Thanks @Tino , I’ve just sent a test amount, I think it was that routing number - and I’ve just seen you mentioned that previously… I must have missed it. TW accepted the transfer this time, I’ll report back in a couple of days for anyone else interested.

Hi Tino, thank you very much for the information about TD, it was very useful and actually I followed your decision to open second account at TD in addition to IB. I’m also Swiss resident, and idea to transfer CHF to IB, convert them there to USD and then to transfer to TD looks easy in my case, but I’m not able to understanfd how to manage ACH connection between IB and TD. I would highly appreciate if you could recall how you managed that connection:

- You originated AHC connection from TD or IB?

- In case of creation connection from TD, it is asking for the routing and account numbers, and I’m not able to understand where to take this information from IB

- In case of connection from IB, I’ve used quick connection option, I’ve found there TD Bank, but it doesnt recognize my loging to TD Ameritrade (I suppose it si different accounts for brocker and for the bank), and it is not clear which credentials I have to use here

Thank you very much in advance for the possible answer,

Regards,

Alex

Hi siddha,

I did 4 tests:

- ACH from IB. With routing number 021912915 y bank number your account number in TD.

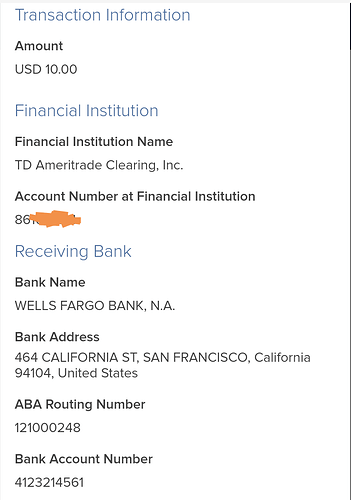

- Wire from IB. Image attached. Hidded the TD’s account. If you do the first in the month, you don’t pay the 25$, is free.

- Revolut or TW also worked perfectly. TW a bit more expensive but it’s OK. With Revolut, free 1000 per month, otherwise you must pay. Use the Routing provided by TD now and your account number.

You must check all the values for TD because that was last past year! Just verify with the updated information in TD. A little mess was always the routing number… Looks like sometimes are different, sometimes are really important and sometimes looks like whatever you put, if the account number is OK, works ![]()

Quick answers to your questions:

Always all from IB, from TD never worked. Neither the ACH to TW.

Answer up.

I contacted some times the TD support. They told me that our brokeage account is like a bank account but not for direct debits, pay bills, etc… They follow the bank numbers, etc. But you cannot use like a bank. They always focus in using a wire to external banks, brokers… of course, paying 25$ per transfer ![]()

Regards.

Hi Tino,

Thank you for the detailed explanation. Let me try some of your scheme, I will give you feedback. Based on your information, I’ve realized that it will be potentially the problem to withdraw money from TD. Well, In my case, I’m not looking for monthly withdraval, but in case of succsessful trades (I cross my fingers :)) it can be a time to get that dollars from TD. What was working for you? Of course, the best would be transfer from TD to IB, you change USD to CHF or EUR, and than to you UBS account, but it seems it doesnt workable so far…

not anymore… see other thread. it’s now 1000

Thanks, I modified my post.

Hi,

Was working for some people but I didn’t try. I’m mainly a buy&hold investor and when I have money from options, selling stocks, etc. I reinvest it right away.

The selling of TD to Schawb could make for us interesting or bad things. Could be that we’ll have more “international” services or could be worst for fees, etc. I don’t know.

In any case, I did not try neither because the 25$ of fees for the wire. I was thinking that in the future could not be a problem if I withdraw, e.g. a complete year of life fees.

What I did was passing positions by FOP from IB to TD and was really quick and easy. I was thinking about testing the other way around but I was tired about tests, but could be a really good solution. You transfer ETF, stocks for a value and sell in IB… You could test that.

Last thing I forgot to mention in the latest post, I tried the micro-deposits stuff with the combinations of ACH : TD → TW (in TW you have routing and number account) but didn’t work. I asked TW and they told me that is a special account and cannot allow micro-payments.

Other combination that I though was going to work was with ACH IB → TD. IB sent the micro-payments to TD. When I saw the deposits I though that was done. I put the data back in IB and IB linked the account as ACH without problem.

I requested from IB 50$ to TD using the connection and worked! I saw the 50$ in my IB account “frozen” but there. 2 or 3 days later the money disappear ;-( I contacted IB and they told me:

We see that the ACH wire has been made. However, it has been recalled by your bank on November 08th with the reason “Non-Transaction account”. The ID XXXXXX you mentioned refers to the rejection and therefore has been credited back. Please contact your bank to either receive the proper ACH routing information or use Wire instead.

I contacted TD and they told me:

To withdraw funds from your TD account via ACH the bank account has to be connected to your account, this does not work for brokerage accounts.

What I am showing is that the $50.00 payment to IB was made via authorized ACH by giving them our routing number and brokerage account number and this does not work. That information only works for direct deposit into your brokerage account not for payments going out so the test deposits worked but does not allow for ACH payments out of your account.

The only way to get funds to and from IB would be via wire or ACAT transfer again. We do charge a $25.00 outbound wire fee to send funds to another bank or brokerage account.

Regards.

Hi Tino,

Quick feedback - I did wire, it was slight change in adress of Wells Fargo address - I’ve asked TD to update the references, all other numbers were tha same. Money were transfered surptrisingly quick - I’e sent them at 15.00 from IB, and around 16.30 they were at TD, no comission, no charges.

Perfect! Just check if IB will take you 25 bucks if you do twice in a month. I remember something like that.

Thank you for sharing.

On website thety state 10 USD after first payment within month

0.35 cents if you use the tiered fee structure

It seems like the discussion has been diverged to IB. Maybe I miss the answer to this question?

Does TD support deposit with CHF? The CHF stays as CHF. I don’t want it converted to USD.

No.

I must post 20 characters more…

hahaha thanks.

I must post 20 characters more…

Hi, glad to have found this thread.

One question regarding TD Ameritrade funding: is the account setting company name TD Ameritrade Clearing, Inc., TD Bank USA,N.A, or either one? I have found the same information regarding the routing in another site and they had TD Bank as the company name.

I did send 10 USD today with Revolut using TD Ameritrade Clearing, Inc. I will let you know how it went. I believe it will only clear by the end of the day because TD only deals with these transactions by 5pm local time, as far as I understood.

I have also found that you can transfer CHF directly thru their Citbank London account. Has anyone done that? I imagine there is a transfer fee and also currency exchange fees.

How does their rate compare to others?

Final question (off topic) : I have read about it here on this forum and on the main site but it’s still not an Yes or No answer:

Taxes wise investing from Switzerland with TD (US based) or IB UK would be the same? As far as I understood it can even be better to use TD: no stamp tax. For ETFs there is only L2TW 15% tax that can be refundable in Switzerland, could anyone confirm please?

Thank you.

Thank you in advance

Those conditions also apply to IB (if you buy US based ETFs), there should be no difference with TD concerning this.

@Cortana I’ve recently found myself in the same situation.

Degiro (clear and intuitive interface, but more expensive and less ETFs choice) VS IB (intimidating interface but cheaper and with a broader ETFs choice).

Curious to know what was your decision  Are you using IB today?

Are you using IB today?

@s-g, Got it. Thank you very much.

Does TD support depositing with CHF?

Yes and no. The account is USD only but there is this possibility to transfer CHF thru their London based account as far as I undestand it.