I am sorry sorry to disappoint you, but

@dbu if you’re waiting with bated breath to plug the “Here we go” joker meme, please make it meaningful this time, make it count you know, say you can only use it once per year or something ![]()

i understand that this is not the point, but one should also consider the absolute value of EU banks vs Mag7. EU banks probably have total market cap of < 1T based on Europe: largest banks by market cap 2024 | Statista, vs >10T for Mag7

So 1. actual value creation from mag7 is much higher than EU banks, and 2. if you had tilted towards EU banks to capture this growth, you would have needed a much bigger deviation from a market cap based portfolio to have gotten a meaningful gain than for the mag7

I think the point of the chart was not to tilt anything.

It was to show Mag7 underperformed EU banks for last 12 months. And if that chart is right then how would market cap matter. ?

How did you read my mind! ![]()

I have a pretty sticky memory, my friends call me to settle argument about what happened in 2001, that night when Maria kissed Johnny etc, I’m like their wikipedia ![]()

Yeah will see when markets open, but right now market participants don’t seem to believe that tariffs will be either implemented or stay long term.

That’s my default view too. Best case, all sides hike tariffs then make a deal to cut tariffs and implement some BS that allows Trump to claim a win and then the whole thing moves to the next one (tariffs against EU?).

However, the mood I’m sensing from the Canadians is that nobody is in the mood to entertain Trump’s BS.

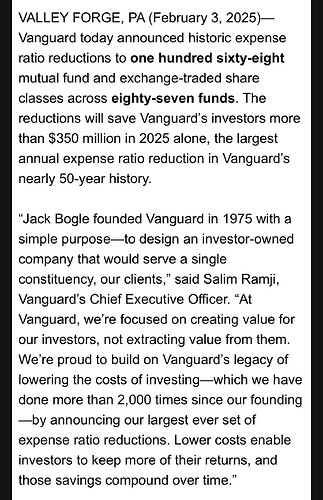

Everything is red today, even Vanguard fees! ![]()

Vanguard further cuts their fees: Vanguard funds with reduced fees for selected share classes

E.g.

- VXUS from 0.08% to 0.05%

- VT from 0.07% to 0.06%

Yay!

Now we will all become rich much faster!

Maybe not much but faster yes ![]()

Example calculation:

Start with 100k, monthly investment of 2k, yearly gain 5% (for simplicity constant 5%, no ups/downs).

20 years later it looks like this:

End amount with TER 0.07: $1,069,951

End amount with TER 0.06: $1,071,414

Difference: $1,462.98

Percentage improvement: 0.137%

Or in other words, Vanguard gifted everyone an iPhone or 5x Android Phones today ![]()

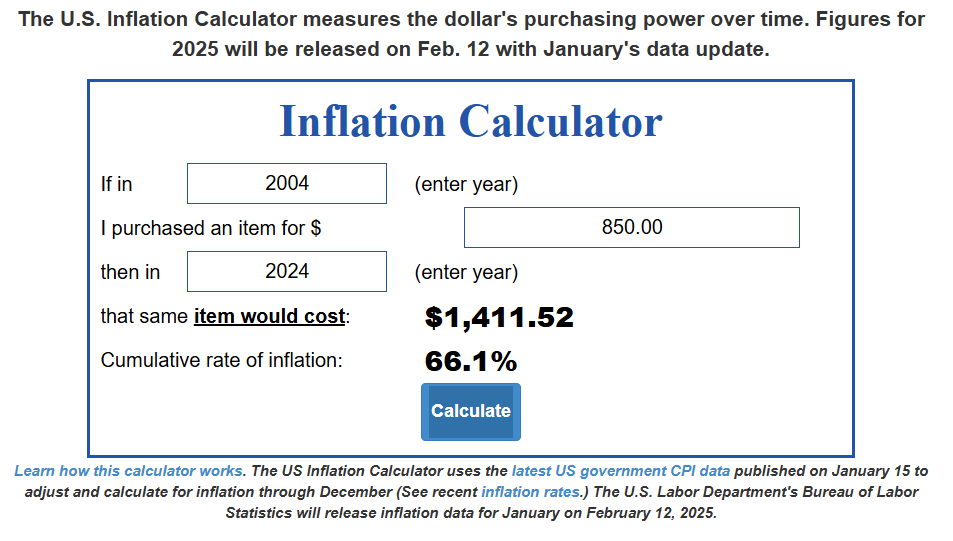

Nope. In 20 years the price of a smartphone must be corrected for inflation. You get $1462.98 savings in 2045 dollars. In the current dollars it is waaaay less.

But nonetheless it is pleasant. It is surely better than nothing! But in a grand scheme of things it is negligeable.

Tariffs for Mexico already on hold for 1 month ![]()

If you assume same inflation rate the next 20 years as the last 20 years, you could still buy your iPhone in 2045 that costs today ~850$ ![]()

But yeah, its not a huge deal.

It’s all wrong! You’ll get paid to use a smartphone in 2045 ![]()

This 1 bps cut feels really gimmicky, as I want to have a part of my portfolio in UCITS: Vanguard has FTSE Developed at 12 bps and FTSE Emerging at 22 bps. And no Small Caps.

Hey, Vanguard, would you do something in the UCITS land? Will you continue lagging all large asset managers there, even Credit Agricole better known as Amundi? It’s a shame.

These 20 cents per day really do add up after 20 years don’t they?

Not to a cheapsk… meant “mustachian”. These are real serious considerations. Life choices are made over basis points.

Much as I like Bogle, Vanguard feels behind the curve in some aspects, whereas Blackrock seems more up to date. That said, google translate and the LLMs could translate all their documents, KIDS etc and get us UCITS versions to their US-only ETFs.

Pennies to you, USD 350M to Vanguard.

I applaud them for doing this. Nobody forced them to.

Also, in the words of Eric Balchunas (highlighting mine):

Vanguard just did the biggest fee cut ever across 87 MFs and ETFs. This is why the Terrordome is the Terrordome. Vanguard created it, and now everyone else (except for private equity and a handful of HFs) has to live in it.

(Source)

It’s not about translations. UCITS requires KIDs to include forward-looking performance scenarios while the SEC prohibits or at least heavily restricts funds from including forward-looking statements in their documentation (as they can be misleading). This means that it is practically impossible to have a US-domiciled UCITS fund. I’m not familiar with the details but that’s my rough understanding.

A few years ago I read about an EU motion that wants to fix this incompatibility. I don’t know whether that might still happen or whether it was abandoned.