It is as insane as your revenue. Saying 10k expenses per month is not insane is the reality of just the top earners of this forum.

Well, it depends how you look at it. If you deduct childcare from a 10k budget, that gives you a budget of 4k per month. Would you call that insane? The reality for single parent/dual income families is that childcare is not optional if you have no family support.

6k monthly would be for three children at 100% external care?

I wish! 3 kids at 100% would be around 7.5k.

6k is for 2 kids at 100% (just over 5k). plus a bit extra for a third kid (part time).

At this point, wouldn’t it be cheaper to hire a nanny that takes care of your kids at home?

A friend of mine has a nanny for 5k taking care of the kids 100%.

They are out of the social circles then though.

Maybe, but the saving is marginal and you have to consider:

- Nannies getting sick, whereas daycare have adequate cover/backup. Or if they decide to move on, then you have to scrable for an alternative

- Socialization and friends, learning to interact with other kids (and adults!)

- Learning the local language

Plus the costs decrease over time. Eldest is now out of TAGI (though costs of sports and other activities eat up those savings). Middle one is now reduced now that he started Kindergarten so we’re now down to 3.5k a month. Hopefully in 2 years it will be down to 2k once the youngest is in KG.

This forum went down the rabbit hole of commenting on other people’s parenting decisions before and the role of women and it was agreed not to discuss non FIRE matters

Ok, I suggest to just stop discussion of family arrangements.

Checking in, now exactly one year in „overtime“ from the 36 months runway we had laid out

Still working, taking a few months at a time, but now off autopilot mode and preparing to land the jumbo

We saw a 25 pct net worth increase in the past 12 months, landing us at 7.8M, up from 6.2M. Way past FIRE goal post of 5M. Market has been kind to us and we count our blessings

Snowball effect is real

Impressive! Well done! ![]()

Still planning to lift the anchor and travel around or that changed in the meantime?

Thanks. Indeed still the plan to travel, which also has made forecasted retirement spend a big challenge. My approach is to budget from todays spend level (with extremely high Swiss COL), and assume this will be same/lower during travel (mix of COL areas)

If we‘d overspend 50k for a year travelling we should still be ok though

Travel or relocate continously?

I tried to calculate how much will it cost to me to travel and I see that I still have to pay the big majority of my expenses in CH (housing and health insurance) so traveling for 6 months means that I might save on groceries, hobbies and fun, which is less than the cost that I’d have to pay for a 2nd rent.

You all probably think of leaving your swiss home, right?

We will leave Basel and Switzerland behind, probably for good, and get a new/cheaper base to travel from

Indeed doing extensive long term travel from Swiss base is super expensive - and issue for permit holders too. Plus, impractical as we still get a lot of snail mail which needs handling, other countries are much further with electronic handling which facilitates life on the road

which country do you plan on relocating to for travel and after that for the long term? i guess you could also tie the temporary travel base with tax planning for the withdrawal of your pension funds too (if you plan on doing that).

My parents paid for my first year of university, accomodation and expenses (luckily education itself was free). After that I took no more of their money but I didn’t work: instead I took debt instead to pay for my education and also 1 year after work (choosing to debt fund my lifestyle until my salary caught up).

It was probably not the most financially responsible thing to do, but in retrospect it was the right decision: it allowed me to stand on my own 2 feet while not compromising lifestyle at all. If anything, ‘future me’ would like to have contributed even more to ‘past me’.

For my kids, I plan to pay for their whole cost of education including a small allowance. It’s hard to find the right balance between being supportive and allowing them to find their own feet and being independent.

@PhilMongoose That’s true — if they decide to pursue third-level education. But it’s probably wise to plan for it either way. How are you preparing for it?

We’re expecting our first child this year, and I’ve been thinking of setting aside a lump sum into an index fund, then contributing a small monthly amount until they turn 18. Let compound interest do most of the heavy lifting.

During my own college years, I worked part-time — tutoring, working in bookshops, and doing some web development for local businesses — mostly to fund my lifestyle. My parents helped cover some education costs, including a year abroad, but I mostly lived at home, and tuition itself was free.

I do think it was valuable to earn my own spending money — for trips, computers, etc. It taught me a lot. But I agree, it’s a tricky balance to strike!

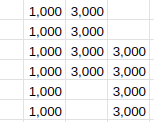

No special plans. There are just extra columns in my spreadsheet (one per child) where I budget 3k per month for 4 years:

The only thing I did extra was to buy life assurance which pays out a lump sum if I die to ensure that kids are financially secure.

And just to show the best laid plans can get de-railed. Originally I was looking to reduce down to 2k this year and then eliminate in a few years when the kids are more self-sufficient. However, we may now put kids into private school which instead increases cost to 4k and extends it for more years.

My advice to you is to do all the stuff you want to do now. Travel, go to restaurants, do every activity you want, splurge, heck go on extra holidays. Because after the kids arrive you have very little time do do this stuff and very little energy.

I basically had no life at all since kids arrived (just work and kids stuff). I enjoy it, but it is a very different life.

@PhilMongoose can you share details of this life insurance, for e.g., amount assured, tenure, annual premium and the insurance company? Thanks.

As PhilMongoose revived the old thread let me then give the 5 year update, so 2 years after the orginal FIRE date (5M target NW)

NW is now 9.3M CHF, up from 7.8M 12 months ago so +19.2%. It has not fully recovered from the high water mark in February, but this is really due to the high CHF currency. If I compare NW increase in USD it is +30% (which is relevant as I plan to travel/ live outside CH/EU). As written in another thread, this lands us now at 1.8% withdrawal rate before any social security would kick in (I know, we spend an insane amount of money, not very mustacian)