SMI and SPI have the same problem: 3 shares (Nestle, Novartis, Roche) make up ~50% of the index. This collides potentially with BVG-rules about diversification and is generally not ideal. SLI has caps in place.

Thank you for your explanations.

Threshholds sound fine. Since the stock market historically (yes, I know, past performance…) went up in more years than not, I invest my 3a at the beginning in bulk. This of course goes a bit against your netting. (Dividends in May would then wait half a year, that is true.)

I only mention them because I only know private investor funds. So my question was rather: is there an SPI etf for institutional investors.

If the SLI method was superior then we would have more indices like this. You could also cap S&P 500 companies, and even whole markets (like: USA has 50% market share? It’s too much! Let’s cap it at 10%!)

I don’t think so. (Check “Ok” and then look for QI funds in the list)

Edit correction:

Multifactor for @Knoch (with added fees from CS!)

Perfect, thanks! That’s what I was looking for. I was on that website but couldn’t find it. So I assume VIAC can provide me with this fund?

I guess you would have to make a convincing argument for it. At the moment, VIAC offers SMI, SLI and SPI extra. What would be the advantage of also offering the SPI-fund on top of it? Remember, your fund allocation (edit: the allocation per fund) is limited to 35% anyway.

Edit 2: And SMI is the cheapest fund they offer for buying and selling, with a respective “spread” of only 0.01 (SPI extra: 0.05). The “spread” is set by CS. (I am not sure if I use the word “spread” correctly here, as the fund is not publicly traded).

I’m not aware of their fees. The SPI etfs for private investors are cheaper than SMI. Convincing argument? You need to put 40% of your pillar 3a in CHF. So if you want to keep a market-weighted ratio and use SMI + SPI Extra, then you need to figure out the ratio, and at some point, rebalance. With SPI you just have 1 etf, period. 1 is simpler than 2. But of course, these are all pennies of difference, not that important. I just got dragged into this by my own curiosity.

What happend to “Cash statt Obligationen”? ![]()

Kidding aside, thanks for listing the available assets for the classic portfolio creation early.

I like the SPI Extra and will be using it for my swiss allocations

What is the reasoning of only allowing 35% SPI Extra and not the whole 40%? Now I have to fill the remaining 5% with SLI/SMI, which theoretically makes re-balancing more complicated and costly (for you).

Could you clarify for me whether the buy/sell spread fees for the CS index funds are covered by the Viac fee? I guess they are…

I really appreciate how you answer questions publicly. This transparency is sorely missed in Swiss banking generally. Thank you.

there are a couple of threads in this forum. was considered too expensive for true mustachians, however for the average guy might be quite nice

they offer a 3a pillar for 0.5% fee, how’s that any worse than VIAC? Just wondering if anyone knows it off hand.

Where do you read 3a?

On the damn front page. Did you even open it?

While you set your plans in motion, Simplewealth will invest your money in a Pillar 3a, in ETF tracking indices and rebalance your portfolio when necessary.

Simplewealth creates a personalized investment plan just for you: tell us how you are, if you want sustainable investments or a Pillar 3a and we will do the rest for you.

We keep our fees low – just 0.5% of your investments per year and no trading commission fee. Enter and exit when you want to, at no fee and with no commitment

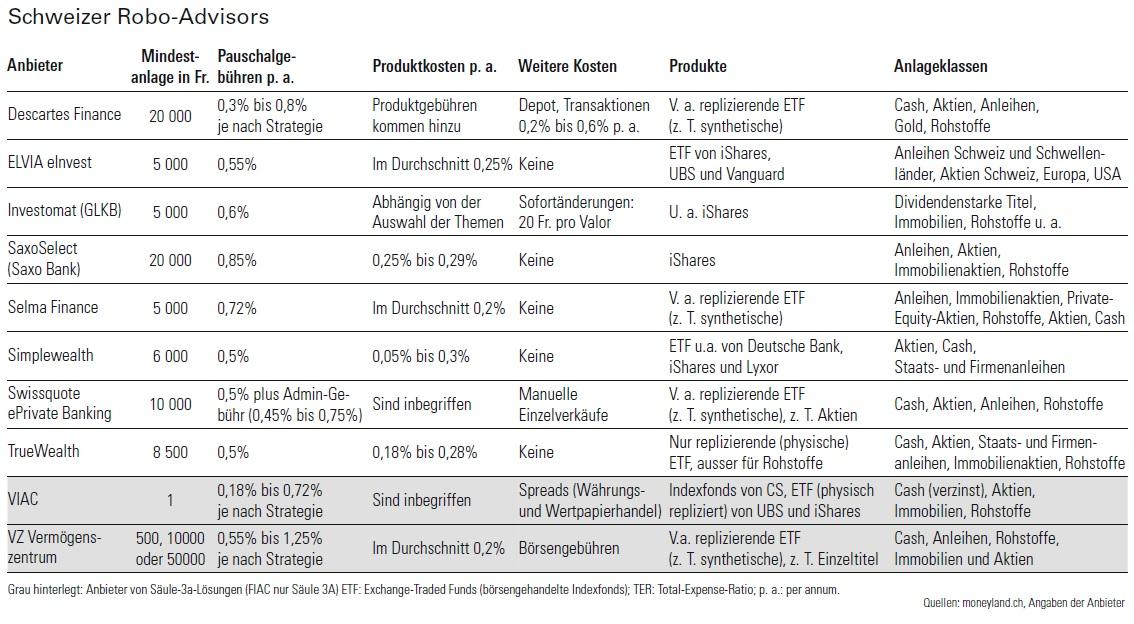

There was a little comparison in the NZZ a couple of days ago. https://www.nzz.ch/finanzen/vorsorgen-mit-der-pensionskasse/fintech-erobert-die-dritte-saeule-ld.1385056 I hope you understand enough german or google translate performs well enough.

Especially the table with the privders might be interesting

I did! But did not realize I had to scroll down (I am on mobile). Clicked on “invest…” and could find nothing. Thanks, mate.

Simplewealth uses Interactive Brokers, True Wealth Saxo

I will ask them how they manage the 3a pillar. They need to have a specific structure to manage this type of account. Little info is on there website

Only VIAC and VZ accept 3a money

I contacted simplewealth. Their max equity quote in 3a is 75% and they implement it with a fund of Zurich Insurance. I got the reply very quickly yesterday evening I asked about the fees, but have not heard back since. Will keep you posted.