speaking of bonds, here is an interesting pdf

It’s a presentation, but I think is sufficiently clear. Unfortunately there isn’t any link to more explanations and it’s not clear to me what happens if they substitute all bonds with just cash.

The only interesting products I found out (after trying to buy single bonds but finding it too difficult) are US bond ETFs with expiration date to build a bond ladder https://www.ishares.com/us/strategies/ibonds so to reduce the rising rate risks. In Europe and CH as usual there is nothing like it yet available

I am currently reading “The millionnaire expat” from Andrew Hallam. The author gives a couple of 3 ETFs Portfolio ideas you should/could build according to where you would like to retire. I am summarizing but the recipe is mostly the same for each nationality, just like the one mentioned in the blog:

-> one part in bonds according to your risk profile and also on whether you will get some retirement money in the country where you expect to retire.

-> the rest in stocks with 50% all world and 50% from the stock index where you expect to retire

I personally have no idea at this point since my partner is Canadian and I am French, therefore it is very open at the moment.

In the book for people in my case, who don´t know where they will retire, he suggests the global nomad portfolio which consists of 2 ETFs only:

-> ishares MSCI world

-> ishares global Inflation linked Govt bond UCITS (IGIL)

I really like this portfolio since it is simple, but at this stage I have the following questions:

-> Is there a big currency risk should we decide to stay in Switzerland? The ETFs are global and I plan to make regular purchase in the next 30 years.

-> The author suggests IGIL which is inflation linked. This one contains 30% UK bonds which I am not too happy with (not really global) but performed quite well recently (yes I know, it should not be a reason to buy  ) Therefore I am also considering to simply go with IGLO (ishares global Government bond). Do you know what would be the best option to consider between both? A mix of the two? Or it just makes no sense to accumulate any bond at the moment and I have to wait for yields to be higher?

) Therefore I am also considering to simply go with IGLO (ishares global Government bond). Do you know what would be the best option to consider between both? A mix of the two? Or it just makes no sense to accumulate any bond at the moment and I have to wait for yields to be higher?

I know I have to take into account 2nd pillar and 3rdpillar and cash as bonds but somehow it does not really work with me. It probably sound stupid but I would like to have a reference point when I make purchases for the rebalancing.

so what do you do with your stocks in pillar3? are you telling me you are full cash in pillar 3a and wnats to ignore this to have an asset allocation only for taxed accounts?

That doesn’t really make any sense and can be very risky, you could end up with a total asset allocation very growth averse (lots of cash), also very risky because then you cannot FIRE.

Since I have pillar 3a with VIAC you can easily rebalance by changing your strategy. Also it makes a lot of sense to include them in your strategy.

Not sure I get fully your comment. Actually I have started with VIAC this year which is my first full equity 3rd pillar. I opened 4 portfolio since I have a 5th one with approx 36k full in cash (opened when I arrived in Switzerland and no clue about investing). I do consider the other 4 for equity allocation.

As far as the 5th one is concerned I havent decided what to do since I may need it for home purchase. Any view on my other questions regarding bonds ETFs?

Hi,

Could someone explain a little about inflation linked ETFs ? Is it really something to look for ?

Thanks

An interesting article (in Polish, so use Google Translator if interested) about investing in bonds with a passive portfolio.

Surely you’ve read before how having bonds in together with stocks “smoothens the ride”. But this article provides correlation coefficients of certain stocks and bonds.

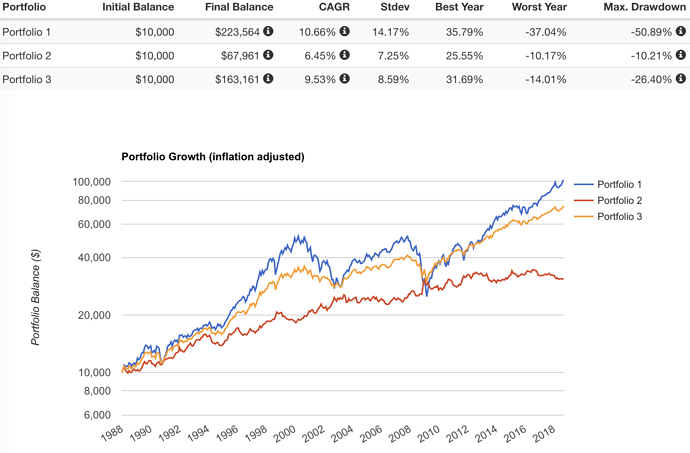

And so, backtested over the last 40 years (1978-2018), apparently the best bond ETF to accompany VTI (US Stock Market) was TLT (iShares 20+ Year Treasury Bond). VTI on its own has delivered CAGR of 11.7% with StdDev of 15.0%, and 60% VTI 40% TLT delivered CAGR of 10.9% with StdDev of 10.3%. That’s only 0.8% lower return by 5% lower volatility. The maximum drawdown went down from 50% to 26%.

I wonder, do you think this strategy has a chance to work in the future? When I’m close to retirement, I would really consider keeping 20-40% out of the stock market in order to combat volatility. The question is: are bonds still a sane choice, or should we just stick with CHF. When you look at TLT returns, it has been growing in the past, but the last few years it’s just flat. But maybe when the next crisis comes, the investors will jump on US treasuries once more?

they cherry picked the time frame too well, end of 70s was when interest rates peaked at double digits

Yup there has been a super long bull markets for bonds since the beginning of the eighties.

With current interest rates so low and debt levels so high, I would be surprised if bonds really perform better than stocks in the next crisis…

EDIT: I just looked at the factsheet of TLT: the duration of the fund is 17.31 years. In other terms, if interest rates go 1% higher, the fund loses 17.31% in asset value (and the other way around if rates go lower). Well, I don’t want to play nor forecast the next direction of interest rates, but with current low rates, a hike would really hurt…

OK fine, I’ve excluded the 80s and have redone the same calculation from 1988 to 2018 (30 years).

What I wrote above still stands: a little lower returns at much lower volatility.

It’s amazing that 10-year treasuries have had a CAGR of 6.45% (3.77% adjusted for inflation). But you can also see that this decade their return (after inflation) has been practically flat = equal to holding a non-inflating currency (CHF?).

It’s also nice to notice that the stock+bond mix (yellow) has been underperforming stocks twice, and during the crisis the stocks twice went down and met with stock+bond at the bottom. Now is the third time. Will they meet again after the next crash?

Last time the blue n red line went down they even met the 100% bond line… That would be -75%

I’m just learning about bonds – bogleheads recommended to include bonds in your portfolio to reduce volatility and risk (since they are uncorrelated with stocks/ETFs) and this recommendation is what motivated me to learn more about bonds and to consider including them in my portfolio.

From this tread I understand that:

(1)bonds may not be a good choice in combination with ETFs to serve to reduce volatility since bonds (outside the CH) are subject to FX fluctuations, making the bond value unstable;

(2)CHF dominated bonds have poor yield (negative or far below 1%) and therefore not worth to invest in;

(3) On the other hand cash can’t keep up with inflation, so cash may not be a superior alternative to bonds.

(Please correct me if my understanding is incorrect)

So what is the final conclusion; are bonds are good or not to include in your portfolio?

If bonds are good which bonds do you recommend to invest in? (being in my 30’s I would have considered having 20-30% invested in bonds based on bogleheads recommendation of having the amount of bonds equal to your age)

If bonds are not good, what is the best alternative can I use to reduce volatility in my portfolio (which will have ETFs)?

Thanks.

continued…If bonds are not good, then would money-market be a good alternative to bonds to reduce volatility?

When you read Bogleheads then probably you’re getting the American perspective. US inflation has been around 2-3% per year, whereas inflation in Switzerland has been between -1% and 1%. So maybe the USD bonds get some nominal return, but real return (taking inflation into account) is also near zero.

Hi @Bojack yes I fully agree (those were my thoughts exactly - bonds are not good because the inflation is near zero in CH). Would there be any alternative to bonds, which is uncorrelated with stocks/ETF, which I could add to my portfolio to reduce volatility? (I read somewhere on the forum someone suggesting ‘money market’ but I have no clue about ‘money market’ investment)

Cash. If you want more return, increase the stock allocation

Um, no, I wouldn’t say that. I only said that you should not just compare nominal returns of currencies without taking inflation/xrate into account.

Bonds pay shit interest, because interest rates are low, so credit is cheap, and bonds are a loan. And central banks have been printing a lot of money and have been buying bonds, allowing bond issuers (treasury & corporate) to offer very low interest and still finding a buyer.

I’m sure you know money market. These are time deposits, call deposits, savings accounts. You can put money on a time deposit for a year, and the bank will pay you. Some years ago in Poland it was not uncommon to get 5% per year. But that was because of higher interest rate and inflation. In Switzerland a typical savings account currently pays sth like 0.5%, I guess. Money market typically barely covers inflation, if at all.

Thanks @Bojack for clearing up all my misunderstandings

Burton Malkiel suggest in last edition of his classic “Random Walk Down Wall Street” that high-dividend stocks are an option for substitute a bond allocation.

My personal strategy is the one of MMM:

" Every Financial Advisor (even Betterment!) Seems to Suggest Lots Of Bonds, – Why Does MMM Only Hold Stocks?

The quick answer is that stocks earn more money on average, especially right now in 2018 with bond yields so low. Sure, stocks are more volatile, but volatility only bothers fearful people who look at the stock market every day and fret when it jumps around. As a Mustachian, you don’t do this. Lower stock prices are simply a temporary sale on stocks."

Thanks @1000000CHF, and thanks @Grog.

Actually my initial plan was to invest in stocks only, but after researching some of the bogleheads stuff, I learned about how bonds are uncorrelated with stocks, and the advantages of having both in your portfolio - this was my only reason for considering to buy bonds. Sure, buying more stocks will increase return, but they will not reduce risk (like bonds would do due to the bonds being uncorrelated with stocks/ETFs).

If I understand correctly to reduce risk in a portfolio which consists of stocks/ETFs we need to include something which is uncorrelated with stocks/ETFs. Maybe if I should have rephrase the question as “what, other than bonds, would be considered to be uncorrelated with stocks/ETFs?”.

In any case, based on all the great advice which I received/read on this forum, I have decided not to invest in any bonds for the moment.