For me it still shows a fee. It shows 75.- for 5000.- using the Migros CC either directly or via Google Pay.

In the app it says “use a locally issued debit card”

Still shows a fee for Migros CC as well

To me that would classify as “commercial card”, but I’ve nowhere seen the definition.

Cards from banks directly I would hope wouldn’t, but still shows the fee for my UBS Mastercard. ![]()

Is “locally issued” for them a Lithuanian one? ![]()

Edit:

"and vou have been onboarded to Revolut Switzerland Payments AG"

Ah I’m still sending money to “Revolut Bank UAB” (that also changed recently, to Post Finance IBAN).

Confused AF now.

Tried Neon, Alpian, Yuh, Radicant, Cembra CC and virtuals if any. None works without fees (~1.15% for debit, ~1.5% for CC).

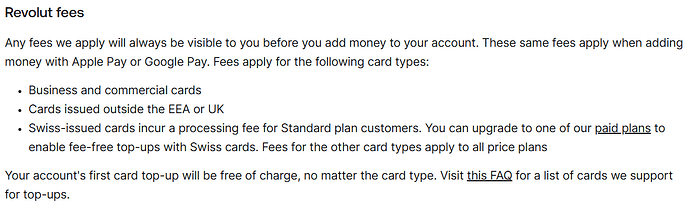

For personal cards -: How I read it is that you can use a card issued in UK or EEA but you cannot use CH or US cards for free transfer. They don’t specifically say what costs , but it’s not free

I think commercial cards are issued to businesses and corporate customers. Like CITI commercial.

Add money using a UK or EEA issued card

** Free (except cash)*

However, if you add money with a card that is issued somewhere else (e.g. in the USA, Switzerland or anywhere else that is not part of the UK or EEA) or you add money with a commercial card then we may charge a small fee to cover our costs.

They have so many versions of same thing ![]()

The PDF I received when I transferred to the Lithuanian bank setup says:

Stored card: free. However, if you add money with a card that has not been issued within

the EEA (e.g. a US-based card) or you add money with a commercial card then we may

charge a small fee just to cover our costs. If you are using a non-commercial card that

has been issued in Switzerland and you have been onboarded to Revolut Switzerland

Payments AG, no additional fee will be charged.

Hahaha

So many versions of same thing

Talk about consistency in messaging ![]()

Why not just bank transfer? I’ve always done that and it’s free, I don’t get it.

There are FX conversion fee (the spread is a fee), can often be in the 1-2% range.

Because of the delay. I don’t have much money on Revolut and with any larger transaction I have to top it up first (i.e. wait a day with bank transfer vs. instant with CC).

Bank transfer take less than 1hr in my case: cler zak to revolut

I send CHF to Revolut, there is no FX fee.

For me too at my cantonal bank. I got it within 1-2 hours the last time I did it.

Only if I issue it before noon, otherwise the next day it is (UBS).

Same. I tend to do these things in the evening and it always takes until next day.

Oops, sorry. Mixed up with the other thread (with migros bank exchange).

Isn’t there a way as a Swiss resident to get a credit card with a bank across the border (e.g. France or Germany for Geneva or Basel for example) with which to charge your Revolut without fees?

Also, if you accept Revolut’s new terms in Switzerland, your card top up fees should be waived. How do I join that? There are no clear step by step instructions.

[quote=“hifly, post:305, topic:9287, full:true”]

Isn’t there a way as a Swiss resident to get a credit card with a bank across the border (e.g. France or Germany for Geneva or Basel for example) with which to charge your Revolut without fees?[/quote]

Yes, there are a number of banks that will accept Swiss residents like DKB, N26 or comdirect, but those will all be in EUR, so not sure, if that serves a purpose.