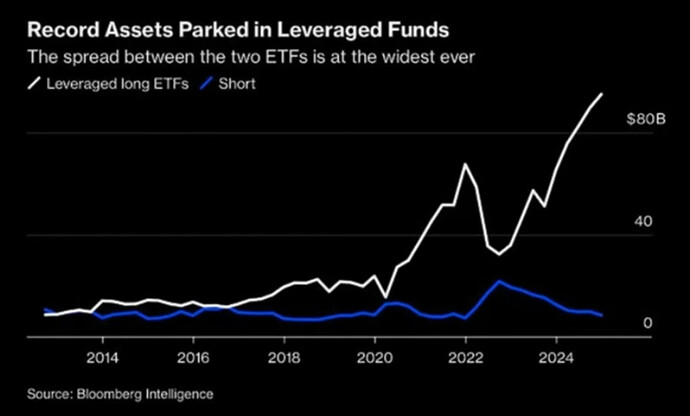

Isn’t this insane?

Eh, greed. I’m genuinely curious if some sort of political intervention may take place to revert a crash, even in a Victorian-level capitalist society like the US, knowing how many peoples’ pensions may be decimated in the event of a 2000 or 2008 crash makes me wonder if JPow, Super Mario (actually Lagarde) and Co may pull out all the stops to prevent it from happening or reverse it like it happened with covid.

CHDVD up, VTI down.

hmmm

Just pre-empting! I’m tracking 5% drops myself and not moving before 10% ![]()

Put 20k USD into VTI and UPRO yesterday. Feeling fine now. Overall leverage of ETF portfolio at 1.33x ![]()

What is this chart showing?

Bracing for the Cortana effect.

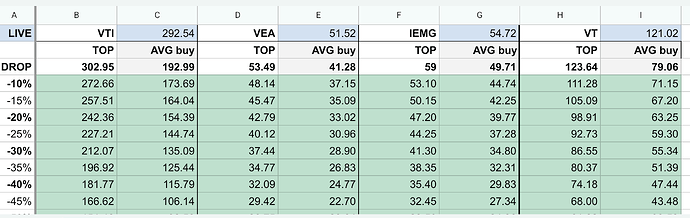

The -X% thresholds hit will/would turn corresponding cells red. ![]()

(Relative to ATH and my own avg price)

((Some ATH might not be fully up to date))

It‘s coming.

You bloody clockwork ![]()

And this time even nicely prenoticed months ago, yet we all hoping it must be coincidence every time anew.

Good man, can you time it so that the bottom is in June? Just to align with my saving plan please.

Seriously though, why do you lever up and all in US right now, doesn’t seem prudent.

More seriously, I expected nVidia’s earnings effect, we’ve seen the same what, three times in a row already?

Anyway we’re back where we were a month ago.

You guys should just buy the 3x leveraged inverse SP500 when I‘m buying in big chunks lol.

Did you say you were going to put 200k in March/April?

I think I might just sell everything just before then!

White House must be very upset with how the market is reacting to the policy and positioning of policies

S&P flat for the year and given up all the gains

Nasdaq negative

Bitcoin 25% down vs ATH

MSTR 50% down vs ATH

This fills me with joy ![]()

Just realized Bitcoin volatility is consistently even above UPRO (3x levered S&P 500): https://testfol.io/analysis?s=cB2Xa61bwxR

Puts things into perspective (though the returns have been so good the sharpe is actually great)

Did anyone ever check whether there is a correlation between sentiment on Mustachian Post Forum and subsequent market development? Many people try to do it for Twitter & co., with mixed success, but maybe there is less noise and more relevant Swiss bias in the data here. ![]()

On a superficial level, check frequency of posts about “moving money to Gold”, “fixed income strategies” or “safe-custody of equity” vs. posts promoting “Leverage”, “Loan” & co.

I know there are plenty of people with CS background reading here, so if you need inspiration for your next pet project, here you go. And please share the results with us ![]()