Late reply. I think both Wise and Revolut explicitly don’t work. Money can only be transferred to IB from a bank account in your name (due to anti money laundering regulations I believe). Does either Revolut or (Transfer)Wise supply you with in this case a German (or perhaps other European) IBAN account in your name in order to transfer to IB. (As well as allowing the transfer to Revolut/Wise from a Swiss IBAN to a Swiss IBAN of theirs.)

Indeed they do if you create an account.

Great! Thank you I will check them out. (It might be stupid to obsess over this but I prefer transparent fees over the vague and unpredictable banking fees that traditional banks have for international transfers.)

Well I tried Revolut and they don’t provide you a Swiss CHF unless you are a Swiss resident (Maybe they do for Swiss residents? Is the Euro account Swiss in that case too?). They will give you a Lithuanian CHF account. So that is useless.

I guess I can test TransferWise too. But my hopes are not good. Also with TransferWise do you really get a European Iban in your name? I used them before and I they only transferred money directly, which IB would not allow.

Does anyone have a working (tested) setup for transferring CHF from a Swiss IBAN account (UBS) to IB (Europe, german IBAN for CHF) that avoids unpredictable international transfer fees for people residing in Europe?

Does any fintech over a suitable solution?

(I know this site is Swiss based but there must be more people who moved abroad but still have CHF funds.)

As I wrote a week ago somewhere else, the transfer is - to my understanding - “unsupported” by Wise’s acceptable use policy.

Wis’s borderless account provides you with multiple personal IBAN (in your name) in different European countries - notably not Switzerland / for CHF.

Generally your best bet would be a Swiss domestic transfer. IBKR do provide Swiss bank transfer details, at least to Swiss customers.

Otherwise you might check this older thread. Maybe you can get away by making a BEN transfer - but still somewhat “unpredictable” IMO.

Transferring CHF to IB from a Revolut or UBS account works for me without problems.

As I said in the first post, IBKR does not offer Swiss bank transfer details unless you are residing in Switzerland. Otherwise I would of course have gone that route (as was my initial attempt).

Did you put a Swiss residence in Revolut? (I, perhaps stupidly, honestly put my French residence, although I don’t remember them asking for proof of residency.) It does not allow me to transfer to a Swiss Iban number, only a Lithuanian one. Meaning I would be subject to the very international transfer fees that I am trying to avoid.

In my case IB gives me a UK (Citibank) CHF IBAN account (starts with CH20) and there are 0 transfer fees. Does not work with you?

Also cant you just use the standard IBAN that all the posters here have? I suspect it’s the same and it will get routed to your account as long as the account ID is included.

Sorry, I admit to not reading the whole thread but I assumed so (and was speaking more generally).

Residence with a broker isn’t a choice that you just “put” somehow. It should reflect your actual place of residence, unless you want to risk opening a can of worms.

It might be worth a try. The question however is if the account works across “all” IBKR entities - something that I’d have at least some doubts about.

Legally IBKR isn’t always the same IBKR but instead multiple entities. As I understand, Kvothe’s IBKR account has - based on his residence - been (re)assigned to one of their EU entities - which might not work with the same Citibank CHF IBAN.

Think about it: The moment you’re transferring funds to IBKR’s account, they are “responsible”. Not only contractually buy probably also required by applicable law. So it makes sense that account can’t accept funds for multiple entities.

As an example, IBCE (Hungary) don’t seem to accept CHF deposits at all.

Which IBKR entity are you with?

I would not risk transfering to any IBAN not directly provided to me by IBKR, moreover I suspect it would not make it there for the reasons explained by San Francisco.

Also I agree that residency for a broker should reflect your official residency (as defined by tax laws). If I had known the trouble though I would have set things up before moving or used my Swiss address for a few more days so that I could have invested most of my savings.

As for which IBKR entity, is there an easy way to see it? I put my residency to be in France and I believe I therefore use the only entity I am allowed to use from there. But I don’t know whether it is French or another European one. (The site is still www.interactivebrokers.co.uk)

Bank account title: Interactive Brokers Central Europe Zrt

And it does allow CHF transfer in my case, but to a German bank.

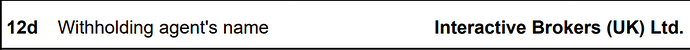

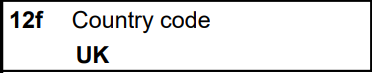

Have a look at the official tax reports from IB, the legal entity should be clearly stated on those.

e.g on my 1042-S form:

I think the account statements (such as activity statement) do contain it, don’t they?

Hungary.

One question for swiss resident, does IBKR provide you a CHF IBAN ?

Because, they provide me an IBAN from Credit Suisse and not from Citibank, so I was assuming that they changed their deposit bank for swiss investor… But maybe this is only for new customers ?

I just created a new recurring transfer at IBKR, though I did chose saved sending institution details (Neon). For me the instruction received is still the Citibank London IBAN for Interactive Brokers LLC, Greenwich CT (USA).

Let’s see if I can increase my monthly inpayment by 50 CHF without going broke.

Side note: When entering recipient details, Neon don’t allow choosing the U.S. - though they do offer Serbia, Pakistan and the Syrian Arab Republic, among others.

Ok, it seems to be their new custodian (?) bank for their news customers.

For the moment it works perfectly and I don’t why but I feel more confident sending my money to a swiss bank (sometimes my brain is a bit irrational).

Yes, they do for me.

The funny part: a few years ago IB was not providing a CHXXXXX IBAN. Some colleague at work figured out they were nonetheless clearing on SIC (so swiss banks could clear directly and consider it as domestic) and reverse engineered the IBAN.

This became a known “trick” (tho you do need a leap of faith sending large amount of money to the non advertised IBAN ![]() ).

).

A few months later I think people contacted IB support, they were confused for a while and then said this was a new account and they’ll use that IBAN going forward (it’s still unclear to me if it was really new or if they realized they should advertise this IBAN).

That was an amazing hacking/reverse engineering demonstration. (That person might be/have been on this forum, if they recognize themself, kudos again!)

Another “funny” part:

Isn’t there one Swiss bank (Migros Bank?) that nonetheless insists (and not wrongly, technically) it’s a cross-border transfer and charge accordingly?