You mean exciting ![]() - frightning would be more around 50 USD…

- frightning would be more around 50 USD…

Yes, time for a little test of your risk tolerance.

VT is back to the level of 14 months ago. Nothing to be scared about.

Not even 15% off the ATH…

Until it’s -50% it’s just a decent little discount.

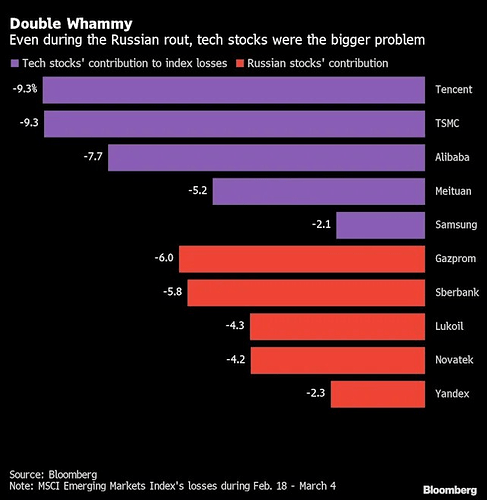

China, on the other hand, starts looking juicy. ![]()

It has ways to go much lower, do you need that money in the coming years?

Note that it could also rebound without previous notice, best to be prepared for both scenarios.

Edit:

The Evergrande’s crisis is (finally) starting to unfold in China, it’s anybody’s guess whether foreign investors will get their capital back. Who knows what will happen with chinese “stocks” in the future?

Edit2: On a related note, the Nasdaq composite has closed in bear market territory. ![]()

Spx broke today an important support.

Never looked into gold, but it sounds it could be the right time.

Fortunately no (for now).

I don’t see all of the world’s markets crashing down together to 0 due to the current environment, so this would be an occasion to buy on the cheap on the way down and the way up then.

If you go for gold, be sure to determine under which conditions you’re planning to sell it and get back into stocks (unless you plan to keep gold as part of your standard allocation from now on).

Do you believe in technical analysis?

Why? What does make it sound like it’s the right time to invest in gold now?

it’s proven that in periods of uncertainties gold performs well and you don’t have even to look into the past or in the future…just recent days

It’s not a religion…![]()

When you entered at 108 it still burn a little.

Two quotes for both topics:

Past performance is not indicative for future results.

It’s difficult to make predictions, especially about the future.

I can recommend “A Random Walk Down Wall Street” for an excellent critique of technical analysis. Technical Analysis goes against the buy and hold strategy, which most people do that invest in VT.

When everyone starts talking about investing in something, it’s too late already.

Enter at 94 then.

(More)

Don’t panic, don’t sell and keep diversified across different assets and rebalance regularly! Make sure you have a healthy cash buffer and hold gold and commodities (and maybe some bitcoin). My portfolio has lost only 6% in 2022 (beacause commodities and gold went went up nearly 20% YTD) but I expect at some point central banks will go back to print more money and then most real assets will rise again.

number of nuclear warheads during WW2 can be counted on one hand (also only available at the very end at that).

number of nuclear warheads today = 13’000

(comparing their “explosive energy” would be even more extreme)

Same here, 6.5% loss.

Almost funny that those assets that lost most value were my genius attempts at stock-picking. Only a small part of my portfolio, though.

And the technology back then was not what we have today. No thermonuclear weapons, no MIRV, etc.

Thanks for the suggestion. The idea of buy and hold definitely works, with the assumption that it always goes up.

Like BTC in 2017? ![]()

Maybe you know her:

Gold1

Because it can go down another 30% and in the meantime why not to buy something that goes up, and go back to stock in the way up?

TA could be just buy when it’s in up trend. Right now VT is in downtrend since Nov 21.

So normal people that are making a living with trading, how can do that? ![]()

I agree

![]()

And given how poorly they perform in invading their neighbours, I wouldn’t be surprised if many of their missiles would also fail…

Are there people consistently making money with trading? Normal people, of all kinds?

Yes, exactly. And in 2021.

I meant that in 2017 (20k USD) everyone said that it’s too late. Then it crashed, then it went ATH in 2021 (65k USD)