Hi all.

As the events on the east part of the Europe are worrying me, I’m quite surprised of the absence of comments or supports messages to the “new” investors like me.

I need to talk of the dégringolade of the VT ETF which is going down.

Thanks to the diversification of the portfolio the result is not that bad even I consider it as bad !

Anyone would like to share some thoughts >0 ?

πR

Well it’s our investment philosophy. Ignore the noise, stay invested.

Keep calm and keep investing ![]()

Sure, my thought right now is that I am looking forward to buying VT for hopefully still 98 USD or even less when the salary arrives instead the ATH of 109 USD we had a few weeks ago.

I agree with the sentiment expressed by others about staying invested.

Worrying too much may indicate that your asset allocation is too risky for you however. Times with small corrections like this one can be a good test to see if you’re taking on too much risk for your appetite. You can’t know what’s going to happen in the future, so the important thing is to act in a way where you can live with your decisions regardless of the short-term outcome.

Personally, I couldn’t care less about the movements of the market. Although I follow it regularly, probably due to some sort of masochism ![]() , I sleep just fine. Also, buying cheaper positions fully compensates having an ugly month in my tracking spreadsheet. Not immune to emotion though, I’ve experienced some worry in the past and expect to feel it in the future, but we’ll see.

, I sleep just fine. Also, buying cheaper positions fully compensates having an ugly month in my tracking spreadsheet. Not immune to emotion though, I’ve experienced some worry in the past and expect to feel it in the future, but we’ll see.

In any case, I encourage you to stay strong ![]()

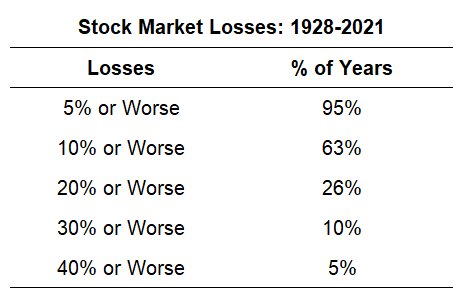

As a rule of thumb, I believe a drawback of 10% is expected about every other year, one of 20% every decade, and one of >30% once in your investment career.

Given that globally we are still having a pandemic creating supply chain issues, Europe is facing record high energy prices, many regions see a significant uptick in inflation and Russia just invaded Ukraine, I‘d say the current 10% down from ATH about four months ago is nothing.

Contrary to previous comments I suggest that you sell a significant portion of your investments tomorrow first thing when the market opens. If this is worrying you, you are in over your head, and it’s best to step back now. Watch it develop and recover, learn from it, and be hardened for the next turmoil. It won’t be the best financial decision, but the much worser one is for you to stay invested as you are, getting more and more worried and eventually panic sell all in a few months if/when we are 20% down, too scared to ever return to invest.

Myself, I keep buying, even on top of my usual monthly investment. All I see is that I get a discount at the moment ![]()

Since we‘ve had both in 2020, shouldn‘t we be safe for at least a decade?

I‘ve witnessed three such drawdowns in the last 22 years myself. And that‘s not long an investment career either (arguably, you could say I was young the first time around and didn‘t have much if anything to invest/invested - but I was definitely following stock markets back then).

Well, it’s nice to read you all.

I’m not in a “panic selling process” at all and I’m going to follow my plan: continue to invest regularly, with the possibility of buying at a good price right now… My message was only a call for feedback on the current situation, to find out “how” you see the news through the prism of investors.

Thanks for your answers guys.

First off, @314rch : you’re not alone. I guess many of us are entertaining these kinds of preocupations right now.

Then:

The question I try to ask myself is “will I enter panic selling process at some point in the future?” In which case, as stated by @1742, selling now may be the lesser bad option.

My current view (starting to get it more ingrained in myself) is:

-

Best outcome comes from buying regularly at a proper asset allocation for my risk tolerance and not selling unless I need it (with the understanding that I am not meant to need the money I have invested in the coming years, but shit happens).

-

Second best is selling early and buying back in early. It may generate “losses” (lesser results than buying and holding) but the main advantage is psychological: in a slow grind to the downside, with periods of bouncing back up, our mental resilience tends to get drained slowly: the more we go, the less of it we have to face whatever is still coming. By selling early, we get out while our mental tanks are still pretty much full, which gives us more “energy” to buy back in at a later point, for which we should either set the rules before going out, or maintain the understanding that we’re keeping mental reserves specifically for the purpose to buy back in early (this is an active process that must be strenghtened daily. It does use mental energy).

-

Worst is watching our mental energy diminishing slowly as the markets keep going down, trying to convince ourselves that we are going to soldier on through it all despite feeling the pain at every new drop, then run out of mental resiliency and sell probably near the bottom, with no “energy” nor willingness to get back in anytime soon.

I’m an early accumulator so my investment success depends a lot more on future gains than on what assets I currently have in my portfolio (the situation is probably very different for someone with more assets already). Participating in the upsides is way more important to me than avoiding the downsides. Buying and holding would guarantee that. I’m personally on my second best, because I’ve been through tiring times in other parts of my life and have watched my ability and availability for action get depleted slowly so I’m trying to preserve it. It can only serve me if the “energy” preserved actually allows for me to buy back in early. Time will tell.

My take is: now is still early, later might not be. Do your risk assessment (need, ability and willingness to take risk), consolidate your AA (be convinced it is the right one for you), assess if you can buy and hold through a painful ride down (with potential significant false recoveries on the way), make sure you are fully willing and ready to invest or be invested early if it starts rebouncing (better to get back in early, then sell again if the drop continues (and then buy back early again), than not getting in at all, in my view) and choose a course of action.

My current lenses are:

-

The markets can rebounce tomorrow and skyrocket back up as uncertainty turns into certainty. Am I ok with that? How do I plan to benefit from it if it happens?

-

The markets can keep going down with false recoveries on the way, all the way to -60%/-80% over a span of maybe 3 years. Am I ok with that? Can I ride through it?

-

The markets can go sideways with +/- 10% ups and downs for an indefinite amount of time. Am I ok with that? How do I make sure that my capital is available and invested when the bigger trend up resumes?

but, if you did not buy on the way up at those prices, why buy now?

just saying, to buy bottoms you have to sell tops.

Or you just keep buying no mather what and never sell.

But buying here cause the price is 10% down makes no sense unless you sold before (or you have been happy to buy before).

I guess it also depends on what type of “worry”. Am I feeling worse at each negative movement of the market, obsessing about it, and not feeling fine? Probably worth selling or reevaluating my strategy.

However, there’s a very reasonable type of worry IMHO one can experience, especially during our first downturn (even if it is light) when we see red numbers for the first time.

Hasn’t everyone at some point had such thoughts?

According to academic literature, asking yourself this question doesn’t work. Humans are apparently bad at anticipating how they will feel given certain circumstances (even if they feel very confident about the prediction). It’s the problem of affective forecasting or “miswanting” and it can go in any direction. This is also why having an IPS is highly recommended, since it takes emotion -positive or negative- out of it.

Iḿ more annoyed that nothing in my portfolio has hit -10% yet, which would trigger an extra investment.

Hi there,

just saw this recently (for US stock market, from “A Wealth of common sense”, 20 Jan 2022):

So smaller crashes and downward slides (remember the last quarter of 2018 with a down of just shy of 20%?) are much more common than one might think.

I agree that “keep calm and buy [your favorite fund]” is easier said than done. having an Investment Policy Statement (ISP) sounds like overkill at the beginning but may keep you from overthinking. Alternatively, have real person to check your thoughts: Girlfriend/spouse, neighbor, colleague at work… Should be familiar with your overall financial philosophy and act more as sounding board than adviser.

A few years of serious investing with the ups and downs that come with it have made me comfortably numb to the noise and headlines. I’ve had a few itches (Crypto, commodities, convertible bonds…) but so far, I’m sticking to my boring asset allocation and IPS from the start. I’m even sticking to one ETF that I’d not buy again (focus on dividends) but only because I fear that I’ll change more and more seriously if I start fiddling with my portfolios.

Cheers, J.

Just out of curiosity…do you think still the same (keep investing) if a massive war is going to start?

Yes. But if you don’t like volatility, consider adding a threshold based on VIX (it tells you how much uncertainty is in the market vs. what it already priced).

What threshold are you considering?

Actually everytime something big happens (ie covid), I’m looking to UVXY or simply SQQQ, but then I chicken out really quick

I sometimes skip when it’s >25 VIX (usually the swings are really large day to day when that happens).

I think that there is something more frightening for an investor than the war and this is the raise of interest rate.

I doubt (but may be I do not understand something) that ultra low or even negative interest rate is achievable in euro currency with the actual situation: inflation, the euro going down respective to CHF, the large investment going in war effort and weapon system donation to Ukraine, Moldavia, Baltic States who else…

I believe that today there are investments more interesting than the financing of the main residence of John Doe, who is over indebted because he buys a house at multiple factors respective to the construction cost.

VT below 94 starts to be a bit frightening