You can also use: https://trackyourdividends.com/

I use google sheets for my watchlist and as long as I manually update the dividend (once a year or more), the dividend yield is updated automaticaly as the stock price is automatically updated

Or divvydiary.com. I use both, trackyourdividends can send you an email and I like the calendar of divvydiary.

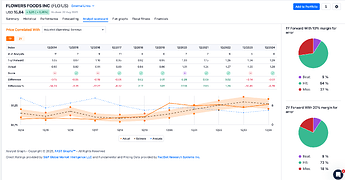

Always looking around for some interesting dividend stocks for my mechanical system. Any opinion on flowers food? That would be my target if I would need to buy something now.

They bought Simple Mills in February, but it seems the downfall has stopped since then around $15.50. Nice dividend yield of 6.25% and a little probability of a turnaround.

Opinions?

Things I like:

- 6.25% dividend

- dividend raised for 23 years

- they raised their dividend even when FCF wasn’t covering it

- Compound Dividend Growth Rate: 12,27% (20yrs)

- S&P Credit Rating: BBB

- Small Cap, not in any major index

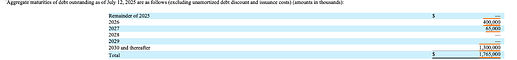

- No near term large debt maturities

- probably fairly downturn resilient as people are less likely to cut on the food they produce

Things I like less:

- LT Debt/Capital: 57%

- apparently cyclical business

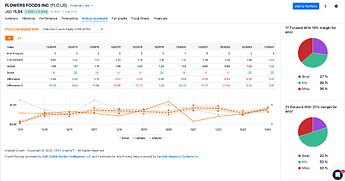

- related: they don’t provide good guidance and miss earnings fairly often

- slow growth in the past 10 years (1.42%)

- high (dividend) payout ratio

- analysts have been revising down estimates for future earnings and FCF over the past six months

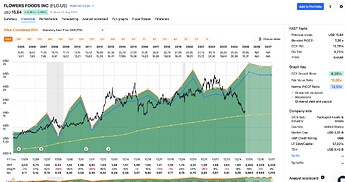

Earnings:

OCF:

FCF:

Analyst scorecard for FCF:

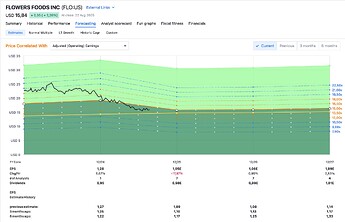

Analyst scorecard for Adjusted Operating Earnings:

Thank you very much.

That is one thing I don’t like.

But covered by FCF.

Stock lost 50% since 2023, we still have to see if the acquisition will work.

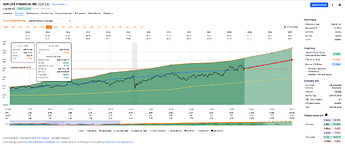

I had a couple k of CAD lying around[CAD] which I deployed into the market last week.

New position in Sun Life Financial:

Not cheap, but in line with its normal valuation.

Added to the position in Power Corp of Canada:

A tad expensive (with regard to its “normal” valuation, but should be fine in the long term.

Chickened out on adding to Magna International, mainly because I hate buying when a stock price rips on the day I want to buy:

Yeah, that’s Goofy. Wants to hold the company forever but waits for daily dips to add to the positions …

Totally makes sense, no?

I had expected as much. ![]()

Well, for FY 25 they’ll actually pay out more in dividends than their free cash flow would allow. They just raised their dividend in Q2. And just on Friday they declared their Q3 dividend (in line with the Q2 one).

Analysts expect FCF to be even lower in the next two years (but at the same time they expect the company will continue to raise the dividend).

I subscribe to the narrative that the company’s management feels confident about the business and therefore keeps raising the dividend, but what do I know.

I looked up the transcript of their most recent earnings call (August 15, no less!) and one of the analysts asks explicitly about the dividend and their payout ratio, but the CFO excels at giving a non-answer.

CAD Swissquote failed to notify me of a couple of Corporate Actions by BNS and CM IIRC for receiving shares instead of dividends which then piled up to several k CAD.

OK, here we have an interesting situation: an acquisition. The price is content of the investment cash flow but I don’t want that. We will see only later how this affects the cash flow.

So, my numbers are 210 FCF for the last 6 months and 283 for the last year, both million dollars. At first sight the acquisition did add nicely to the cash flow.

Is not completely fair, but I just don’t want takeovers to obscure FCF. I suppose it depends on what for you use FCF; I use it to decide if the company can survive and I think it can.

That is also the reason I use the raw numbers and re-calculate. Most internet pages just take over the numbers as is.

I listened to it too. I think if this was one of my favourite companies, I’d buy it based on the technicals/price action.

But it is not and I still see a lot of risk/uncertainty ahead, and would wait for things to get worse before they get better as I’d want a much bigger margin of safety before jumping in.

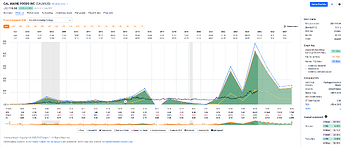

If we’re looking in the consumer defensive space, CALM looks better across all metrics. I got a bit too greedy on this and tried to get a price of $37 when I could have bought a lot more at $42. Now it is at $116 and P/FCF, ROE, ROIC are all better than FLO. But anchoring at the $42 level makes it hard for me to buy now.

Thanks @PhilMongoose

CALM looks nice, no debt, dividend yield >7%, tons of cash. And a very nice chart:

Just one thing I don’t like too much: tons of cash. I mean what for they keep almost 1.4 billion in the coffee fund. I buy this stock and they give me back my own money, $28.70 per share, in dividends. I change money from my left to my right pocket and have to pay taxes in between…

To be fair, the $28 is about what they earned in the year ($25).

You just need to utter the magic phrase “CALM?! This CALM???” to make the stock go up 500% and allow me to cash out ![]()

Egg prices have been volatile so when the price drops the share price will follow. Now that CALM is no longer family controlled, maybe they’ll be taken over. I think it is only remaining large publicly-listed egg producer in the US.

Another pick in trouble:

The same VALE we discussed in January? (Any Stockpickers out there? - #449 by Your_Full_Name)

Can’t say the FASTgraph today looks much different from January – just shite as always. ![]()

In other news, I sold some Southern, bought some more Edison International.

While I like the earnings curve of SO better, I wanted to exchange some of an overvalued Utility for some of a seemingly undervalued one for a few hundred bucks of additional income. ![]()

I manage the portfolio for my parents. Because it is not my money, I don’t do the stupid shit that I do in my own portfolio.

So it is not surprising that their portfolio has outperformed mine significantly. YTD, they are up 21% versus 8% for me. In the last 12 month, they are up 29% vs 12%.

There’s a poker saying that goes something like “It’s not enough to know how to play poker well. You have to also play poker well.” ![]()

Wow, what is in it? OK, I only have it real-time and today seems to be a down day, but:

YTD: SP500 9.67%, Dow 6.79%, Nasdaq 11.26%, Russell2000 6.08%, my dividend strategy 10.76%, my momentum strategy 11.64%. Your parents beat all of that!

![]()

I have to go off my memory, but largest positions are:

- BTI

- AEM

- Kazatomprom

Is anyone else tempted to buy Nestlé?

It’s still not cheap, but hasn’t been at its current valuation basically since the GFC.

I updated my analysis and it doesn’t look like a buy to me. If you compare the low net effect of share reduction and the huge amount they use for buybacks, then you don’t need to look where the shares are going… And now they are low on ammo if you look at the equity ratio