It’s your numbers and your sanity check, but IMO it doesn’t make sense to exclude the 600k in 2/3a from your NW (and hence your withdrawal rate), since it’s yours and you can invest and allocate pretty much as you wish (Finpension, Viac etc.). You can even use to re-balance stocks-bonds-cash. And in 11y it becomes “free” and spendable (of course subtract about 10% for taxes at that time, or subtract this tax amount now already, i.e. adjust the amount for your NW calc).

Thanks, yes I see what you mean now. It will take a bit of time for my thinking to adjust/educate.

Not sure if it was already mentioned in one of the replies, but split your pillar 2 into two VB accounts so you can withdraw in two different tax years and pay lower overall taxes for the two withdrawals.

I suppose it depends on how you invest in the VB accounts and 3a.

Contrary to your employer’s pillar 2 you don’t have a general downside protection or even have a guaranteed return (for pillar 2).

Unless you basically stay in cash your VB accounts – depending on your portfolio – can go up more than the guaranteed return of your employers pillar 2, but it can also go down.[VB] Ditto for 3a.

-

If you need withdraw at a certain point in time that is, say, less than ten years from depositing the pillar 2 money into a VB account, you might be looking at – depending on your risk profile – potentially significantly less than you put in.

After 10 years you statistically come out without losses most of the time, but I believe you need 20 years to come out without losses (with backtesting; future path might bring more bearish data points).

Anyway, point is not to present the exact case with lots of data, just that there is risk with a sufficiently short investment horizon (even 5-10 years) and the need to withdraw that you might end up with less money in your VB/3a accounts than you had planned. -

If you don’t need to withdraw at a certain point in time, you have a 5 to 10 year window (60 to 65/70) for (timing your) withdrawing.

The devil’s in the details as with the latest AHV change, some rules have apparently changed and as always there’s an Übergangsregelung. Look it up yourselves.

Anyway, going back to the initial question: I look at my VB and 3a money as birds in the bush while I regard my moneys and companies at my brokers as the cutest and most beautiful little birdies in my hand.

As the chicken bird that I am myself I mostly count on VB and 3a money arriving at my bank when I can legally access it, but I’m mentally hedging against the Bunderrat deciding that they’ll willy nilly tax it 39% (coming out of left field like the current proposal on federal savings measures) at the time I want it paid out because Switzerland just ran out of money somehow. ![]()

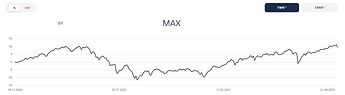

[VB] Here’s a real life example for one of my VB accounts since I dumped part of my pillar 2 into it:

Finpension risk profile “medium” which translates to (in their terms) 5 year investment horizon, can handle 20% drawdowns, medium investing knowledge (at the time I chose the risk profile)

That’s about a 2% CAGR, which is still better than the guaranteed pillar 2 return, but only since the recent rise of the market.

Had I had to withdraw in October 2022 or 2023, I’d be looking at a negative total return of 10-11%.

I don’t think the time of withdrawal matters that much. You can immediately reinvest the withdrawn capital with a very similar strategy outside pillars 2/3a, if desired.

This again depends on what you do with these money afterwards. If you withdraw them and keep in cash - yes, you lost some. If you invest them again, this is a case of moving money from one pocket to another.

Totally!

It’s all about the allocation! The total allocation of your NW (“free” and VB and 3a).

Point is, in 2025, you can basically construct VT in your VB (+), so since OP has 4M in VT and 50k Cash, he can go full stocks (99%) in his VB (full risk, since his withdrawal rate is quite low) or full cash (zero risk in VB) or somewhere in between. But that those 600k is at Finpension or Viac and not at Interactive Brokers in VT is (sowas von) irrelevant, no?

(+) 97% Swisscanto IPF I Index Equity Fund World ex CH NT + 2% SMI

(+) courtesy of finpension

One must be comfortable with the allocation of the Total NW, and the implied risk.

Withdrawals in 5, 10, whatever years, it’s not a “withdrawal”, but a move of those funds (**) to IB from VB.

(**) yes, minus the tax, 10% at this time is a good estimate, 39% is a good … random… guess for in a few years ![]() although I’m hoping that maybe at withdrawal time one will be able to negotiate a reduction from the 39% to 15%, by promising to invest half these withdrawn funds in fine Swiss overpriced Bio-groceries and medicine within the next 5 years.

although I’m hoping that maybe at withdrawal time one will be able to negotiate a reduction from the 39% to 15%, by promising to invest half these withdrawn funds in fine Swiss overpriced Bio-groceries and medicine within the next 5 years.

![]() not great… of course a poor match to your stockpicker portfolio..

not great… of course a poor match to your stockpicker portfolio.. ![]()

but how much stock allocation is risk profile “medium”?

One of my VB accounts dumped into the fund allocation mentioned above currently has a CAGR of 10% (but I’ll be super fast to mention that it was pure luck due to timing, and I also have some VB in a bank account with a CAGR of about 0.5% (and sinking fast)). My point is comparing your “medium risk profile” VB with your stockpicking portfolio is not fair. My other point is, maybe you could increase your risk on that VB, if your total allocation allows it?

Anyway, that’s the allocation I chose and am comfortable with, and will hopefully stick to, even when withdrawing the VB in 10-15y (the exact time is irrelevant IMO).

I think we’re all in violent agreement.

All I am saying is that you cannot count on your x00k from your pillar 2 that you shoveled into your VB accounts being at least x00k when you want to withdraw. OTOH if you had stayed in pillar 2, your x00k will become a guaranteed x00k + at least guaranteed return.

Maybe that’s why the OP wasn’t comfortable with including it in their NW and withdrawal calculations.

At any rate, you’re all professionals, and you can mentally move your funds easily from this tax sheltered bucket to that tax sheltered but not downside protected bucket (and then eventually to your non-tax-sheltered bucket), and it is the correct way to think about this.

It might psychologically be another matter to update your year-end spreadsheet and log a -10% return on one of the VB buckets that was previously part of a pillar 2 bucket with a guaranteed return.

Timing and luck enters into your VB investments that you were previously shielded from, both from a downside and and upside perspective.

The seasoned folks responding above obviously know all this.

Maybe it’s not entirely clear to everyone.

I’m actually interested in this because, to me, it really doesn’t sound like there is a difference. The non tax sheltered bucket can also get downside protection by staying on a bank account in slices of up to 100k (or other esisuisse insured vehicles like medium term notes).

Do people really feel a difference between their VB and taxable accounts once they are not employed anymore (beyond the simple “I can access my taxable account but can only access the assets in my VB under certain conditions”)?

Huh, interesting.

No, but I am interested in the difference (in performance and volatility) between my tax sheltered VB accounts and my former (or sometimes concurrent, see below) pillar 2 account.

I suppose this might have interested me more than many because my experience was:

- fully employed by some Internet start-up, all of pillar 2 in one downfall protected bucket with abysmal returns

- unemployed, split my pillar 2 into two VB accounts

- employed again, moved one VB account to my new employer (forgot about the 2nd VB account)

- watched my, ahem, forgotten VB account experience the 2022 correction – "serves you right, Goofy, should’ve moved it to your new employer as the law requires – while my VB account moved to my new employer sailed through smoothly, tacking on another 1% or whatever the minimal return was.

- reduced my employment such that my pillar 2 again moved to a VB account (separate from the one I, ahem, forgot)

My takeaway is: while performance was better in my “forgotten” tax sheltered VB account over my tax sheltered pillar 2 account, volatility was a lot worse. Glad I wasn’t eligible for (and did not need to) withdraw from my “forgotten” VB account in 2022.

Edit: Oh, and I guess we’re slightly off topic… ![]()

I feel practically no difference. The only tiny difference I’ve felt is, I can’t mess up the VB part as much as the potential mess-up in taxable accounts (by poor stockpicking, market timing, loss aversion etc.).

This could of course be difficult, as your VB can only be split in 2, maybe 2x2 depending on your Pension Fund, and total amounts can “easily” be 400 to 800k (depending on FIRE age, salary, employment duration in CH, buy-ins, etc.) - so well over 100k per VB account.

True. On top of that, VB assets are not guaranteed but privileged in case of bankruptcy. Maybe they’re better held in money markets rather than cash.

So would it make sense to spread among as many providers as possible to not have eggs in one basket?

I guess you could end up with 4 (2x2) or 6 (2x3) VB accounts. So you need to find 6 providers.

VIAC, Finpension, Neon and Frankley cover four.

What about the last two? Truewealth? Yuh?

(I’m not sure the last four even offer VB accounts, I know them only for 3a)

And all this time I believed it was Ahem, a friend of yours ![]()

Just invest it at the providers, “risk” is only for cash deposits (and returns for cash in VB is sh*t)

This is overkill IMO.

Amd remember 3a amount will also be in the same places, so that’s another 2 providers…?

Finpension 1 and 2, and Viac are the Top 3, and then a big gap because of inflexible, (more) expensive, forced hedging, forced gold, forced ESG funds, etc.

The mustachian best-of-the-rest are

Frankly, relevate/pensexpert, descartes and tellco.

I’m “waiting” for Truewealth’s offering, a year ago they said to me "maybe in 2025”, but nothing yet.

Not to be pedantic, but “VB assets” could be misleading here, you mean “VB cash deposits” right?

Also it’s a bit overblown, the cash is still segregated, those firms are audited and even if where they bank blows up, deposits would still rank first.

(When was the last time deposits took a haircut in CH at a regulated bank?)

1993, in the last real estate crisis

Thanks, which bank was this?

Edit: I guess Spar- und Leihkasse Thun - Wikipedia

My bad. VB cash deposits.

Securities are subject to segregation with their own set of upsides and downsides (which are similar to securities in taxable vehicles).