Do you mean zero % currency exchange ?

I can confirm, compared to xe.com, they take 0.2% when doing conversion inapp (CHF → EUR/USD)

I’m wondering if this move is not just to keep the clients who were leaving after the 12 initial months and show good number to investors.

I still don’t understand how this new bank can make money which such low fees…

Most likely having a bank account doesn’t cost much in today’s digital world in terms of incremental cost.

So if the bank account stays at Alpian then there is a relationship. And that also helps to eventually up-sell other services

Swissquote is free, ZKb is free, NEON is free. It’s tough not to be free and be „new age bank“ ![]()

But they have a lot to improve as a bank… no Twint, no eBill, no permanent orders and not possible to set the date of a payment…(or I really missed it but I don’t think so). And the last not possible to cancel a payment (so yes I’ve done a payment to test today without possibility to change the date and once confirmed not possible to cancel it nor modify, lol).

They also have a nice metallic card but I was surprised to not see any numbers on it, so if you don’t have your cellphone or numbers in your head…

so is alpian the cheapest (at 0.2%) for currency conversion/ transfers abroad compared to everywhere else? Im not talking about paying for things in other currency but rather converting between multi currencies deposited in the account. This might be the only benefit if it is the case, Radicant is not multi currency

Maybe Revolut but it depends how much (free, premium, …)

This is so incredibly stupid, I could never think about using them for anything serious that way…

They have a lot to improve. Not sure they will survive that way. Free is not the only thing.

There were also reports, that there are different IBAN for incoming and outgoing cashflows.

E.g. there are several institutions who need to know the IBAN upfront, you are sending from.

Nevertheless, I am trying to open a bank account with them because of a nice referral benefit ![]()

I can confirm that. Quite some time ago I tried to send money to WillBe, but it didn’t work, because the last IBAN digit just didn’t match. As there was no way to know it, I complained at WillBe just to make a bad figure in the end, because the IBAN they received the money from was another one.

I mean, that’s not surprising.

Les chiffres noirs ne sont peut-être pas si éloignés car la banque a enregistré une forte hausse des actifs totaux des clients (incluant les avoirs investis et les montants en compte courant), qui dépassent aujourd’hui CHF 100 millions. Le mois de juillet a été le plus fort à ce jour, permettant à la base de clients d’augmenter de plus de +30% depuis fin juin.

That’s probably the only important metric they’re after. But it’s a long way to just break even with a 0.75% fee (100M = 750k in revenue for wealth management). Maybe after 1B in AUM they will be able to implement standing orders…

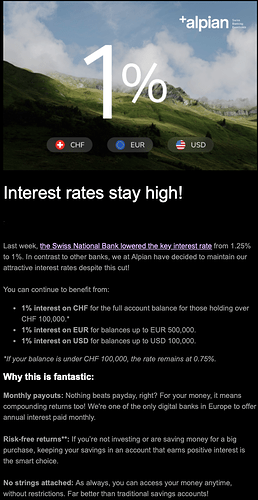

Note that 1% is for those holding 100k+, for under that it’s 0.75% (vs. 0.85% at willBe for up to 50k)

1% interanual payed monthly for sure is interesting but what about the dififcult financial position they are in? I know money is insured but for sure I don’t want to go through the paperwork in case of bankruptcy.

Opinions?

Don’t know why people always have this bankruptcy fetish, but esisuisse will probably pay you the money within 7 working days.

It’s off-topic (and I do not wish this upon any bank), but during a voluntary liquidation, the bank may take a year’s time to come up with the money to pay back all clients’ funds. Only then would esisuisse pay out 100k per client within 7 days. Please note that this insurance is capped at CHF 8 billion. With a million clients, everyone would get only CHF 8000 (not so hypothetical case of a large bank’s default).