just doing ETF indexing.

Guys, have you seen this?

A Morgan Stanley representative shared an insight, that they divide S&P 500 price by gold price, distrusting the official CPI as inflation measure. Such a chart showing index value in grams of gold does not really look very nice. Huge spikes during bubbles, followed by drops to the bottom, and the long term growth is not really very exciting. What do you think?

I think it’s an awesome chart. Gold is better for measuring value of other things than USD, because it’s way more stable over time, especially long-term, and the measures don’t depend on such arbitrary and manipulative thing as CPI.

But do you understand what it means? It means that the total value of S&P 500 measured in gold is only slightly higher than in 1929. Of course, the chart does not include dividends, so it cannot be used for calculating return.

Yup, I know. It doesn’t include dividends + gold is a little bit deflationary - it’s growing in value over time. so today’s 1oz is not exactly equal to 1 oz from 1929. Today’s 1oz can buy more stuff.

Check out this chart (from this website):

I’m not completely surprised that awesome returns of the stock market are also due to the high-inflationary era that we’re living in (partly because CPI sucks in measuring inflation and partly because of so-called “Cantillon effect”). Of course, you can calculate inflation-adjusted returns by just subtracting the CPI from nominal price, but I think it’s not showing the full picture. It’s more realistic to long-term measure S&P500 “real” value in terms of gold (and perhaps other long-term-stable-value assets) price.

Reviving this old thread as there doesn’t seem to be other outlets for commodities on the forum.

I am looking to replace current position on USCI (https://etfdb.com/etf/USCI/) with a similar product. USCI is a PTP (publicly traded partnership) and from January 1st will be subject to 10% withholding tax for non-US residents.

Any suggestions?