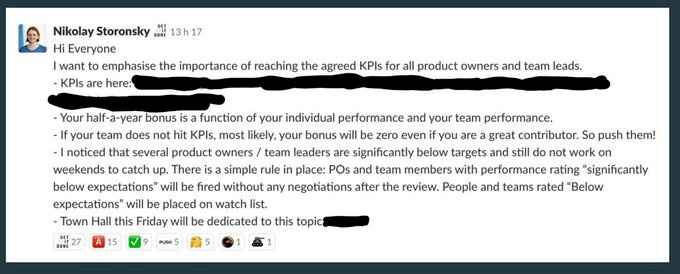

I think the problem is, if true, that they were forced to resign being told that otherwise they would be fired for underperformance.

Threatening employees with untruthful termination grounds would be pretty bad behavior.

Yes I agree theses methods are unfair. I moved to n26 2 months ago because they allow 5 cash withdrawal in euro per month which is what i am looking for my vacations in Portugal. Many small shops does not accept cards where I go.

The main drawback is that n26 only accept euro inbound… Not CHF.

I have to find the cheapest way to convert chf to eur before sending them to n26. Revolut or transferwise ?

Most certainly Revolut, when converting on trading days and staying below their monthly free conversion limit (5000£) on non-premium plans.

Looks like revolut just became a bit less interesting, they’re changing their fee structure

The new fees will be from 12th of August

The big change I see is that standard (free) accounts can only do 1000 CHF of free currency exchange per month.

Thanks for the information about the new 1000 CHF exchange limit… ![]()

![]()

Bait 'n switch

What’s next best thing? How’s n26 or neon?

It’s a simply change of conditions. The old conditions had been in force for months.

Bait & switch is when you aren’t getting what you signed up for - that doesn’t mean however, that the service have to continue providing these same conditions forever.

The biggest issues is maybe the exchange rate during weekends. If you spend more than 1k per month maybe it’s ok to buy the revolut metal imho.

Edit: reading that reddit post makes me happier about my english knowledge. it seems that people can’t really read.

I just got an email from them - in fact it will be 1250 CHF. Be aware also about the fee for exchanges during the weekend - going up from 0.5 to 1%.

The FX conversion limits have really been slashed…this was my reason for getting Revolut in the first place ![]()

I have thought of a work around and thought i’d share it with you: Neon gives you the Mastercard (& Revolut) FX Rate when you purchase in foreign currency. Top up in the foreign currency of your choice directly from the Neon Card (Credit Card Top-up) and you’ll get to keep the actual FX rate without any fees or limits, as the conversion is being handled by Neon and not Revolut. To my knowledge, there is no conversion limit for Neon.

If desired, I can also provide a referral for a Neon account, they’ll give you 10 CHF as a starterbonus.

If so… why don’t pay directly with Neon card? Unless you want to split money into 2 accounts…

Yeah? Neon doesn’t charge 1% on weekends. Why not just use Neon?

the point for me is the conversion of money, not spending it. i want to hold euros and spent the money at a later time. so do the other people affected by the 1250 chf limit. reasons for this can be multiple. suppose you want to reimburse a mortgage in euro for instance - you’d want this to be as cheap as possible, but neon charges 1.5% FX Spread on the conversion for SEPA transfers. by virtue of applying the top up method, you save that fee.

if not applicable to you, don’t use that method.

Why not use IBRK for FX trades?

Complicated to open.

Relatively complicated to grasp and handle (currency pairs, buying and selling).

Minimum activity fee.

Expensive transfers beyond the first withdrawal each month.

If you have an IBKR account anyways (as I do), it’s a good option.

Opening up one just to do occasional FX exchange? Hardly worth it.

PS: Also, wouldn’t IBKR be slower, due to settlement delays before withdrawal is possible?

@Kanel: Everything @San_Francisco said.

With Revolut, I can just wait when the exchange rate is good. There’s even an auto-convert option. And it’s instant. I can top up, convert the amount and wire it back to my EUR account instantly. There’s no good alternative to that right now.

Roughly two months ago they removed Switzerland from their country list. Has somebody noted any (negative) effects in the meantime besides the lack of refund / protection for card payments in Switzerland?

From my experience, the exchange rate that neon applies (or Mastercard charges) is always the rate at that moment during the day of payment in which there was the least favourable exchange rate for me as a customer. I’ve done now several payments in EUR, USD, TRY and other currencies, and you can clearly check it: The applied exchange rate is always the maximum (or minimum respectively) exchange rate reached during the day. As an example: If on 12 June lowest EUR price was e.g. CHF 1.06 and the highest CHF 1.08 and you pay with the neon-Mastercard at the moment when the exchange rate is 1.065, then you the rate applied will be 1.08 CHF whereas Revolut applies the real-time rate of 1.065. So, you can be sure: if you pay with Revolut, the exchange rate will be always lower or, in worst case, exactly the same as the exchange rate of neon. Just my experience…

Doesn’t look to me like that. Counterexample: 18 May 2020: Mastercard had a rate of 1 EUR = 1.0576 CHF - yet in Forex the exchange surpassed 1.06.

That said, there seems to be a spread of around 0.5% for the CHF/EUR pair.

You can’t. Revolut does have a 0.5% weekend surcharge - which is more than half the Mastercard spreads for all the couple of dates I calculated.