Here’s a funky mind-copulating thought I had last night: “if one stacks cash in anticipation for a fall in the market, or is planning to raid emergency funds to buy a dip, it makes no sense that they don’t just sell right now”.

I agree that if you have decided to stop buying stocks and accumulate cash in anticipation of a crash, then you probably ought to sell some stocks if you want to be perfectly rational and logical.

However humans are not logical nor rational. I for one have a rule that I will “never sell” my equity exposure to avoid the potentially catastrophic risk of panic selling during a downturn. So for me to implement a reduction in equity exposure, my only option is to cease investing and hoard cash. (I’m not doing this though, it’s just for argument’s sake)

You’re exactly on point. I consider myself very pragmatic and rational, so do my family, friends and coworkers, however I felt I caught myself doing something illogical by saving cash - never stopped saving - since last June, since I did and still do believe in a crash, first due to P/E and now increasingly due to volatility in a euphoric market which, in my opinion, just needs a few sparks to burn up.

I plugged it all into gold last Monday but mostly thinking it’ll run up counter to a dip in stocks so I’ll plug it in stocks when that happens. Have set some sell X/buy VWRL targets for VWRL which is my main investment.

Same, I don’t plan to ever be uninvested, if anything the only thing that stopped me selling is the idea that I am giving away dividends.

Wrong.

You hedge the fall of the market by stashing cash. If it crash, you have cash to buy it, if it doesn’t, you have your ETFs.

There’s no real right or wrong, other than panic selling.

Edit: theoreticians will come and talk nebulous things like opportunity cost.

Edit 2: hedging I agree with conceptually, but in reality it also depends on the portfolio’s size and saving rate. If one can save 2,000/month and their portfolio is 500k then the “hedge” is not a hedge, it’s peanuts.

I heard that argument before, and I don’t think it plays fair.

If you were 100% sure there’s a crash coming, you should be selling all stocks, and it would be illogical to still keep some. But you cant’t be 100% sure, everyone is guessing what will happen, and in that case, you stay invested in case the crash doesn’t come.

I haven’t heard it before, other than in my own head. It’s not an argument, just a thought. Of course nobody legally knows what’ll happen and when, otherwise there’d be acting upon and making a ton of money at it.

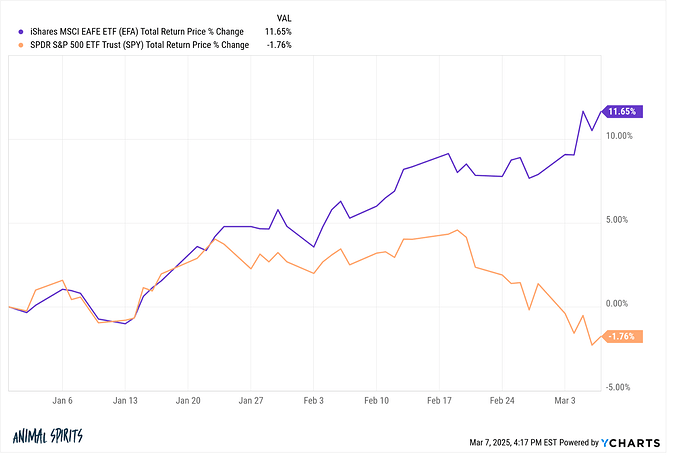

Fast forward to 2025 …

(Source)

Beginning of tables turning or just a Trump induced hiccup?

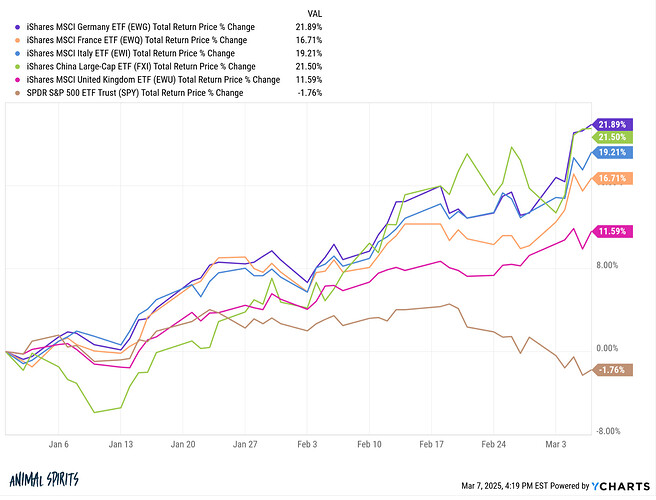

Country breakdown:

(Source)

Insert why not both? meme

Not really sure if this fits this thread, but stumbled on an insightful article about the alleged rare earths in ukraine. According to the author from Bloomberg, there are no relevant rare earths deposits in Ukraine. Ukraine initially talked up the potential to engage Trump, he believes it and no-one has bothered to actually check if its true. There is even a report with a NATO imprint with questionable research / basic errors.

Here a link to the article without paywall: https://archive.is/42xZy

I remember reading about the riches of Ukraine when the invasion started: oil/gas around Crimea, rare earths all over, the famous “black earth” which is great for growing wheat (that’s known since the middle ages).

If that’s true, that would be quite funny. ![]()

Maybe the Ukrainians were speaking of this, calling it “raw earth” cos it kinda is, and rhymes with rare earth. Certainly Donald couldn’t differentiate between the two terms.

Forecasts from 5200-6500 S&P500 close for 2025: Wall Street starts to rethink lofty S&P 500 forecasts for 2025 – BNN Bloomberg

These forecasts seem to be changing with trend … are they just using trend lines on excel ![]()

Of course the market crashes after I invested my bonus again lol. Already down -20% on my UPRO positions I bought.

We’ll revisit it next year: What is your investment strategy for 2025? - #3 by Mirager

Not yet at my first buy signal though, “it’s turtles all the way down, son” (as an Indian, I do hope you’ll appreciate it!).

It’s nonetheless a great price you got when comparing to the last two to three years but it might take a little longer to recover. Buying down on margin might be an option too.

Now even Trump said “we need to have long term view on stocks. China have a view of 100 years . We have a view for a quarter”

Not sure what to make of this. But seems like

Short term pain in stocks & maybe even a recession to come for the larger good of society over long term

I guess you know you can do a lot worse than a real 3x leverage if there’s daily volatility (e.g. if we have a sequence of mini crashes that recover).

Hey! I thought you were going to warn us before the big one!