I like the word κραχ.

Note: κραχ inherently has αlpha.

I bet you do! Your username is π. You might be Greek and we have no clue about that ![]()

In addition most Pharma stocks are up today. Pfizer struck some deal with US government and it seems there is an example of how to avoid the wrath of White House .

As usual these days - a speech at White House praising President, some sort of optical victory and fake investment promises - seems to do the trick

Helps to gloss over today‘s rather bad labour market data and the US government shutdown.

whatever happens, buy stocks.

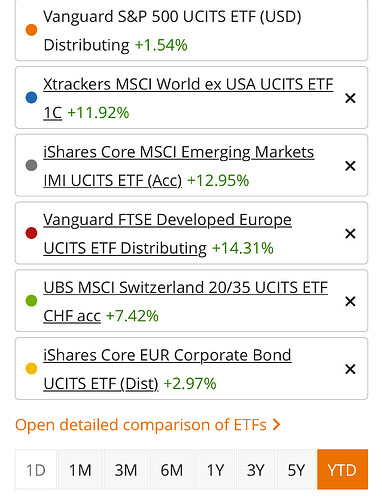

2025 so far has been interesting with US stocks underperforming rest of the world and even Euro corporate bonds.

What‘s your view for the full year? Will the fortunes change?

All numbers below are in Euro (dividend reinvested)

Don’t have an opinion re the fortunes, an overall opinion is that people speculating and chasing performance (ie momentum), and buying the news appears to work in the short term, look at Rheinmetall.

It’s an obvious thought, not just in hindsight, that (European) arms manufacturing would explode (edit: poor choice of word, no joke intended) since the invasion of Ukraine, became even more obvious after Trump won. It’s a self-fulfilling prophecy which also held true for nVidia since ChatGPT launched. More broadly, it’s momentum carrying what’s a very wonky year but at the same time it doesn’t at all mean great money cannot be made. Whatever happens seems to always reaffirm “time in the market”.

Edit: here’s a feel for the future: value’s time will come.

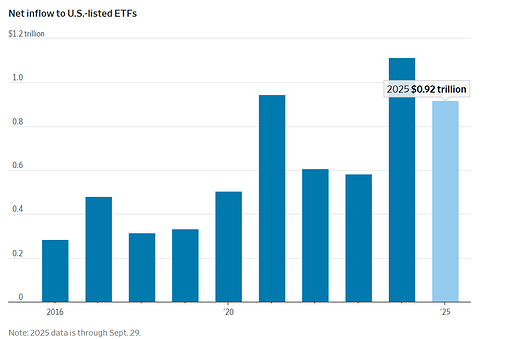

The Journal:

“U.S.-listed ETFs have taken in a net $917 billion through Sept. 29, according to FactSet. If that pace holds during the fourth quarter, when inflows tend to pick up, it will be the market’s second straight record year. In 2024, ETFs added $1.1 trillion.”

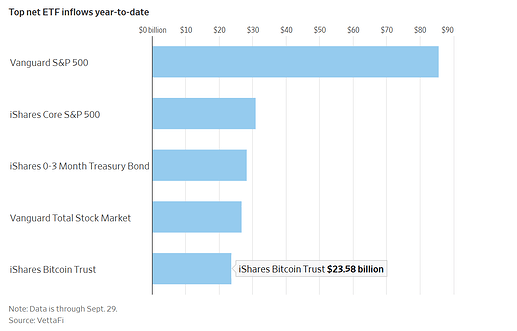

This forum’s favorite ETF took in only slighty more that the iShares Bitcoin Trust but not as much as short dated treasuries.

Looks like VTI rather than VT to me. It’d be interesting to know how ETFs exposed to “international” stocks have done.

That‘s not even VT, that‘s VTI, an US only fund.

VT is total world stock market.

For americans total stock market = US only, for some reason.

E: ah @Wolverine beat me to it haha

I mean, what good is “the rest of the world” for? Compiling actual job and inflation data all of the time instead of not doing so because of a government shutdown (and because they’re bad)? ![]()

Their total is different from our total.

The main point was the Relentless Bid but I understand you’re all passionate about the particular flavor of your ETF(s).

![]()

Indeed.

Anecdotally speaking, my VXUS position even outperformed my stock picked portfolio, but in the grand scheme of things it still does not seem to matter much?

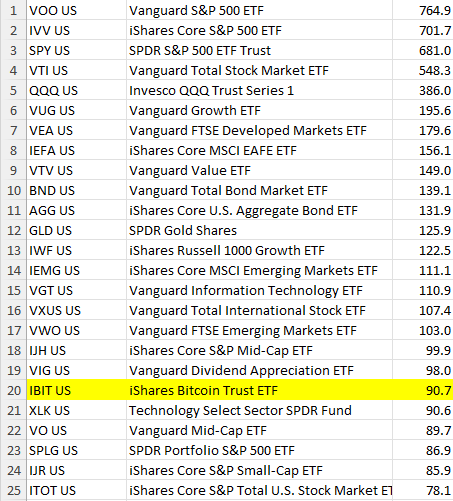

At least EAFE made the top 10 in AUM.

List as of yesterday IIUC. Numbers indicate billions in AUM.

(Source)

Redacted comments about trying to find VT on this list.

68B?!

After violently stirring a stick in the hornets’ nest, Goofy shows himself out of this topic.

Indeed, crazy. Or maybe not … ?

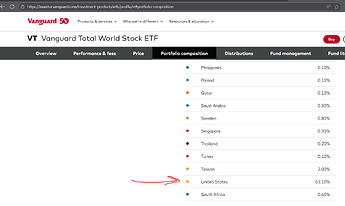

And the US is not even at 2/3 of the total VT market cap.

Taiwan is at 2%, Japan is at 5.7%, the UK is at 3.4% and China is at 3.4%.

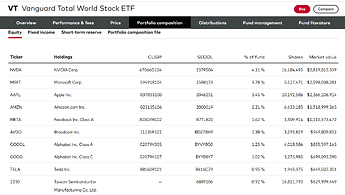

At least things look mostly balanced when inspecting individual holdings, right?

A mere fifth – 20.69% of VT – is in the top ten holdings (which contains one “international” holding, wow), out of another 10k holdings or so.

For Non-Americans total stock market seems to be US mostly, for some reason.

Sorry, could not resist.

![]()

By weight for sure. There are however another ~10‘000 stocks existing outside the US‘ ~4000 ![]()

Yes, because the top ten are solely producing, sourcing and selling in the US.

Well it’s mainly because of free float and what’s listed. So yeah for free float basis world is 60% in US for now

“OpenAI spent more on marketing and equity options for its employees than it made in revenue in the first half of 2025.”

From the FT Alphaville:

Isn’t one reason that the stock price went up so much? (And grants are typically over 4y)