As long as you are accumulating (only buying), there are anyway no gains to tax…

I was also interested in automating the buying and rebalancing, even if I still have to be in front of the computer to log in for the API. I was a bit surprised not to find some code to do this sort of thing already, though, at least a starting point. Has anybody seen/done this sort of thing?

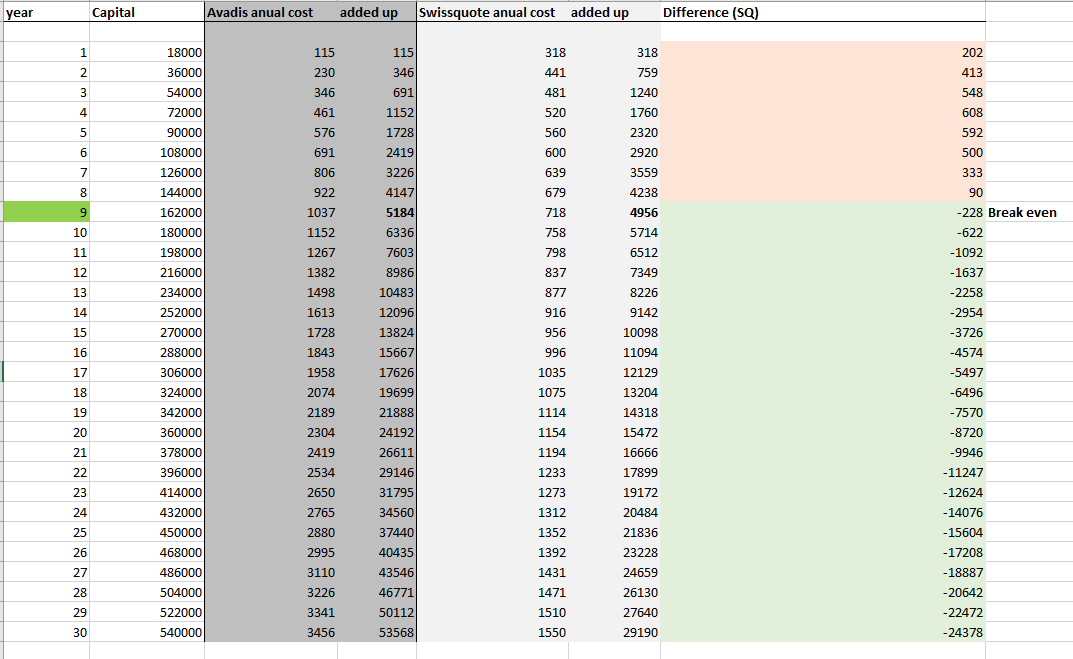

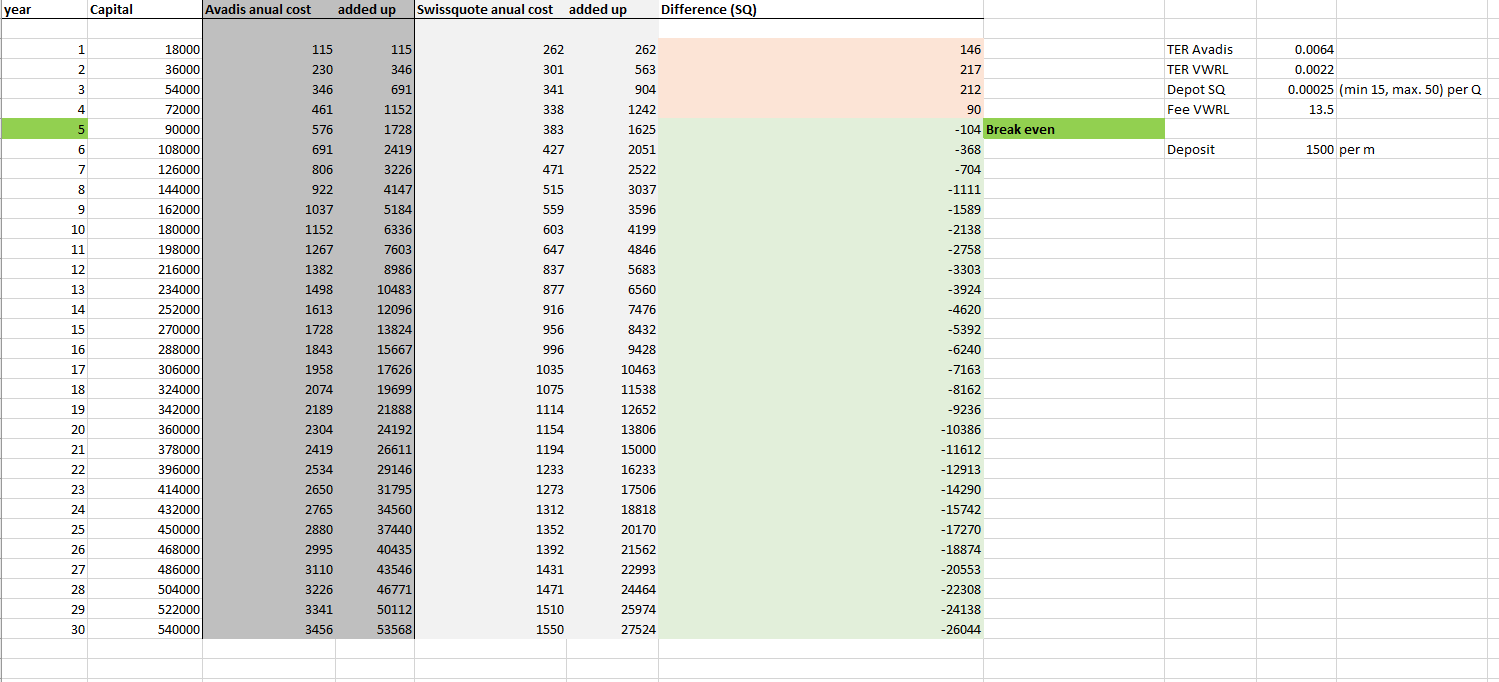

As a avadis user I considered switching to Swissquote after seeing the math here.

But before I wanted to do my own calculations, based on the following:

Investing amount monthly: 1500 CHF

Avadis:

Strategie Aktien 100%

TER: 0.64%

Transaction: 0

Depot fee: 0

Swissquote:

Only buying VWRL

TER: 0.22%

Transaction: 13.25 CHF

Depot fee: 116.25 CHF first year, every other 200 CHF

Regarding my calculations break even is after 9 years.

Of course, provided that they have a similar performance and cost structure doesn’t change.

Probably the two products are not absolutely comparable but it’s the most similar product Avadis offers.

5y Performance: Avadis Aktien 30.58%, VWRL 27.81%

1y Performance: Avadis -1.73, VWRL - 1.98%

I know past trends are no predictor for future trends, but seems as at least in the past Avadis performed better than VWRL in good as in bad times.

Now I’m confused ![]()

At Sq

Up to depot value of 200k depot fee won’t be 200 p.a.

Isn’t VWRL an ETF which can bought flat rate Fr9? Won’t the transaction cost about Fr 10 incl tax & stamp duty?

Depot fee is 0.025% (min. 15 CHF, max. 50 CHF) per quarter according to their website.

My fault, forgot a zero. According the correction, break even is at year 5.

Indeed, VWRL is 9 CHF flat but the calculation in their demo interface is 13.25 CHF, no idea what else is included there.

At the end the difference will be 26’000 CHF only form costs.

Cost wise you cant beat an index fund. Avadis is a mix, partially actively managed (85% passive+15%active), hence the higher costs and potential higher return / lower max draw-down, low volatility. In this case 5years standard deviation is a little lower (13.38% avadis VS 14.4% vwrl).

I think they may be interesting for lower risks funds with bonds, so you pay a fee but you don’t have to rebalance the various asset class.

I can confirm that in 2018 (when I still had my SQ account) I paid for VWRL 9.85 (SQ fee) + 3.85 (stock exchange fee) = 13.7 CHF (plus stamp duty on top, ofc)

Don’t know if one or both amounts get reduced to reach 13.25